[ad_1]

Stock markets look set to kick off with small losses Monday, resuming the weakness seen in last week’s holiday shortened trading, as another big slate of earnings looms.

That’s as bond yields creep up.

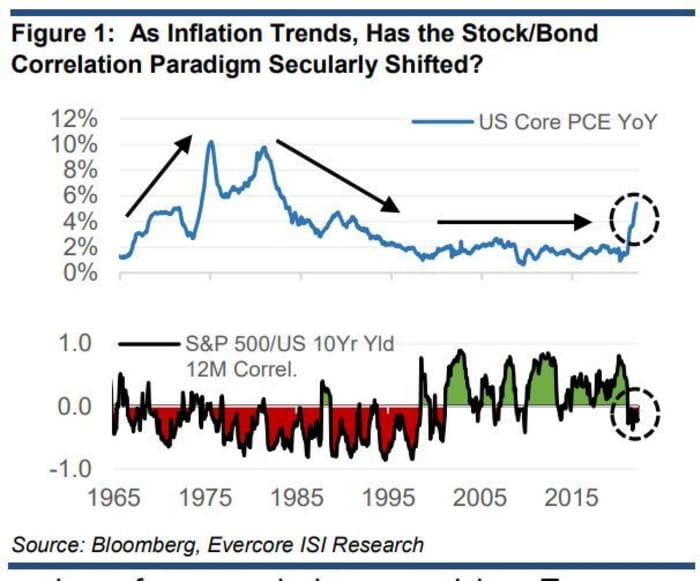

Our call of the day, from a team of Evercore strategists led by Julian Emanuel, says stocks and bonds are “destined to move together” for the foreseeable future. Equities are down 7.8% and bonds are off 8.5% year-to-date, a phenomenon that has been seen only once before in 40 years — 1994, they noted.

Uncredited

“More significant than performance alone is the breakdown of the negative correlation between stocks and bonds, risk on/risk off, that has prevailed for two decades,” said Emanuel and the team.

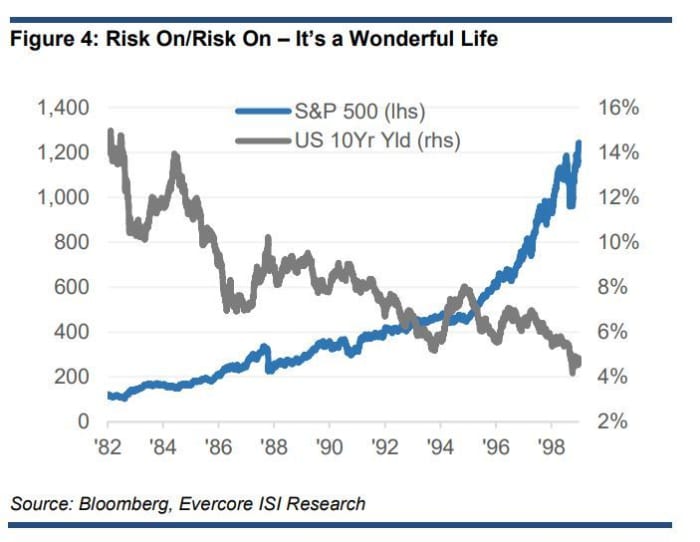

Stocks and bonds “languished together during the inflationary mid 1960s and 1970s, risk off/risk off, and rose as inflation declined in the ‘80s and much of the ‘90s, risk on/risk on. The commonality between these regimes: inflation ‘trendiness’,” they said.

Uncredited

“While there are signs that inflation is peaking, setting up the possibility of ‘risk on/risk on’ for stocks and bonds, the ‘old normal’ has become the ‘new

normal’ – stocks and bonds are destined to move together. ‘Risk on/risk on’ could commence with 10 year yields stabilizing near current peaks and accelerate with a retreat below 2.55%; the end of the recent parabolic advance

would enable investors to refocus on both earnings growth and the still low absolute level of interest rates, underpinning a rally toward SPX 4,800,” said Emanuel and the team.

That could give investors a chance to refocus on earnings growth and low interest rate levels, underpinning a drive toward 4,800 for the S&P 500. But “until yields show further signs of stabilization/moderation, we reiterate a balanced approach to equity exposure into earnings season,” he said.

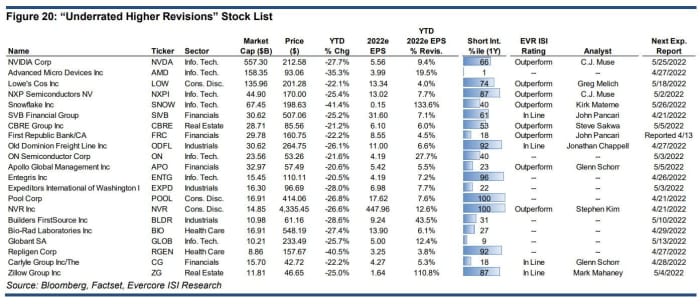

As for companies they like, Evercore offered an updated list of Russell 1000

RUI,

names on their list of companies that are expected to outperform. What they have in common is $10 billion plus in market capitalization, in the bottom 25% of index performers year-to-date, despite being in the top 25% of 2022 earnings revisions and positive expected earnings.

Uncredited

The buzz

Bank of America

BAC,

shares are up after reporting a profit fall that still beat forecasts, while BNY-Mellon

BK,

fell short of its profit view. Charles Schwab

SCHW,

shares, meanwhile, are down about 5% on weak net income.

Other big highlights this week include Netflix

NFLX,

earnings due Tuesday. On Wednesday, results are due from Tesla

TSLA,

where investors will be looking for any information on CEO Elon Musk’s $43 billion buyout offer for Twitter

TWTR,

whose shares were rising in premarket after the social-media company announced a so-called “poison pill” plan to thwart any takeover.

China’s economy expanded 4.8% annually in the first quarter, which beat expectations. That still puts the country behind scheduled to reach an officially target of 5.5% growth this year, with fresh COVID outbreaks not helping.

Didi Global

DIDI,

stock dropped 18% in premarket trading after the China ride-hailing firm reported a sharp fall in revenue over the weekend, and said it would hold a shareholder meeting next month to vote on a planned delisting from the New York Stock Exchange.

Explosions rocked the western Ukrainian city of Lviv early Monday leaving several dead as the country braces for all-out eastern assault by Russian forces.

The National Association of Home Builder’ April index is ahead, with comments also expected from St. Louis Fed President James Bullard.

The markets

Stocks

DJIA,

COMP,

have opened mixed, specifically on the tech side. Treasury yields

TMUBMUSD10Y,

are rising, oil prices

CL00,

are slightly lower, while natural gas prices

NG00,

are soaring. Gold

GC00,

is climbing too. Asian markets had a mixed day, with some weakness in China

000300,

after that growth data. The Nikkei

NIK,

dropped 1%. Europe markets were off for an extended Easter break.

Cryptos

BTCUSD,

are also lower across the board.

The tickers

These were the most active stock-market ticker symbols on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

MULN, |

Mullen Automotive |

|

TWTR, |

|

|

ATER, |

Aterian |

|

NIO, |

NIO |

|

NILE, |

BitNile |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

Random reads

Soaring food prices mean a few more billionaires in this already “super rich” family.

Jury awards Kentucky man $450,000 after he was fired over an unwanted birthday party

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.

[ad_2]

Source link