[ad_1]

What are young investors getting wrong these days?

Our call of the day from co-founder of data provider DataTrek, Jessica Rabe, flags seven rookie investing mistakes being made by Millennial and Gen Z investors. While just 29, Rabe has spent a decade writing about and analyzing capital markets.

Here goes:

-

Trying to pick single stocks. Those can be short-term winners, but “most don’t even beat low-risk U.S. Treasury bill returns over the long run,” says Rabe, who adds picking winners requires fundamental research and discipline. Just 2.4% of global stocks were responsible for global equity gains from 1990 to 2020, but big indexes always come back and create value. Better to invest in exchange-traded funds (ETFs) that track the S&P 500 — the SPDR S&P 500 ETF Trust

SPY

— or the Invesco QQQ Trust

QQQ

for the Nasdaq 100. - Treating investing like gambling. “Most investors make money if they stick to major U.S. stock indexes for at least several years,” she says, adding that despite all the crisis over the last two decades, the S&P 500 is on the doorstep of a new record high.

-

Thinking you don’t have enough to invest. Build up that emergency fund, but then look into buying fractional shares in a brokerage account. Putting $100 in the iShares Core S&P 500 ETF

IVV

today and $50 monthly for 30 years would yield $100,000 if the S&P 500 earns a typical 10% annual return rate. -

Only investing in companies you “believe in.” The iShares Global Clean Energy ETF

ICLN

is down 26.5% year to date, which means an investor would need more savings and aggressive investments elsewhere to hit financial goals. Be aware that many theme funds or ESG products invest in energy or heavily in big tech, says Rabe. - “Letting big gains cloud your judgment.” Risk management should always be a priority. So don’t base future decisions on that big crypto win. And always diversify — not just digital currencies but also the stock market.

- Fear of missing out (FOMO). Social media is full of young investors making a killing on cryptocurrencies during the pandemic, leaving everyone else to worry they’ll miss the next big boom. “They got very lucky under unique circumstances…not a fair benchmark for your own success,” says Rabe. Cryptos are volatile and speculative so invest only as much as the cost of a nice lunch. Young people are more trusting of technology so cryptos appeal, but they lack regulatory structures that make U.S. stocks solid long-term investments. So invest sparingly and diversify elsewhere.

- Options investing: “They see peers on TikTok or Instagram discussing how they’ve made money with these strategies and want in on the action, but inexperienced investors need to understand that most equity-linked options end up being worthless,” says Rabe. Those are an especially bad idea for younger investors because all of that money will “likely disappear.” If the S&P 500 compounds at 10% for the next 40 years, like the last 40, $1,000 invested in that today instead of options, would mean $45,000 in four decades.

Plus: ‘Is this a stock market, or a casino?’ New 4X leverage S&P 500 ETN met with caution

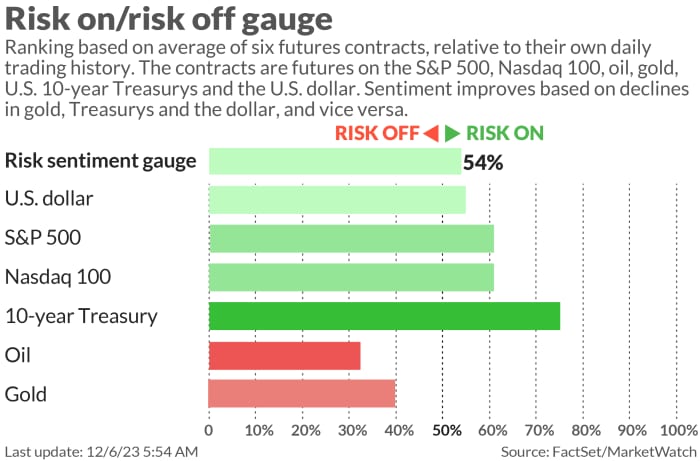

The markets

Stock futures

ES00,

NQ00,

are tilting higher after back-to-back losses for the Dow

DJIA

and S&P 500

SPX.

Bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are steady and gold is inching up at $2,040. Oil

CL.1,

is off 1%. German stocks

DX:DAX

are climbing after Tuesday’s record close.

The buzz

In the cloud space, Box shares

BOX,

are sinking on weak sales guidance, with MongoDB

MDB,

falling despite beating forecasts.

And: Apple is a $3 trillion company again, for the first time since August

Wall Street bank CEOs, including JPMorgan’s

JPM,

Jamie Dimon, are due to appear before Congress on Wednesday, and are expected to caution against stiffer regulation for lenders.

British American Tobacco

BTI,

wrote down the value of its U.S. cigarette brands by $31.5 billion.

Private-sector payroll data is due at 8:15 a.m., with third-quarter revised productivity and trade deficit numbers at 8:30 a.m.

Best of the web

How Russia punched an $11 billion hole in the West’s oil sanctions.

How a toy becomes the coveted ‘it’ gift of the holiday season.

Inflation is falling but interest rates will be higher for way longer.

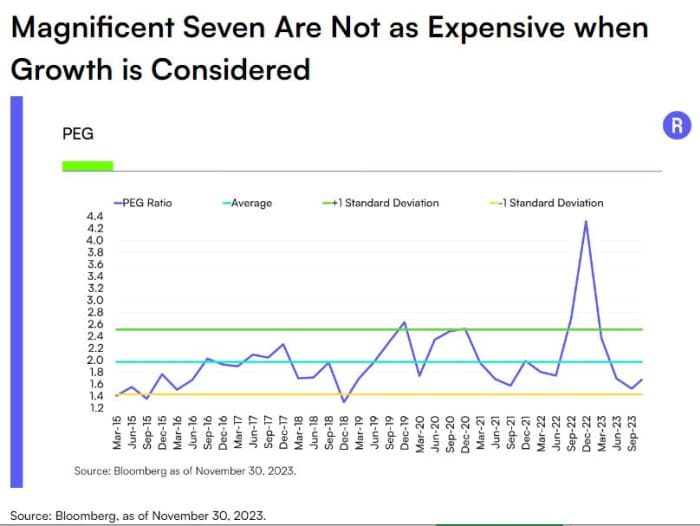

The chart

Are the Magnificent Seven stocks — Alphabet

GOOGL,

Amazon

AMZN,

Apple

AAPL,

Meta

META,

Microsoft

MSFT,

Nvidia

NVDA,

and Tesla

TSLA,

— actually cheap? Observe this chart from Dave Mazza, chief strategy officer at Roundhill Investments:

Mazza focuses on the PEG ratio — price/earnings versus growth — that can indicate a company’s true value, and a lower ratio means an undervalued stock. PEGs of tech giants surged at end 2022 to 4.32, but fell in the third quarter to a current 1.68, below the historical average of 1.97, so the Seven “may actually be undervalued when earnings growth is considered,” he writes.

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

NIO, |

Nio |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon.com |

|

PYPL, |

PayPal |

|

PLUG, |

Plug Power |

|

MARA, |

Marathon Digital Holding |

Random reads

Gaelic football team battles 72-year old curse

Woman sells home for dream luxury cruise that gets canceled.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

[ad_2]

Source link