[ad_1]

Japanese Yen Technical Price Forecast: USD/JPY Weekly Trade Levels

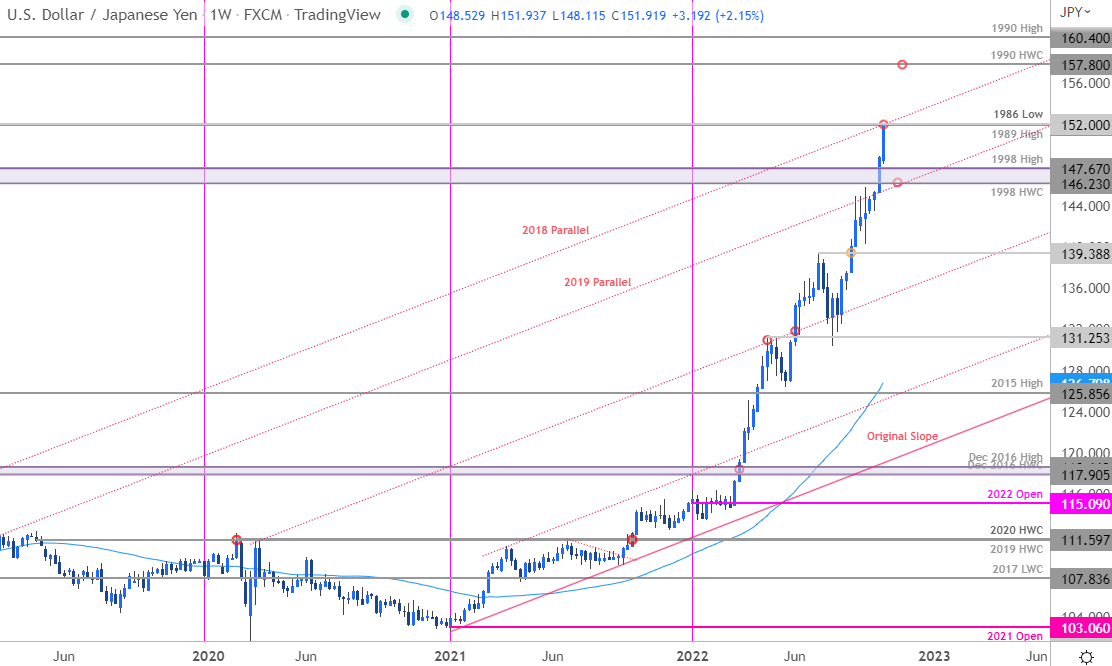

- Japanese Yen technical trade levels update – Weekly Chart

- USD/JPY breakout approaching uptrend resistance at multi-decade highs

- Support 146.23-147.67 (key), 139.38 – Resistance 151.90-152 (key), 157.80, 160.40

The US Dollar surged more than 2% against the Japanese Yen this week with USD/JPY pressing multi-decade highs on a multi-month advance. The rally has now extended more than 16% off the August lows and a full 32% year-to-date. While the magnitude has been impressive, it is not unprecedented in USD/JPY price action and the focus remains on possible inflection into technical resistance just higher. These are the updated targets and invalidation levels that matter on the USD/JPY weekly price chart. Review my latest Weekly Strategy Webinar for an in -depth breakdown of this USD/JPY technical setup and more.

Starts in:

Live now:

Oct 24

( 12:10 GMT )

Live Weekly Strategy Webinars on Mondays at 8:30AM EST

Weekly Scalping Webinar

Japanese Yen Price Chart – USD/JPY Weekly

Chart Prepared by Michael Boutros, Technical Strategist; USD/JPY on Tradingview

Technical Outlook: In last month’s Japanese Yen Technical Forecast I noted that USD/JPY was approaching a, “major technical threshold at the 1998 high-week close / swing high at 146.23-147.67– an area of interest for possible topside exhaustion / price inflection.” A solid inflection last week fueled another accelerated rally with the advance taking out, “objectives at the 100% extension of the 2011 advance (149.07) and the 150-handle, and the 1998 high at 151.90.” Looking for a reaction up here.

USD/JPY is poised to mark a tenth consecutive weekly advance – a feat not accomplished since 2013. There have not been many instances of such a stretch and few technical assumptions can be assumed off this single observation. That said, weekly RSI remains in deep in overbought territory, keeping momentum on the side of the bulls for now. I’ve been tracking ongoing divergence since the May high and looking to see if this stretch marks a third reference high, raising the threat for near-term exhaustion. Stay tuned. . .

The immediate focus is on a weekly resistance just higher at the 1989 high / 1986 low at 151.90-152. Note that a parallel of the original 2021 / 2022 slope, extending off the 2018 highs converges on this threshold- looking for a possible price inflection up here. Initial weekly support rests back at the 1989 high-week close / swing high at 146.23-147.67– a break / close below this threshold would threaten a larger correction within the broader uptrend (medium-term bullish invalidation). A topside breach / close above 152 would likely fuel another accelerated run with such a scenario exposing subsequent resistance objectives around the 1990 high-week close at 157.80 and the 1990 high at 160.40.

Recommended by Michael Boutros

Download our Japanese Yen Trading Forecast!

For a complete breakdown of Michael’s trading strategy, review his Foundations of Technical Analysis series on Building a Trading Strategy

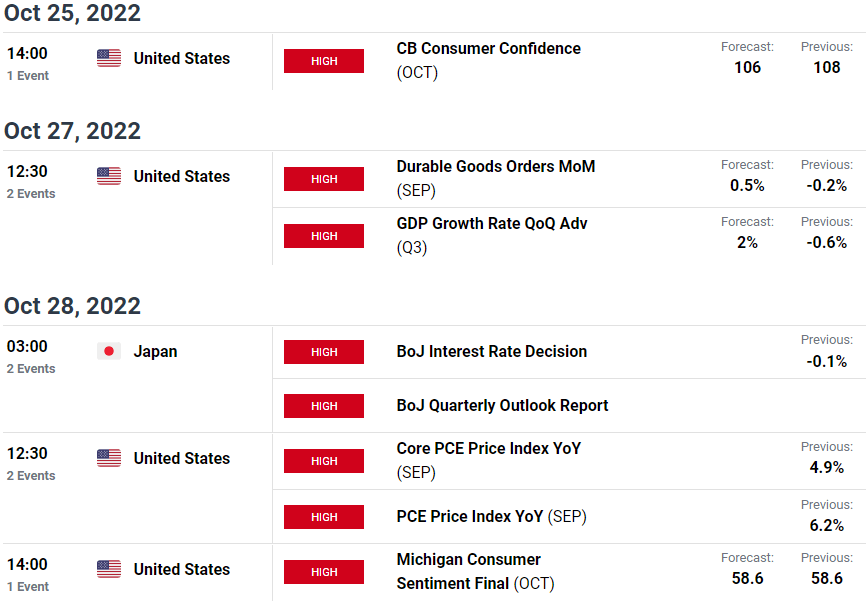

Bottom line: The USD/JPY breakout is extending into confluent uptrend resistance- risk for price inflection / exhaustion in the week ahead. From a trading standpoint, look to reduce portions of long-exposure / raise protective stops on a stretch towards parallel resistance– losses should be limited to the 146.23 IF price is heading higher with a breach / close above this zone needed to keep the immediate rally viable. Keep in mind aside from the clear & present danger of FX intervention, the BoJ interest rate decision and US Core Inflation (CPI) are on tap next week – expect volatility here. I’ll publish an updated Japanese Yen Short-term Outlook once we get further clarity on the near-term USD/JPY technical trade levels.

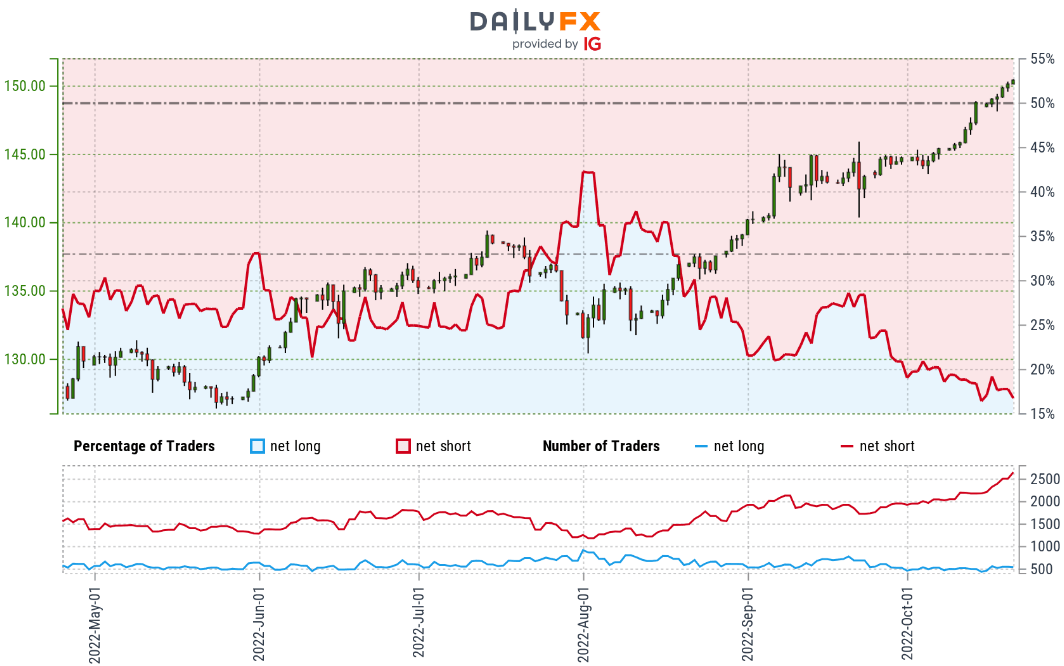

Japanese Yen Trader Sentiment – USD/JPY Price Chart

- A summary of IG Client Sentiment shows traders are net-short USD/JPY – the ratio stands at -4.54 (18.05% of traders are long) – typically bullish reading

- Long positions are 1.39% higher than yesterday and 14.99% higher from last week

- Short positions are 2.72% higher than yesterday and 18.97% higher from last week

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger USD/JPY-bullish contrarian trading bias from a sentiment standpoint.

| Change in | Longs | Shorts | OI |

| Daily | -5% | -7% | -7% |

| Weekly | 0% | 11% | 9% |

US / Japan Economic Calendar

Economic Calendar – latest economic developments and upcoming event risk.

Active Weekly Technical Charts

Foundational Trading Knowledge

Forex for Beginners

New to Forex Trading? Get started with this Beginners Guide

— Written by Michael Boutros, Technical Strategist with DailyFX

Follow Michael on Twitter @MBForex

[ad_2]

Source link