[ad_1]

Leafly Inc. rang the opening bell at the Nasdaq Wednesday as the cannabis marketplace celebrated the unofficial cannabis holiday of April 20 at a very official place.

With cannabis fans highlighting April 20 as a special day for stoners and pot now legal in the Big Apple and New Jersey, Leafly Holdings Inc.

LFLY,

CEO Yoko Miyashita chose the crossroads of finance at the Times Square Nasdaq headquarters in New York City to generate a buzz around the stock’s initial listing on the exchange earlier in 2022.

“There is not a lot in this business that’s easy — it’s faced decades of prohibition,” she told a crowd of about 100 cheering employees, shareholders and board members of the cannabis marketplace gathered at the Nasdaq. “Leafly has emerged as a mainstream change-maker.”

Also Read: How 420 the stoner’s holiday went mainstream

With cannabis still illegal under federal law, the Nasdaq continues to ban plant-touching companies that do business in the U.S. from trading on the exchange. The New York Stock Exchange has a similar policy.

While Leafly provides information on cannabis strains and helps consumers purchase cannabis, it does not have any direct contact with the plant, so it’s one of many U.S.-focused cannabis companies that trade on the Nasdaq. (See chart at bottom of story).

Leafly stock began trading in February after it was acquired by special-purpose acquisition company (SPAC) Merida Merger Corp. I in a deal with an equity value of about $532 million. The stock has since risen to just above $10 a share after trading at the $6 to $7 level shortly after it made its debut.

Overall, cannabis stocks have been moribund in 2022 amid dim prospects for federal legalization. The AdvisorShares Pure US Cannabis ETF

MSOS,

is down about 30% this year, even as states continue to introduce adult use and medical use programs as a way to drum up more tax revenue from cannabis cultivation, distribution and sales. In comparison, the S&P 500 index

SPX,

has slipped 6.0% year to date.

Leafly traces its roots to founder Brendan Kennedy, the former executive of SVB Financial Group subsidiary Silicon Valley Bank

SIVB,

who formed cannabis private-equity firm Privateer Capital, which has backed Leafly, Marley Natural and Tilray Inc.

TLRY,

Kennedy helped launch the company as a cannabis information source.

At least check, the company employs about 236 people with 2021 revenue of $43 million and a net loss of $12 million. Wall Street analysts expect Tilray to grow revenue to $52.9 million in 2023, with a projected net loss of $34.1 million.

The company ended 2021 with 5,265 retail accounts, an increase of 44% for the year.

Leafly CEO Yoko Miyashita

Leafly

Miyashita has been CEO of Leafly since August 2020 after working at the company since 2019 in her previous post of general counsel. Prior to Leafly, she was senior vice president and general counsel at Getty Images from 2005 to 2019.

Cannabis lovers have been celebrating April 20 for decades, but the date has never received any official designation by Congress or any other major governmental body. Nevertheless, it has spread mostly through word of mouth.

Four-twenty observances have grown in renown as more states legalized the plant for medical and adult use.

New Jersey, for example, will begin adult-use sales of recreational cannabis on Thursday with a limited number of stores.

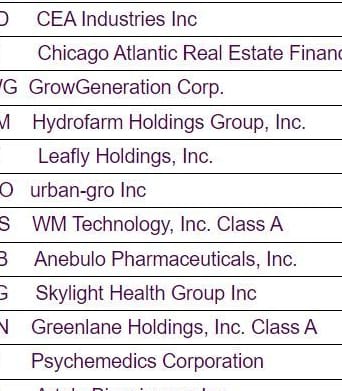

Leafly is one of many ancillary cannabis companies that trade on the Nasdaq including GrowGeneration Corp.

GRWG,

Hydrofarm Holdings Group Inc.

HYFM,

and Village Farms International Inc.

VFF,

and business development company Silver Spike Investment Corp.

SSIC,

(See chart at bottom of article for full list).

The Nasdaq allows some plant touching companies such as Organigram, Cronos Group

CRON,

and Tilray Brands Inc.

TLRY,

to trade because they’re based in Canada, where pot remains legal nationally.

Also Read: Cannabis company that DEA is allowing to grow for research purposes to list shares on Nasdaq

The roots of 420 go back to the 1970s in northern California, when a group of high-school students would meet at 4:20 in the afternoon to smoke cannabis and socialize.

High Times editor Steve Bloom helped popularize 420 by writing about a 420 flyer that he found at a Grateful Dead show in Oakland, Calif., in 1990. April 20 became the cannabis day because it’s 4/20 on the calendar.

Nasdaq listed ancillary cannabis and non-U.S.-based cannabis companies

Nasdaq

[ad_2]

Source link