[ad_1]

“Some financial advisers are asserting that Buffett is finding it harder than ever to find undervalued companies to acquire.”

Warren Buffett’s company may be sitting on a record amount of cash, but that doesn’t necessarily mean the famed investor thinks the stock market is overvalued.

It’s important to point this out in order to counter the narrative that has emerged since the latest quarterly report from Buffett’s company, Berkshire Hathaway

BRK.A,

BRK.B,

Some financial advisers are asserting that the conglomerate’s huge cash hoard — more than $150 billion in cash and short-term investments, largest ever in the company’s near-60-year history — indicates that Buffett is finding it harder than ever to find undervalued companies to acquire. If so, that in turn would imply that the stock market is dangerously overvalued.

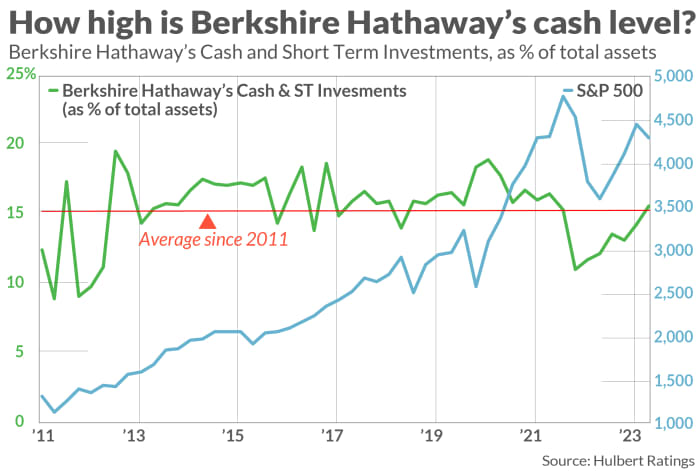

Put in its proper context, however, Berkshire’s current cash level is unexceptional. As a percentage of the company’s total assets, that level is almost precisely equal to its historical average. Think about it this way: Because Berkshire has grown as a company, a constant percentage allocation to cash translates to a growing dollar amount held in cash and short-term investments. All Berkshire’s expanding cash hoard might be telling us is that the company is bigger than it used to be.

As you can see from the chart below, though Berkshire’s cash allocation hasn’t been constant, it has fluctuated in a narrow range. Berkshire’s most recent allocation — 15.7% — is essentially no different than it 15.5% average since 2011.

The chart also includes a plot of the S&P 500

SPX,

showing that changes in Berkshire’s cash level are not inversely correlated with the market’s ups and downs. Such an inverse correlation would exist if Buffett’s allocation to cash reflected a contrarian reaction to an over- or undervalued market. Instead, there often has been a positive correlation between the two series. During 2022’s bear market, for example, the cash allocation fell — opposite of what you would expect on the theory that the allocation reflects a growing number of bargains on Wall Street.

This does not mean Buffett is a bad market timer. After all, he doesn’t believe in market timing in the first place. Fluctuations in Berkshire’s cash level are largely due to other factors unrelated to market timing. The drop in the company’s cash allocation in 2022, for example, largely reflected the acquisition of Allegheny Corp. for $11.6 billion in cash.

The bottom line? While Warren Buffett may believe that the stock market is overvalued, you can’t conclude this from Berkshire’s current allocation to cash and short-term investments.

A broader takeaway from this discussion is the value of adopting a skeptical attitude towards Wall Street assertions. Not all are misleading, but many of them are — even those that superficially seem compelling.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

[ad_2]

Source link