[ad_1]

Japanese Yen (USD/JPY) Analysis and Charts

- USD/JPY ticks up as November bows out

- A BoJ official has cast doubt on any near-term monetary alteration

- The USD, meanwhile, has been boosted by stronger US growth data

The Japanese Yen slipped a little against the United States Dollar on Thursday, with the possibility of tighter Japanese monetary policy undermined by recent commentary from an official at the Bank of Japan. The foreign exchange market has been cautiously bullish on the comparative outlooks for the two majors since mid-November. The prospect of lower US interest rates in the first half of next year has stripped the Dollar of a lot of support, and not only against the Yen. Meanwhile, the view that domestic Japanese inflation might have risen far enough to see the BoJ unwind its incredibly loose monetary policy stance has given the Yen a boost.

However, Bank of Japan monetary policy board member Seiji Adachi said quite explicitly on Wednesday that Japan’s economy had yet to reach the stage at which an exit from current policy settings could be considered.

“For now, it’s appropriate to patiently continue with monetary easing,” he reportedly said.

Learn How to Trade USD/JPY with our Complimentary Guide

Recommended by David Cottle

How to Trade USD/JPY

While inflation has been clearly seen across the entire global economy, the durability of its impact on Japan has kept markets guessing as to what the BoJ might have planned. Japan’s economy has been wrestling with a lack of locally generated pricing power for many years now. And, as Mr. Adachi pointed out, it’s probably going to take more than a few months of stronger inflation data to convince policymakers that it’s back. The belief that the BoJ will act, albeit cautiously, to roll back some of its accommodation, remains quite strong in the foreign exchange market, but this latest commentary has certainly given traders and investors pause.

If they start to feel that they’ve got too far ahead of the BoJ’s thinking, then the Yen could face some stronger headwinds, but it’s equally likely that Thursday’s modest weakness is explicable by some calendar-based position squaring as we head into the end of the month. So, a bit of caution is clearly warranted going into the next monetary policy decisions from the Federal Reserve and the Bank of Japan. They’re coming up on the 13th and 19th of December, respectively.

Recent upgrades to overall US growth figures have also offered the Dollar some general support.

Recommended by David Cottle

The Fundamentals of Breakout Trading

USD/JPY Technical Analysis

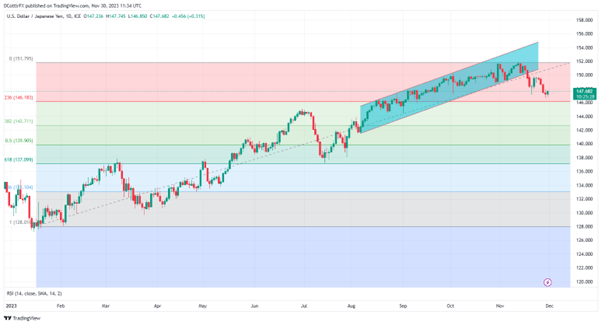

USD/JPY Daily Chart Compiled Using TradingView

The Dollar is back at lows not seen since early September against the Japanese currency, but it is perhaps notable that despite some sustained weakness, even the first Fibonacci retracement of the long rise up to mid-November’s peaks from the lows of January has yet to face a serious challenge, although maybe one is coming shortly.

It comes in at 146.183, less than a single Yen below current levels.

Dollar bulls’ efforts to regain the uptrend channel in place since August 4 petered out with the falls seen on Monday, with the 149.54 region abandoned in that session now offering near-term resistance. That will need to be retaken if the year’s highs above 151.00 are to come back into the bulls’ sights.

The Dollar is drifting toward levels at which its Relative Strength Index would suggest that it had been oversold but, with the RSI at 39, it’s not there yet. A reading of 30 or below would be unambiguous oversold territory.

IG’s own sentiment indicator finds traders extremely bearish on the Dollar, to the tune of 74%. This may well favor at least a short-term contrarian play for a bounce.

–By David Cottle for DailyFX

[ad_2]

Source link