[ad_1]

The inflation fight by central banks isn’t even close to over yet, according to Jumana Saleheen, Vanguard’s European chief economist.

That means markets likely remain vulnerable to additional shocks, like the crisis that erupted in U.K. government debt in September, which forced the Bank of England to step in to calm markets.

“Interest rates have increased rapidly over the past six months, and that pace is expected to continue,” Saleheen wrote, in a Monday client note. “Our view is that policy rates in these major economies will continue to rise into March 2023.”

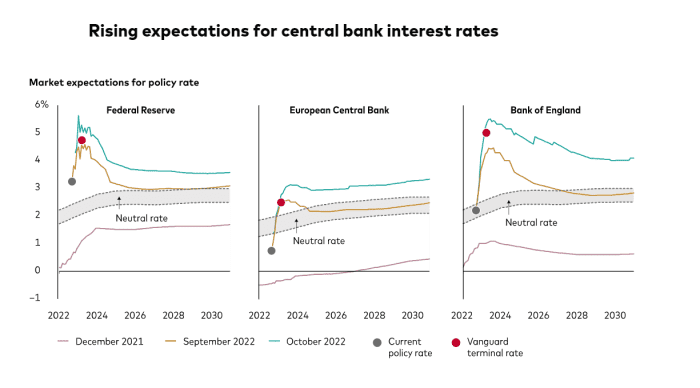

Expectations rose significantly in October (see chart) in terms of where the Federal Reserve’s policy rate was headed, with it recently pegged as likely to top 5% in 2023 from its current 3%-3.25% target range, based on one-month forward swaps rates.

The Federal Reserve’s policy rate is expected to eclipse 5% next year, but for the Bank of England’s rate to shoot even higher.

Vanguard analysis, as of Oct. 14, 2022

The red dot (above) is the “Vanguard terminal rate,” or the level at which central bank policy rates will peak for this interest rate tightening cycle.

The Bank of England’s policy rate is expected to reach almost 6% in 2023, while the European Central Bank’s rate was expected to stay below 4%. Those rates would be much higher than existing policy rates and the roughly 2% “neutral rate,” a level expected to neither stimulate to restrict major economies.

The benchmark 10-year Treasury rate

TMUBMUSD10Y,

pushed toward 4% on Monday, near its highest level since 2008, according to Dow Jones Market Data. Its climb in each of the past 11 weeks has weighed on U.S. stocks and made it increasingly more expensive for consumers to major corporations to borrow.

While the path of rates ultimately depend “on future events and data,” Vanguard’s Saleheen also said she expects central banks to stick with plans to fight inflation with higher rates unless “something breaks,” or a market threat erupts “beyond the controlled slowdown they are trying to engineer.”

Stocks closed higher Monday, following the extreme volatility that came after a key U.S. inflation reading for September remained above 8% on a year-over-year basis, dashing hopes for a quicker drop toward the Fed’s desired 2% inflation target. The S&P 500 index

SPX,

gained 2.7%, the Dow Jones Industrial Average

DJIA,

rose 1.9% and the Nasdaq Composite Index

COMP,

jumped 3.4%, according to FactSet.

Also see: ‘This is not QE or QT. This is none of those.’ Why the U.S. Treasury is exploring debt buybacks

[ad_2]

Source link