[ad_1]

Japanese Yen analysis and news:

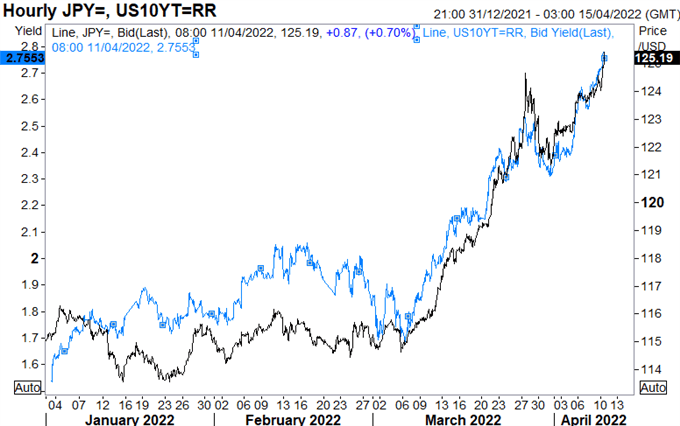

USD/JPY Tracking Bond Yields Higher

The Japanese Yen remains on the backfoot as global bond yields continue its upward trajectory, in which the US 10yr has hit a fresh multi-year high of 2.78%. Subsequently, USD/JPY has made a break through the 125.00 handle, which had previously been the line in the sand for the BoJ in 2015. However, with BoJ Governor Kuroda reiterating that a weak currency is good for the economy, the BoJ appear calm over Yen weakness for now. In turn, risks remain geared towards further upside, with dips likely to find support, particularly in the current environment with yields remaining elevated.

USD/JPY vs US 10Y Yield

Source: Refinitiv

Client Sentiment Signals Further Bullish Momentum for USD/JPY

Data shows 23.58% of traders are net-long with the ratio of traders short to long at 3.24 to 1. The number of traders net-long is 3.54% higher than yesterday and 17.31% lower from last week, while the number of traders net-short is 6.23% higher than yesterday and 11.63% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias.

Topside levels

125.85 (2015 high)

130.00

135.15 (2002 high)

USD/JPY Chart: Monthly Time Frame

Source: Refinitiv

[ad_2]

Source link