[ad_1]

Stocks extended losses on Monday after Federal Reserve Chair Jerome Powell’s Jackson Hole speech on Friday indicated that the central bank plans to continue raising interest rates to tamp down on inflation, even if it results in “some pain” for U.S. households.

While Powell’s blunt speech increased fears on Wall Street about the central bank’s potential tolerance for a recession, economists at Jefferies expect the American economy to remain strong even as the Fed pushes rates to 4% and keeps them there for the entire 2023.

The Dow Jones Industrial Average

DJIA,

lost 51 points, or 0.2%, to 32,232 on Monday afternoon, after shedding more than 1,000 points on Friday and notching their worst day since May. The S&P 500

SPX,

was off 7 points, or 0.2%, to 4,051. The Nasdaq Composite

COMP,

declined 58 points, or 0.5%, to 12,083.

“We believe the Fed and continue to think they will push rates to 4% and keep them there for all of ’23,” wrote Aneta Markowska, chief economist, and Thomas Simons, money market economist at Jefferies in a Friday note. “We believe rates will be higher for longer because the economy will be stronger for longer.”

“In our view, the risk of a recession over the next 6-9 months is much lower than perceived. To be clear, we do not believe in a soft landing scenario; we do think that the Fed will ultimately be forced to induce a recession in order to reduce wage growth and push inflation back to 2%,” said economists. “However, taking the economy down will be harder, and will take longer than expected.”

According to Jefferies, there are three narratives now driving recession expectations. Here are reasons why they disagree with all three.

Margin expansion, positive cash flow in Q2 won’t trigger layoffs

Many investors are worried that firms will respond to high inflation and productivity weakness in the first quarter by reducing headcount, but economists at Jefferies said companies, so far, were able to pass on those costs to consumers, and margins in the second quarter expanded quite significantly.

“Non-financial domestic profits, which drive future hiring and capex decisions, increased by 9.4% quarter-over-quarter on a pre-tax basis,” wrote Markowska and Simons. “Employee compensation, which makes up roughly two-thirds of the corporate cost structure, rose by 2% quarter-over-quarter, but net revenues increased even more, by 3.3%. This resulted in margin expansion and positive cash flow.” (See chart below)

SOURCE: HAVER, JEF ECONOMICS

See: Fed’s Powell sparked a 1,000-point rout in the Dow. Here’s what investors should do next.

Real wages to rise in August; GDP to expand by more than 3% in Q3

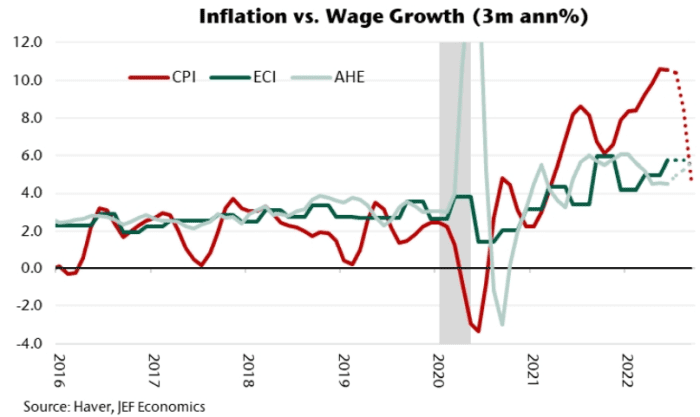

Economists at Jefferies said the narrative that negative real wages will squeeze consumer demand is “very backward looking,” and ignore that real wages increased by 0.5% in July from a month ago.

“Real wages will almost certainly rise again in August, given the fact that the CPI is on track to contract by 0.1% month-over-month,” said Markowska and Simons. “With consumers spending less on gasoline, discretionary spending – and real spending – is set to accelerate.”

Meanwhile, the two economists expect GDP to expand by more than 3% in the third quarter as net exports are likely to be very additive to the growth. “The goods trade balance narrowed by $9.5 billion in July, and has now fully reversed the Nov-March widening. We estimate that real imports declined by 2.1% month-over-month last month, while real exports rose by 3%. If both stay at their current levels through September, trade will add 2%-3% to Q3 GDP.” (See chart below)

SOURCE: HAVER, JEF ECONOMICS

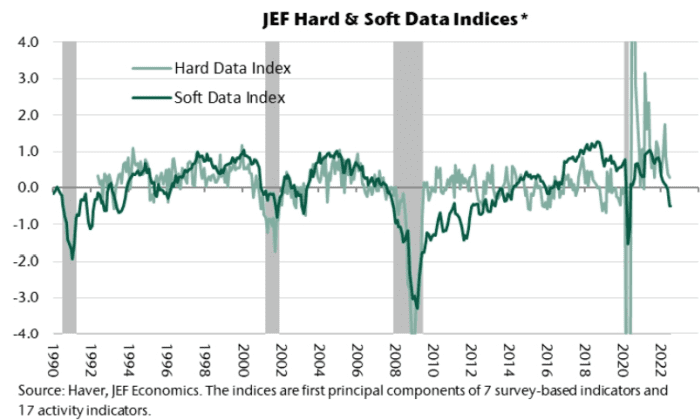

Surveys have become a misleading indicator with poor correlation with activity and GDP

Investors look at soft data to construct a Q4/Q1 recession forecast on the premise that surveys are a good leading indicator, but Markowska and Simons said they become misleading, given their poor correlation with activity and GDP over the past decade.

“Our soft and hard data indices show that these divergences are systemic and

have existed for some time,” said Markowska and Simons. “Soft and hard data used to move together, but have become very de-correlated over the past decade.” (See chart below)

SOURCE: HAVER, JEF ECONOMICS.

[ad_2]

Source link