[ad_1]

GOLD PRICE, CHARTS AND ANALYSIS:

GOLD FORECAST: NEUTRAL

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

READ MORE: Bank of Canada Comes Out Swinging with 25bps Hike, USD/CAD Slides

Gold prices look set to finish the week higher and yet the move can be described as anything but convincing. The precious metal fluctuated between the $1940-$1970 handles for the majority of the week as continued repricing of rate hike probabilities for the US Federal Reserve weighed on Golds attempted recovery.

The biggest shock to markets this week was delivered by the Reserve Bank of Australia and the Bank of Canada who surprised markets with a 25bps hike each on continuing concerns around price pressures. This has left market participants weighing up the probability of a hot CPI print from the US on Tuesday, a day before the Federal Reserve rate decision. A hot CPI print may complicate matters further for the Federal Reserve and may add more uncertainty heading into the meeting. Will the Federal Reserve follow the RBA and BoC and hike now or will they go the route of a ‘Hawkish’ pause?

Recommended by Zain Vawda

Trading Forex News: The Strategy

THE WEEK AHEAD, US CPI AND FOMC MEETING DOMINATE

From a volatility perspective market participants will no doubt welcome the heavy economic docket in the week ahead. The Federal Reserve remains quite split on the way forward with there likely to be intense debates and discussions on whether a pause or another 25bps hike is needed. There have been small signs of late that the economy maybe beginning to slow, however wage growth remained steady at 0.3% with an uptick in unemployment during the month of May. The NFP print however smashed estimates in what the Fed hawks will likely use as ammunition heading into Wednesday’s meeting. A significant beat of estimates by the US CPI data could see the probability of a hike increase and the Dollar bids start ahead of the FOMC meeting which could hinder Gold prices attempted push toward the $2000 mark.

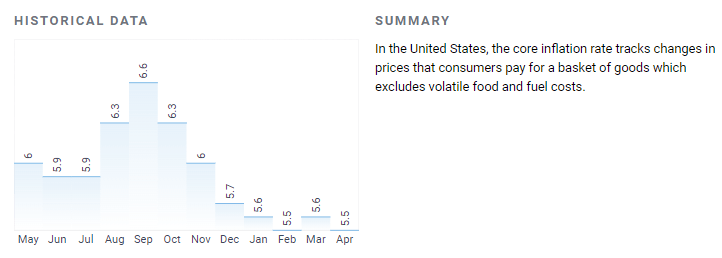

CORE CPI HISTORICAL DATA

Source: DailyFX

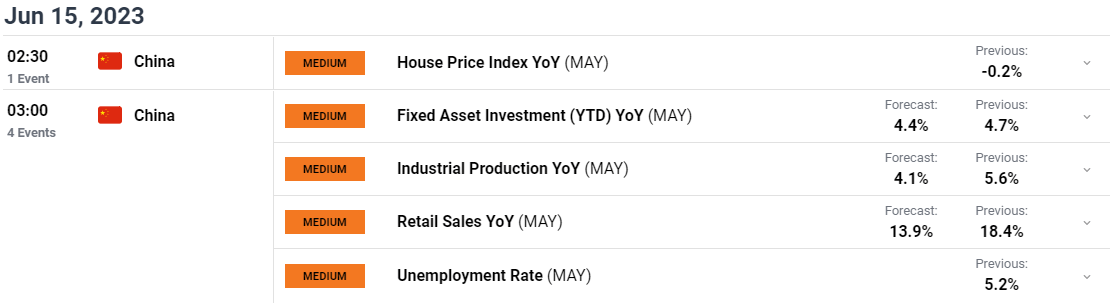

Although US data will dominate the proceedings next week, we do have retail sales data out of China as well. Given the continued uncertainty around the Chinese economy these numbers could also stoke recessionary fears once more and could see safe haven appeal return which could assist the precious metal as it looks to make its way higher.

All things considered it is shaping up to be a pivotal week for markets as a whole while the effect on the US Dollar in particular could have longer-term implications for gold prices and provide some form of direction.

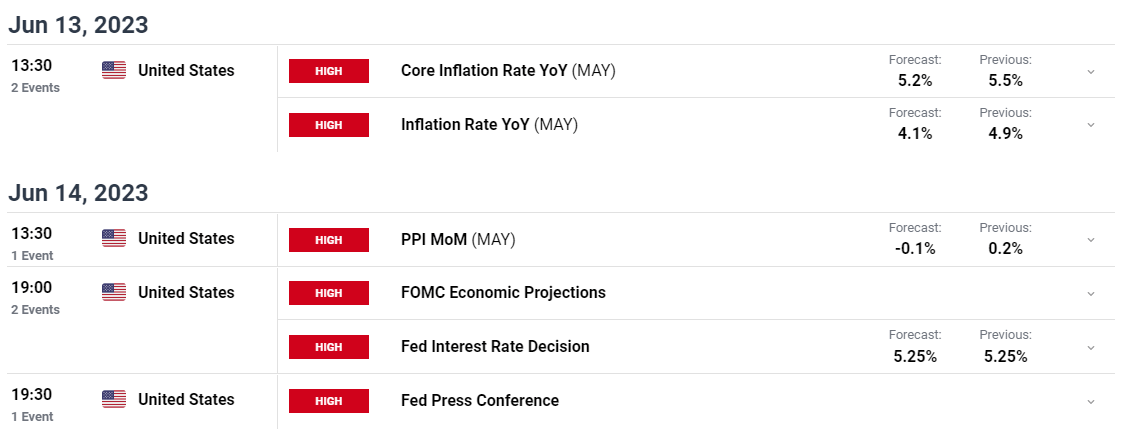

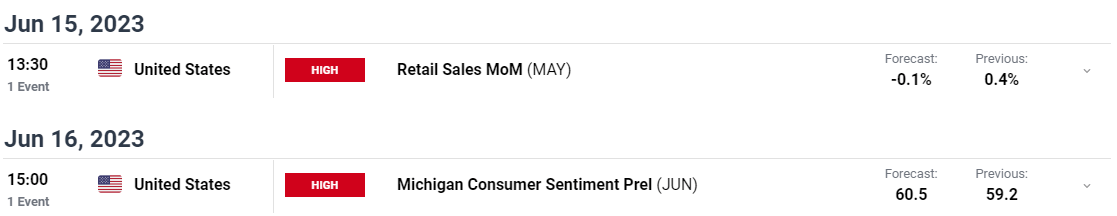

ECONOMIC CALENDAR FOR THE WEEK AHEAD

The week ahead on the calendar is simply blockbuster to say the least with a host of Central Bank meetings leading the way. However, we are focused on the US and Chinese data in particular and on that front, we have five ‘high’ rated data releases, and a host of ‘medium’ rated data releases on the docket.

Here are the five high ‘rated’ risk events for the week ahead on the economic calendar which could affect Gold prices:

For all market-moving economic releases and events, see the DailyFX Calendar

Introduction to Technical Analysis

Learn Technical Analysis

Recommended by Zain Vawda

TECHNICAL OUTLOOK

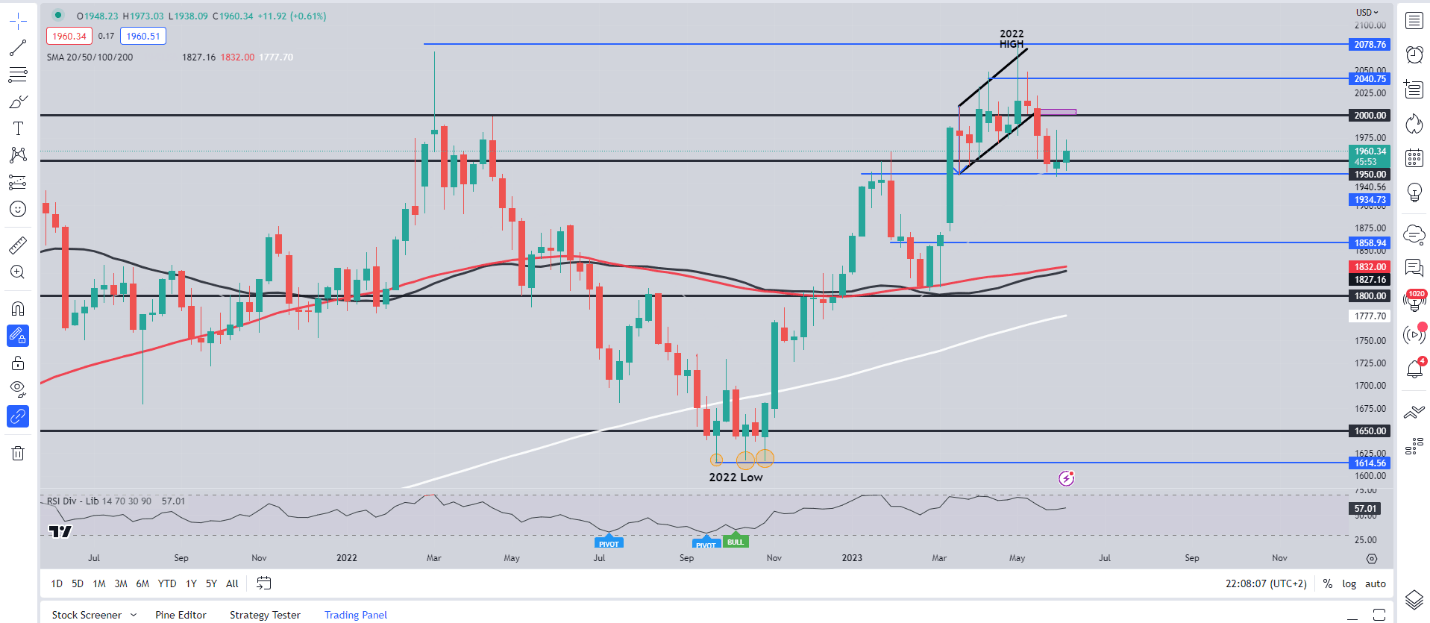

The weekly chart for XAUUSD looks on course to print a doji close which would be appropriate given the indecision we have seen for the majority of the week. The weekly candle looks set to close above the $1950 resistance turned support area. The lack of follow through on many of the moves seen this week could be due to the low volatility markets experienced and it will be interesting to see if we similar price action should liquidity return.

XAU/USD Weekly Chart – June 9, 2023

Source: TradingView

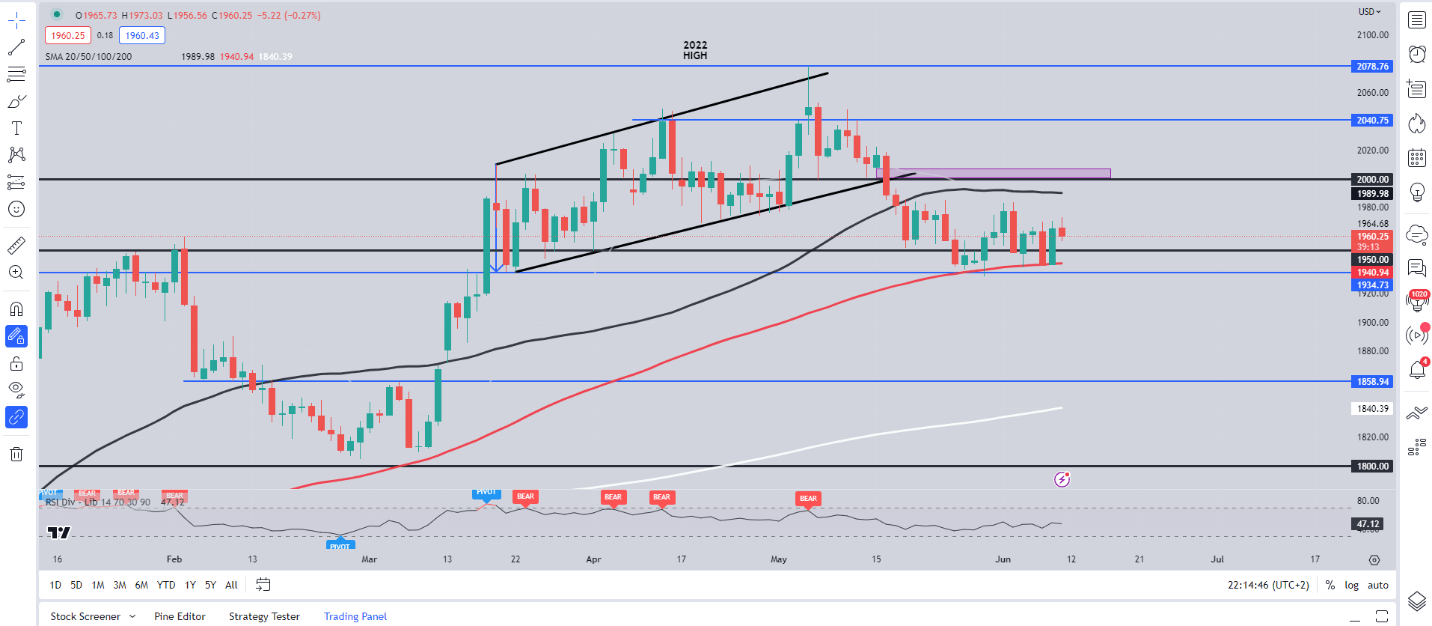

Dropping down to a daily timeframe and we can see the indecision this week more closely with a bearish engulfing candle followed immediately by a bullish engulfing candle close. Price remains caught between the 50 and 100-day MA with the latter providing support twice this week around the $1940 handle.

Heading into the new week and the range between $1940 and $1970 remains key as a break in either direction could see an accelerated rally toward key support or resistance levels. An upside break of the $1970 handle will have to contend with the 50-day MA at $1990 before an attempt once more at the $2000 psychological mark.

A downside break of the $1940 support and 100-day MA could see gold prices freefall as we have little in the way of immediate support till the $1900 handle. Given the mixed price action of late its hard to stand by a bias from a technical standpoint while the constant indecision around the FOMC meeting and the uncertainty around the global macro picture leaves me neutral as we kick off what promises to be a blockbuster week.

XAU/USD Daily Chart – June 9, 2023

Source: TradingView

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda

[ad_2]

Source link