[ad_1]

It was only last week that Morgan Stanley opined that one of the macroeconomic surprises for 2023 could be that the Bank of Japan decides not to make any changes to its ultra-loose policy.

That just goes to show the perils of forecasting surprises after Japan’s central bank on Tuesday widened the band that it would tolerate bond yields by a quarter point, a move that sent the yen surging and rattled markets.

More on the BOJ to come.

Analysts at wealth manager Glenmede Investment Management point out there’s been a huge disparity between the performance of real estate investment trusts listed publicly, and those that are private.

The National Council of Real Estate Investment Fiduciaries Open End Diversified Core Equity Index — phew that’s a mouthful — has gained 22% over the last 52 weeks, through the end of the third quarter. Compare that to the MSCI U.S. REIT

BBRE,

which fell 16% over the same time period. According to Glenmede, the 38% outperformance for private REITs is the strongest on record, with data going back to the late 1970s.

There’s a pretty good reason for the disparity. Public REITs face nearly instantaneous pricing courtesy of the open market, whereas private REITs enjoy the luxury of a periodic appraisal process.

That sets up an opportunity, however. According to Glenmede, when public REITs underperform by at least 30%, they then outperform by an annual 13.5% over the next three years. The last time there was such an outperformance, in early 2009, public REITs more than doubled in value, whereas private REITs fell 18%.

The market

U.S. stock futures

ES00,

NQ00,

eased after the surprise from the BOJ. The big move was in the yen

USDJPY,

which jumped 3% vs. the dollar. Marc Chandler, chief market strategist at Bannockburn Global Forex, said the move in the yen was about two standard deviations, compared to four when the British pound slumped in reaction to the budget of former U.K. Prime Minister Liz Truss.

Bond yields, not just in Japan

TMBMKJP-10Y,

but in the U.S.

TMUBMUSD10Y,

rose.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

General Mills

GIS,

upped its outlook after beating profit estimates. Nike

NKE,

and FedEx

FDX,

will report results after the close.

The European Commission reached a settlement with Amazon.com

AMZN,

over marketplace policies without imposing a fine.

3M

MMM,

says it will take up to a $2.3 billion charge as it stops making PFAS-based additive products.

U.S. housing starts highlight the economics calendar.

Negotiators released their 4,000+ page appropriations bill, ahead of a vote on the $1.7 trillion package.

FTX founder Sam Bankman-Fried agreed to be extradited to the U.S.

Best of the web

Binance’s ex-CFO didn’t have full access to its books, a Reuters profile of the cryptocurrency exchange finds.

Neither Citigroup

C,

nor Goldman Sachs

GS,

have employment records for Rep.-elect George Santos, who said he worked for both major banks, according to The New York Times.

Here are the new buying incentives for electric cars.

Top tickers

These were the most active stock market tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

COSM, |

Cosmos Health |

|

AMZN, |

Amazon.com |

|

APE, |

AMC Entertaiment preferreds |

|

CEI, |

Camber Energy |

The chart

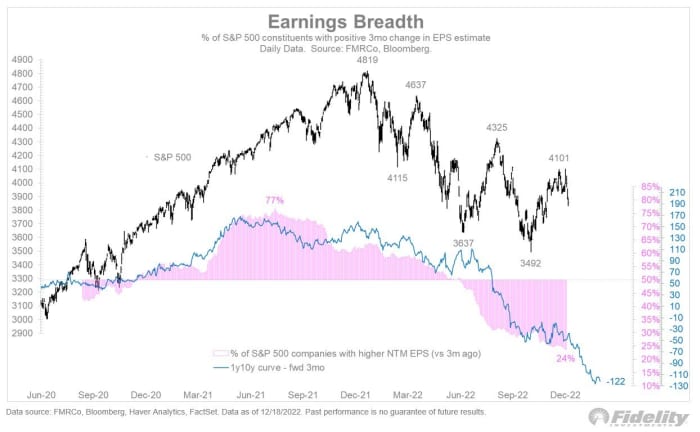

Jurrien Timmer, director of global macro at Fidelity Investments, says the percentage of companies seeing earnings downgrades keeps rising. He said given how inverted the yield curve is, this could continue, as he anticipates 2023 to be a “sideways choppy market.”

Random reads

Fugitive cows in Canada have earned some fans.

The new King Charles III banknotes were unveiled.

The weird weather phenomenon known as hair ice, which has popped up in Scotland.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

[ad_2]

Source link