[ad_1]

Surely everyone’s contrarian impulses were triggered by the sight of the guy nicknamed Dr. Doom saying the biggest risk to markets is that the economy does too well, and given the S&P 500

SPX

did end lower (barely) on Monday, maybe a few people shared that thought.

Kevin Muir, the former trader turned blogger, has a piece breaking down the current bear and bull market advocates. The bulls, represented by Jefferies strategist David Zervos, argue the Fed put is back in markets, on the possibility, even if not enacted, that the Federal Reserve will cut interest rates. (The Fed put is the idea the central bank will step in if the economy deteriorates.)

He quotes Zervos, who spoke at the iConnections Global Alts 2024 event last month, as saying, “we took the pain, the firetrucks went and put the inflation fire out, and Jay, and the Fed infrastructure which has backstopped this economy through many different kinds of supply and demand shocks, is back in play.”

The bears are represented by Morgan Stanley’s Mike Wilson, who argues the bond market will end up being the source of the problem. “There is a threshold where rates get to a point where market says, oh gosh, we’re not getting the cuts, and financial conditions are actually going the wrong way again, and I’ve got too much risk on,” said Wilson at the same event. “We get bond vol. Then we get equity vol. And that’s how it happens. It doesn’t have to be a crash, but that’s a correction.”

Where that bond vol could come from would be the term premium, or the risk premium that official interest rates may be changed over the life of the bond. Term premium can only be inferred, but the New York Fed’s estimate is that it’s back to being negative after a brief positive spell last year, when worries about the U.S. government’s ability to fund itself sent the 10-year yield

BX:TMUBMUSD10Y

north of 5%.

Muir points out the term premium back in 1982 was 521 basis points. “Where should it be? No one knows, but with record non-recession deficits and higher-than-anytime-in-the-past-few-decades inflation, it’s easy to make the argument that the term premium should be higher. I don’t think it’s unreasonable to say that 10-year term premium should be 100 to 200 basis points. If that’s the case, then the bond market has some ugly repricing ahead of it,” says Muir.

Muir’s view is that Wilson may be end up being right about term premium, but wrong in his forecast, since Wilson’s view is that the economy is in a late-cycle period. “Don’t fear an economic slowdown. If that happens, the Fed will lower rates and eventually the economy and market will respond. David’s forecast will prove correct. That’s not a worrisome outcome,” says Muir. “Instead, fear an inflation that refuses to come down. Even worse, fear an environment where inflation starts to pick back up. That scenario is a can’t-win for financial markets.”

The market

U.S. stock futures

ES00,

NQ00,

pointed lower, and even bitcoin

BTCUSD,

showed signs of cooling off. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

was 4.18%.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,130.95 | 1.21% | 3.81% | 7.57% | 26.74% |

| Nasdaq Composite | 16,207.51 | 1.45% | 3.91% | 7.97% | 38.81% |

| 10 year Treasury | 4.193 | -10.82 | 9.01 | 31.21 | 22.34 |

| Gold | 2,133.10 | 4.51% | 4.49% | 2.96% | 15.15% |

| Oil | 78.63 | 1.33% | 8.01% | 10.23% | -2.31% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

Best of the web

China kept an annual growth target of about 5% and forecast a budget deficit target of 3% of GDP, as it also said it would issue 1 trillion yuan in special treasury bonds and 3.9 trillion yuan in local government special bonds.

According to the research firm Counterpoint, Apple

AAPL,

iPhone sales collapsed by 24% in the first six weeks of the year in China, as consumers turned to domestic rivals such as Huawei while the overall market fell 7%.

Production at Tesla’s

TSLA,

Berlin factory was halted due to a power outage, German media reported Tuesday. One of Tesla’s Chinese rivals, Nio

NIO,

said sales may dip in the first quarter as its loss was wider than analyst estimates.

Target

TGT,

reported better earnings than forecast, helping the stock rise in premarket trade.

The ISM services report highlights a quiet day on the economics front, ahead of two days of Chair Jerome Powell testimony and then the payrolls data on Friday.

The Consumer Financial Protection Bureau finalized a rule capping credit-card late fees at $8 each.

President Joe Biden and former President Donald Trump are expected to take a big step toward a rematch during the Super Tuesday slate of primaries.

Best of the web

Banks stuck with X debt held unsuccessful refinancing talks with Elon Musk.

Speaking of Musk — Jeff Bezos has overtaken the Tesla chief executive as world’s richest person

JPMorgan to become first major bank to report ratio of clean energy-to-fossil fuel financing.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

NVDA, |

Nvidia |

|

TSLA, |

Tesla |

|

NIO, |

Nio |

|

SMCI, |

Super Micro Computer |

|

PHUN, |

Phunware |

|

AMD, |

Advanced Micro Devices |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

COIN, |

Coinbase Global |

|

TSM, |

Taiwan Semiconductor Manufacturing |

The chart

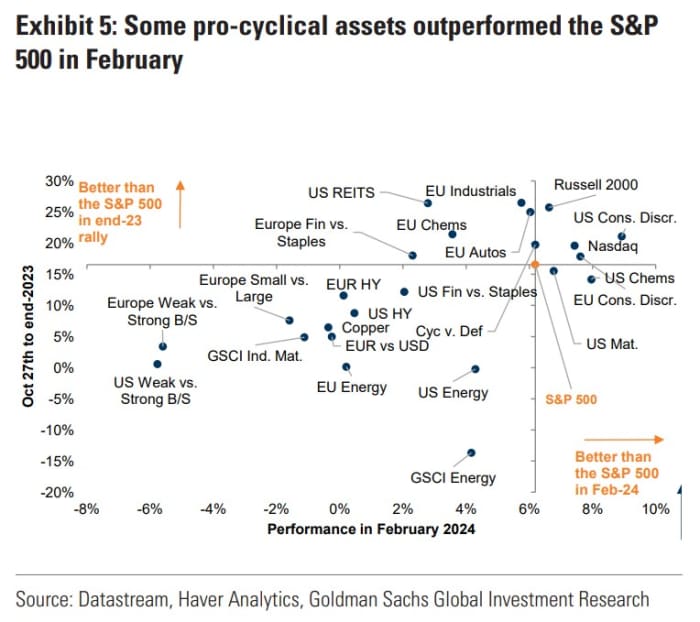

This interesting chart from Goldman Sachs plots asset performance from late October to the end of 2023, against February performance. Strategists led by Cecilia Mariotti point out “some of the most cyclical pockets, including chemicals, materials and consumer discretionary,

outperformed the S&P 500 in February, suggesting a reflationary flavor.” They say they like pro-cyclical sectors like industrials in Europe and a reversal of the quality trade in the U.S. that should favor small caps.

Random reads

A golfer ended up with a $240,000 penalty for playing too slowly.

There’s a bubble in everything, including people dressed in dinosaur costumes.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching — and how that’s affecting the economy and your wallet.

[ad_2]

Source link