[ad_1]

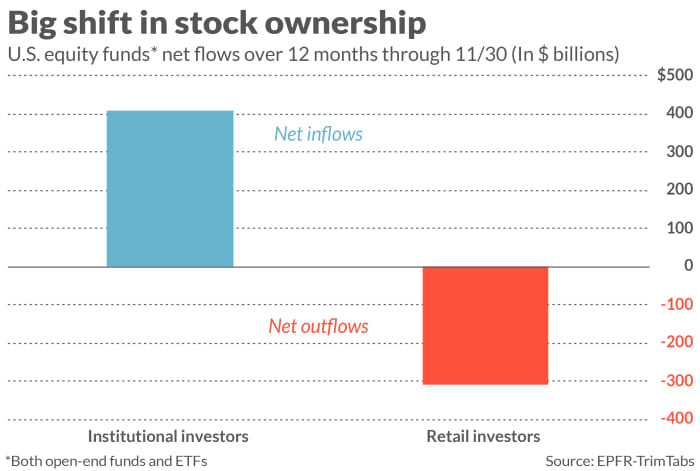

The stock market’s longer-term prospects are looking up, according to flow data for U.S. equity mutual funds and ETFs. That’s because institutional investors over the past 12 months have poured significantly more money into U.S. equity funds than retail investors have taken out.

Institutions have a longer-term investment horizon than the typical retail investor. So it’s encouraging that they on balance are not only buying the shares which retail investors are unloading, but investing even more.

The chart above summarizes the data, courtesy of EPFR-TrimTabs. Over the 12 months through the end of November 2022, during which the Vanguard Total Stock Market ETF

VTI,

lost 11.3% and the Nasdaq Composite Index

COMP,

lost 26.2%, institutional investors poured a net $408.6 billion into U.S. equity funds. Meanwhile, net outflows from retail investors, in contrast, totaled $310.1 billion. Winston Chua, an analyst at EPFR-Trim Tabs, said in an email that “it is a longer-term positive” that institutions are exhibiting confidence in equities.

It’s worth noting that these 12-month totals are not being skewed by extreme readings from just a couple of months. Institutions have been the source of net inflows in 10 of the past 12 months, according to EPFR-TrimTabs. And retail investors have been the source of net outflows in each of the past 12 months.

“ Retail investors have a much shorter investment horizon than institutional investors, and are far more reactive. ”

Retail investors have a much shorter investment horizon than institutional investors, and are far more reactive. They tend to sell after the market has begun to decline, just as they tend to chase a bull market higher.

This is why the behavior of retail investors is such a good contrarian indicator: They will be maximally bearish at market bottoms and maximally bullish at market tops. So not only is the net inflow from institutional investors a bullish omen in its own right, so also is the large net outflow from retail investors over the past year.

The contrasting behavior of retail and institutional investors is the source of Warren Buffett’s famous line that “the stock market is a device to transfer money from the impatient to the patient.” We should worry about the stock market’s longer-term prospects only when patient investors themselves lose patience. Fortunately, that is not happening right now.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: New research claims the bear market won’t be over until the VIX says so.

Plus: Want millions more in retirement? This small investment tweak can make a big difference.

[ad_2]

Source link