[ad_1]

HSBC named Walmart its favorite of a group of seven U.S. retailers it initiated coverage of in a new report on Friday, saying Dollar General Corp. is its least favorite.

Analysts assigned Walmart

WMT,

a buy rating and Dollar General

DG,

a reduce rating, equal to sell. It assigned Costco Corp., Home Depot, Kroger’s Inc., Lowe’s Inc. and Target Co. a hold rating.

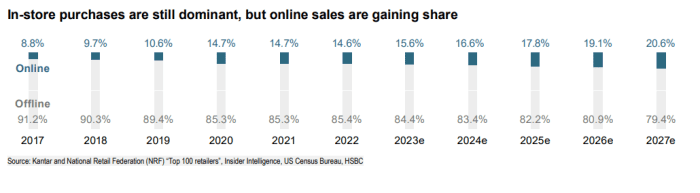

The pandemic greatly accelerated digital sales, which now account for about 15% of total retail sales in the U.S., up from about 10% before the pandemic broke out in 2020.

HSBC is expecting that trend to continue with online purchases becoming the main driver of retail sales and growing at a faster pace than bricks-and-mortar sales. At the same time, offline sales will remain the most relevant channel for most players, accounting for about 80% of sales by 2027.

“In our view, retailers with the best offline-to-online, or O2O, strategies will be the leaders in this environment,” said analysts Daniela Bretthauer and Guilherme Domingues.

HSBC report

The analysts reviewed the seven companies against the background of the postpandemic world, in which consumers appear to be valuing experiences over discretionary goods purchases. That’s based on the amount of travel — and especially international travel — that was recorded this summer, the first in which people were comfortable flying long distances again.

“With mobility essentially back to normal post COVID-19 disruptions, spending on travel and experiences is gaining momentum at the expense of discretionary spending on physical goods, accounting for a higher share of total consumer expenditures, as reported in the U.S. Census Bureau for economic data,” the report said.

Some discretionary goods, such as furniture, building materials and electronics, enjoyed “pulled-forward” demand in 2020, and are now experiencing volatility. The BEA has found the personal savings rate is below prepandemic levels, suggesting householders are relying on excess savings to support consumption.

As high inflation squeezes household budgets, consumers are spending more carefully, but of course, groceries remain a priority.

That makes Walmart a top pick for the analysts, who praised its “superior O20 strategy, sheer size, and attractive growth story with operating profits growing at a faster pace than sales.”

“Size matters in retail,” they wrote. Walmart snaps up one in every four U.S. dollars spent on U.S. groceries, which is almost as much as Kroger, Costco and Albertsons combined.

Dollar General, in contrast, is behind on digitization and is hurting from a dearth of short-term drivers. The company has a strong value proposition as the biggest discount retailer by store count in the U.S., but its exposure to weaker consumer spending on discretionary goods call for a bearish view, said the report.

Costco’s

COST,

e-commerce strategy complements its warehouse business well and its pricing is competitive.

“Shares appear fairly valued trading at a 2024e PE of 36x (10% premium to the historical average), and we see few near-term catalysts,” said the report.

Home Depot

HD,

is a leader in the fragmented but large home-improvement market, which is estimated to be worth about $1 trillion. It has a solid 020 strategy and delivered $50 billion in revenue and $6 billion in earnings in the last three years.

See also: Dollar-store stocks slide and UBS says Chinese discount websites may be their next challenge

“While we acknowledge Home Depot’s distinct competitive advantages and operational excellence, we think shares present a balanced risk/reward return,” the analysts wrote.

Kroger

KR,

meanwhile, would be the third-largest U.S. food retailer if its merger with Albertson’s

ACI,

goes through, but the timing and terms of any deal remain unclear.

“Given that shares are trading in line with the historical sector average and

merger uncertainties, we believe the stock is fairly priced,” said the report.

Lowe’s is the second-largest home-improvement retailer in the U.S. after Home Depot and it has returned $34 billion to shareholders in the last four years for an average return on invested capital of 37%. However, “shares appear fairly valued given that our target PE multiple is 6% below the average multiple the stock traded at during the pandemic years.”

Finally, Target

TGT,

is one of the most iconic retailers in the U.S. with an estimated 3% market share in 2022, the report said, citing Euromonitor data.

Read also: Retailers compete to be first to hold holiday sales in a bid to spur flagging demand

But the analysts questioned whether its store-as-the-hub model is the best and most profitable way to grow its 020 business.

“Higher exposure to discretionary (c60% of sales) categories and execution risks keep us on the sidelines on Target shares,” they wrote.

The Consumer Staples Select Sector SPDR exchange-traded fund

XLP

has fallen 4.6% in the year to date, while the SPDR S&P Retail ETF

XRT

has gained 0.5%. The S&P 500

SPX

has gained 16%.

[ad_2]

Source link