[ad_1]

The so-called Magnificent Seven have had an incredible run in 2023. But what are the chances it might continue in the New Year?

That’s a question that many on Wall Street have been asking after the seven most valuable publicly-traded U.S. companies recouped all of their losses from 2022, and then some in 2023, propelling the S&P 500

SPX

up more than 17% year-to-date even as five of the index’s 11 sectors remain mired in the red, according to FactSet data.

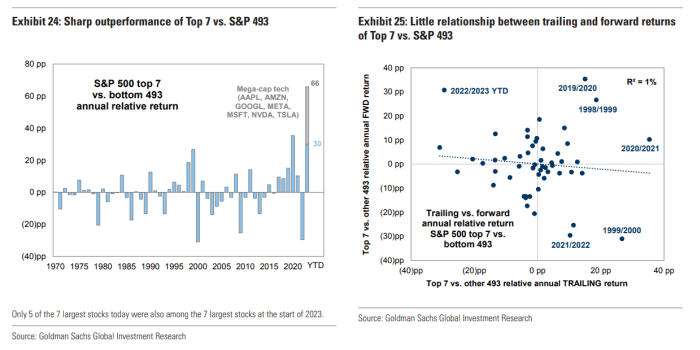

But according to an analysis by a team of analysts at Goldman Sachs Group led by Chief U.S. Equity Strategist David Kostin, there’s no reliable correlation between trailing and forward outperformance when it comes to the seven most valuable stocks in the S&P 500, as the team illustrated in the charts below.

Credit: Goldman Sachs

That means they could see their valuation relative to the rest of the market climb even higher during the months ahead.

“The [30 percentage points] of outperformance of the seven largest stocks at the start of this year vs. the rest of the index YTD ranks as the second largest annual difference since 1970,” Kostin and his team said in a note.

“While the magnitude of outperformance has been striking, there has been no reliable historical relationship between the trailing and forward 12 month outperformance of the largest seven S&P 500 constituents vs. the remainder of the index,” the team added.

A remarkable year

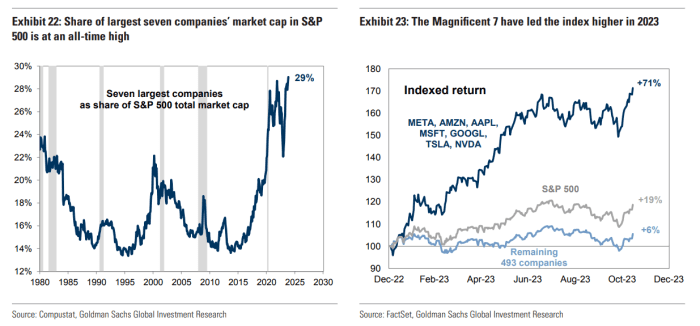

After falling 39% in 2022, the Magnificent Seven bounced back in 2023. They’re up 71% year-to-date, according to Goldman’s numbers.

Other sectors of the market continued to slide in 2023 — extending a trend that saw U.S. stocks have their worst year since 2008 in 2022, according to FactSet data. As of Thursday, five of the S&P 500’s 11 sectors were still in the red year-to-date.

Over the same period, the communications services sector, information technology sector and consumer discretionary sector, the three sectors to which members of the seven stocks belong, are up 48.8%, 49.6% and 30.6%, respectively.

This divergence has caused the Magnificent Seven’s share of the S&P 500’s aggregate market capitalization to swell to 29%. Seven stocks haven’t had such a large share of the index’s market cap since at least 1980.

Credit: Goldman Sachs

What’s next?

For what it’s worth, Goldman expects megacap tech to continue to outperform in 2024. Or at least, that’s their base case. But the team of strategists cautioned that the risk-reward on offer doesn’t look particularly attractive, suggesting that value-conscious investors might want to go hunting for bargains elsewhere.

Ultimately, they expect next year’s performance will depend on whether Nvidia Corp.

NVDA,

and the other Magnificent Seven stocks manage to continue to beat lofty forecasts for sales and earnings growth.

To justify this, they looked back at the bursting of the dot-com bubble in 2000, when investors’ enthusiasm for Internet stocks faded, forcing them to face the fact that many of these companies were failing to meet expectations for earnings growth.

“In 2000, the eventual underperformance of the mega-cap market leaders occurred when those companies failed to meet elevated growth expectations and multiples collapsed,” the Goldman team said.

“If the Magnificent 7 repeat this dynamic and disappoint expectations in 2024, those stocks’ valuations will likely ‘catch down’ towards the remainder of the index and underperform.”

In addition to Nvidia, the other members of the Magnificent Seven include Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Alphabet Inc.

GOOG,

GOOGL,

Tesla Inc.

TSLA,

Amazon.com Inc.

AMZN,

and Meta Platforms Inc.

META,

[ad_2]

Source link