[ad_1]

HANG SENG, Hong Kong Equities, HSI – Technical Outlook:

- The Hang Seng Index’s slide could be about to pause.

- Beyond the short-term, the index risks a drop towards the Great Financial Crisis low.

- What are the key levels to watch?

Recommended by Manish Jaradi

Get Your Free Top Trading Opportunities Forecast

HANG SENG INDEX TECHNICAL OUTLOOK – BEARISH

Deeply oversold conditions point to a potential consolidation in the Hang Seng Index, but it may not be enough to trigger a reversal of the broader downtrend.

The Relative Strength Index on the weekly and monthly charts is well below 30, the territory under the mark defines oversold conditions. Also, the index is flirting with fairly strong support at the 2011 low of 16170. Given the tentative stabilization in global risk sentiment, it wouldn’t be surprising to see a positive spillover onto Hong Kong equities.

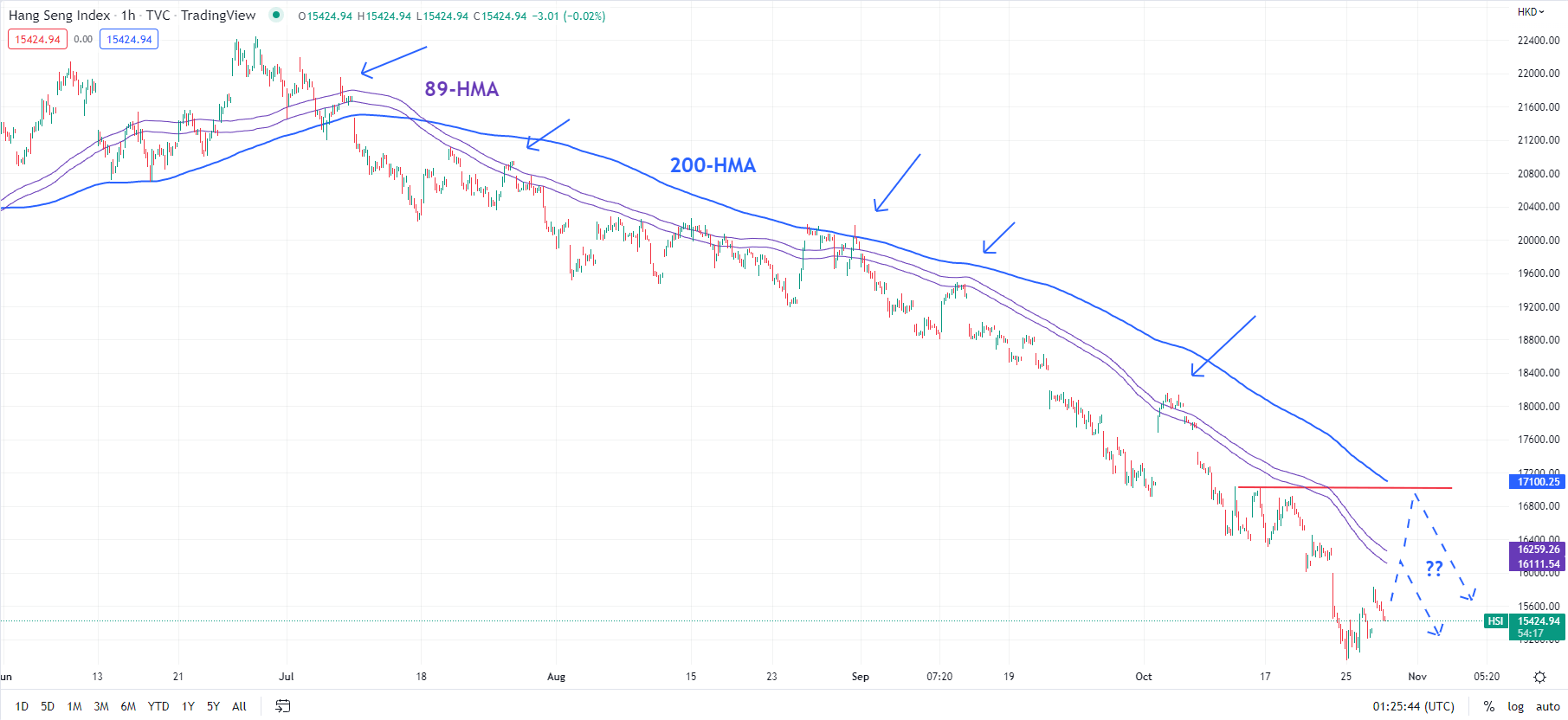

Hang Seng Index Hourly Chart

Chart Created Using TradingView

A potential rebound is likely to run into stiff resistance, starting with the 89-hour moving average – the last time the index was above the average was in June-July (see chart above). Stronger resistance is at the mid-October high of around 17000. Overall, the broader trend remains down as reflected by the negative Moving Average Convergence Divergence indicator (MACD) on the weekly, monthly and quarterly charts. A negative reading of the MACD signifies a downtrend and vice versa.

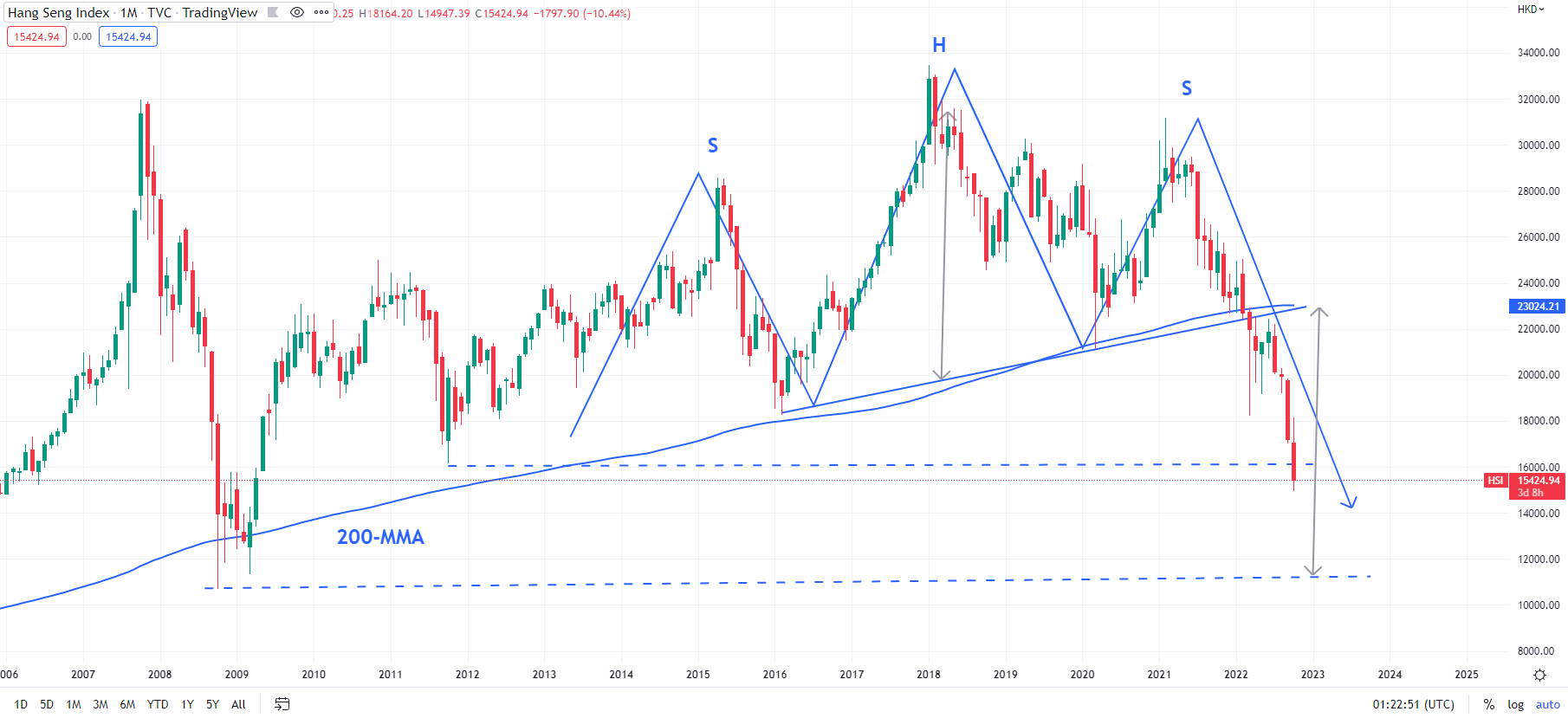

Hang Seng Index Monthly Chart

Chart Created Using TradingView

The downtrend in the Hang Seng Index has accelerated this year after it fell below an uptrend line from 2016 (that came at about 22600). The break triggered a major head & shoulders pattern (the left shoulder is at the 2015 high, the head is at the 2018 high, and the right shoulder is at the 2021 high), implying a potential move towards the Great Financial Crisis low of 10676.

Recommended by Manish Jaradi

Traits of Successful Traders

— Written by Manish Jaradi, Strategist for DailyFX.com

[ad_2]

Source link