[ad_1]

Japanese Yen, USD/JPY, US Dollar, Bank of Japan, Fed, Momentum – Talking Points

- USD/JPY might be eyeing a test of the high seen just before intervention

- Although Bank of Japan selling of USD/JPY worked initially, questions remain

- If the Yen resumes weakening, how high will USD/JPY go?

Recommended by Daniel McCarthy

Get Your Free JPY Forecast

USD/JPY

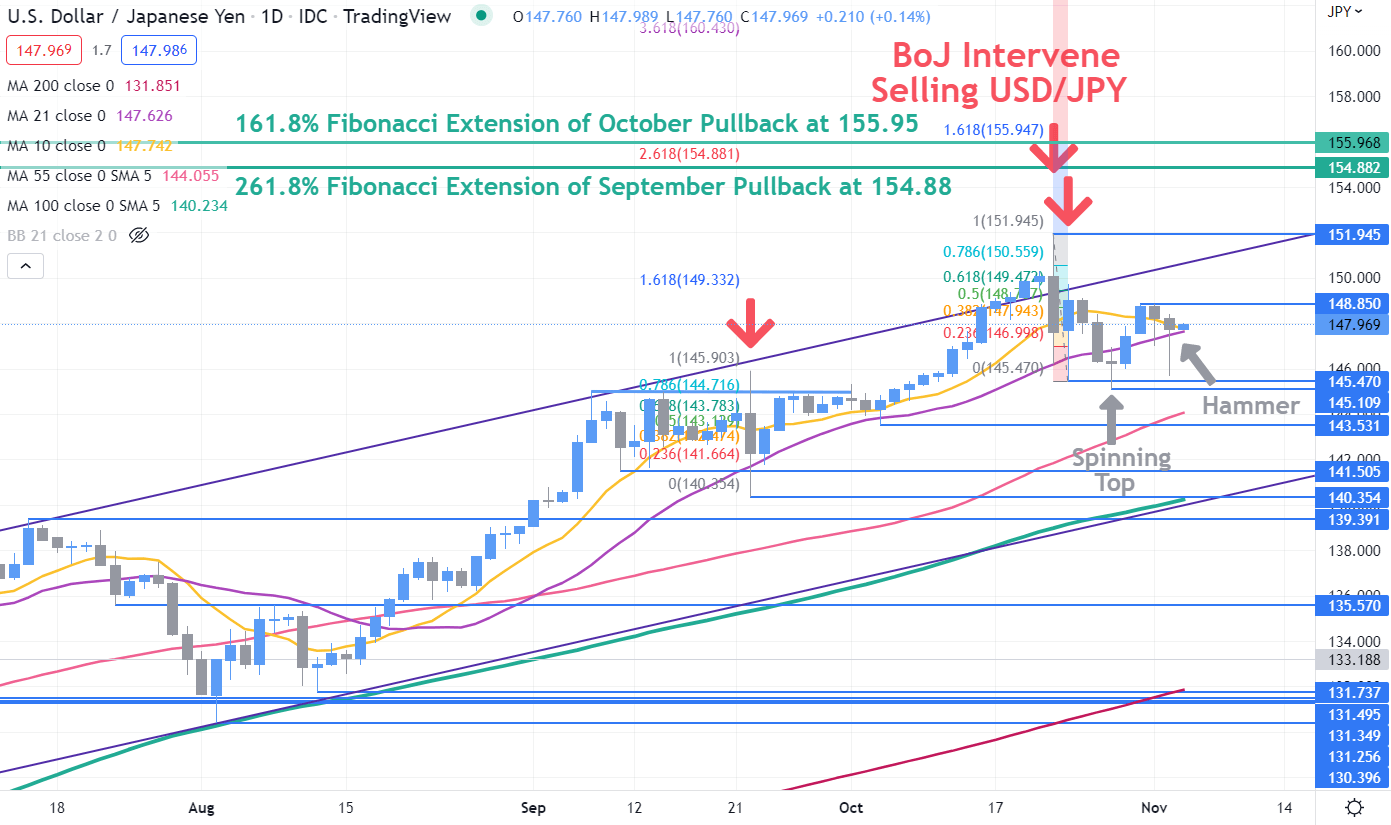

USD/JPY broke the upper bound of an ascending trend channel in mid-October before the Bank of Japan intervened and sold US Dollars, and bought Yen.

The run lower came to an end when a Spinning Top Candlestick emerged to signal a reversal. The run higher was relatively short-lived before it collapsed yesterday.

The move lower was based on hopes that the Federal Reserve might pull back from aggressive rate hikes. That ambition was quashed by comments from Fed Chair Jerome Powell and USD/JPY rallied into the Wednesday close.

That price action created another potential bullish reversal signal in a Hammer Candlestick formation. The run lower yesterday was unable to penetrate below a break point and prior low at 145.47 and 145.11 respectively. That area may continue to provide support.

A bullish Hammer is most often recognised at the end of a trend lower, but none-the-less, it might provide indication of a return to bullishness.

Further down, support could be at the break points and previous lows at 143.53, 141.50, 140.35 and 139.39. Support may also be at an ascending trend line and the 100-day simple moving average (SMA) in the 140.20 – 140.25 area.

Recommended by Daniel McCarthy

How to Trade USD/JPY

Nearby resistance might be at the prior peaks at 148.85 and 151.95.

154.88 may offer resistance as it is the 161.8% Fibonacci Extension of the mid-September pullback from 145.90 to 140.35. Another potential resistance is at 155.95, representing the Fibonacci Extension level of the move from 151.95 to 145.47.

Both of those instances of a sell-off in USD/JPY are days that the BoJ intervened.

Medium and long-term bullish momentum could be intact with the price above the 55-, 100- and 200-day SMA and all three SMAs have a positive gradient.

Short-term momentum is somewhat opaque with the price criss-crossing the 10- and 21-day SMAs. A break higher from here would place the price above both of these SMAs and possibly turn the gradient on the 10-day SMA from negative to positive. The 21-day SMA is currently positive.

In this event, all period SMAs may suggest that bullish momentum is further evolving.

{{EDU_SUBMODULE|15}}

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

[ad_2]

Source link