[ad_1]

Google is celebrating its 25th birthday, but as far as Wall Street is concerned, the company is still only 19 years old, and some might say it’s really only eight years old.

Whatever the company’s age, its investors have a lot to celebrate. Here are some major events since shares of the internet behemoth — whose name is now used more often as a verb than a noun — debuted on Aug. 19, 2004.

Google’s

GOOGL,

GOOG,

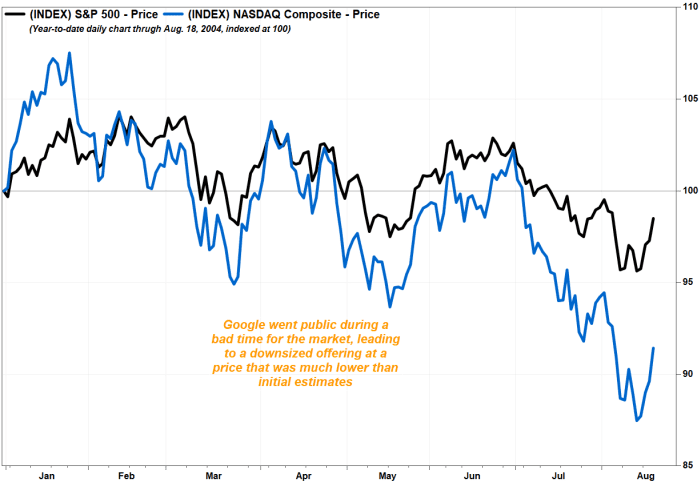

path to going public wasn’t exactly smooth. When the company first set terms for its initial public offering, it was planning to sell 24,636,659 shares to the public, including 14,142,135 shares offered by the company and 10,494,524 shares offered by selling stockholders.

The IPO was expected to price between $108 and $135 a share. With a total of 268,519,643 shares expected to be outstanding after the IPO, the expected pricing would have implied a market capitalization of $29 billion to $36.3 billion.

But as Google looked to go public during a turbulent time on Wall Street — the Nasdaq Composite

COMP

was down 8.6% in the year through the eve of the IPO, and the S&P 500

SPX

had lost 1.5% — there just wasn’t enough demand to support that pricing.

Google went public in August 2004, at what was a bad time for the stock market.

FactSet, MarketWatch

Eventually, only 19,605,052 shares were sold — as selling stockholders cut the number of shares they sold to 5,462,917 — at an IPO price of $85 a share, at the bottom of the expected range of $85 to $95 a share. Basically, the IPO price was 30% below the midpoint of the initial expected range.

With 271,219,643 shares outstanding after the IPO, the company was valued at $23.05 billion at its IPO price. The current market capitalization is $1.63 trillion.

Read MarketWatch’s deep-dive story into the drama behind the Google IPO.

But the road got a lot smoother from there.

The stock opened on Aug. 19, 2004, at a pre-split adjusted price of $100, or about 18% above the IPO price. It hit an intraday low that day of $96 — it never traded that low again — before closing that day at $100.43.

For what’s happened since then, take a look at this chart:

Google shares have undergone two stock splits that effectively multiplied the price by a total of 40 times.

FactSet, MarketWatch

The stock has undergone two splits since its debut. There was a 2-for-1 split on April 3, 2014, that in effect halved the stock price, from about $1,143 to about $572.

There was also a 20-for-1 split that took effect on July 18, 2022, that cut the price from above $2,235.60 to $111.78.

If you take away the effects of those splits, the stock would be trading around $5,186, or about 61 times the IPO price.

On a pre-split adjusted basis, the stock’s all-time closing low would be $100.11, hit on Sept. 3, 2004, and the record closing high would be $5,993.60, reached on Nov. 18, 2021.

With the stock splits, the company has a total of 12.6 billion Class A, Class B and Class C shares outstanding as of July 18, 2023, which at current prices makes it the third most valuable company in the U.S. and one of just five companies with a market cap of over $1 trillion.

And while the Wall Street version of the company is 19 years old, in its current structure as Alphabet Inc., it is only eight years old. The company announced the new umbrella company after the Aug. 10, 2015, closing bell.

Read: Google becomes Alphabet in ‘crazy’ corporate restructuring.

Since then, the stock has gone up 291%, while the Nasdaq Composite has climbed 156% and the S&P 500 has advanced 103%.

And Alphabet is now far more than an internet search company. The company’s Services business now includes Android, YouTube, Chrome and Maps, while Cloud includes infrastructure and platform services and collaboration tools.

Overall, while the stock has soared 5,064% from where it closed on its first day on Wall Street, the Nasdaq Composite has run up 617% and the S&P 500 has gone up 291%.

As impressive as the stock’s gain has been since its first day, it’s not even close to what the company has accomplished in terms of making money.

The company has been profitable every year it’s been public. The last time it lost money for the year was 2000, when it lost $14.7 million.

For 2004, the company recorded net income of $399.1 million on revenue of $3.19 billion.

In 2022, the company recorded net income of $59.97 billion on revenue of $282.84 billion.

Basically, net income has skyrocketed by 14,926% and revenue by 8,768%.

Despite all that profit growth, the company has never paid out a cash dividend, but it has repurchased shares.

It spent $29.5 billion buying back its stock during the first half of 2023, after spending $59.3 billion on share repurchases in 2022.

[ad_2]

Source link