[ad_1]

U.S. stocks are off to a strong start this year, but the choppiness that characterized last year’s tumult has yet to subside, which could portend more volatility ahead.

Last year, the S&P 500

SPX,

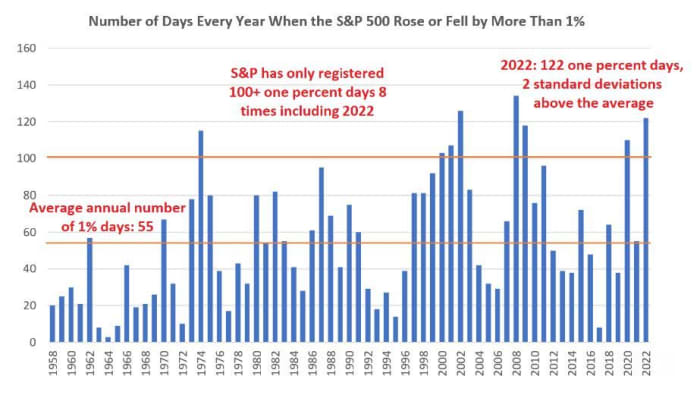

logged 122 daily swings of 1% in either direction, according to data shared by DataTrek’s Jessica Rabe. That’s the most since 2008, and 12 more than in 2020, when the advent of the COVID-19 pandemic sent markets into a tailspin, but also a torrid recovery.

DATATREK

The swings of last year were well above average. Since 1958, the S&P 500 has typically seen 55 1% swings per year. By this measure, the index’s performance was a major outlier, falling two standard deviations above the mean.

The S&P 500 was launched more than six decades ago in 1957, but in all that time there have been only eight years where the index recorded more than 100 daily swings of 1% or greater. They were: 1974 (115), 2000 (103), 2001 (107), 2002 (126), 2008 (134), 2009 (118), 2020 (110) and 2022 (122).

What does this tell us about potential performance for the stock market in 2023?

An analysis by DataTrek found that heightened realized volatility typically bleeds into the first quarter of the following year. Often, the number of exaggerated swings remains significantly higher than the historical quarterly average for the index, which stands at 13 per quarter.

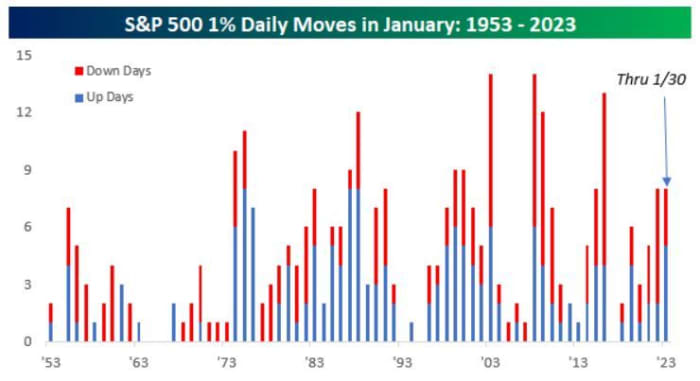

So far, the market’s performance for the first quarter is shaping up to be about as volatile as the historical data would suggest. According to an analysis from Bespoke Investment Group, the S&P 500 is on track to log eight moves of 1% in either direction in January, barring another outsize swing on Tuesday, the final trading session of the month.

That’s tied with the number from last January. However, there is one important difference: only three of the 1%+ moves from this month have been to the downside, roughly half the number from last January, as Bespoke shows in the chart below.

BESPOKE

Should the large-cap index record another 1%+ move on Tuesday, it would mark the most 1% swings to kick off a year since January 2016, when the S&P 500 logged 13 such moves during a rocky period for global equities.

According to DataTrek’s analysis, investors should expect this choppiness to continue for the remainder of the first quarter.

“…the Q1 after an especially volatile year is typically choppy and returns are therefore a coin toss, whereas volatility tends to abate over the course of the entire year and the annual return is more favorable as a result,” Rabe said.

The S&P 500 is up 0.8% in recent trade, putting it within reach of another 1% swing as of the early afternoon in New York. The Nasdaq Composite

COMP,

was up 1%, while the Dow Jones Industrial Average

DJIA,

was up 0.5%. All three indexes are on track to log a quarterly advance, with the Nasdaq in the lead with a gain of about 10% so far, while the S&P 500 is up nearly 5.5%.

[ad_2]

Source link