[ad_1]

The Institute for Supply Management’s manufacturing index is due for release Tuesday, which outside of inflationary periods (i.e., now), tends to be one of the more important economic indicators for financial markets, given its record as a bellwether.

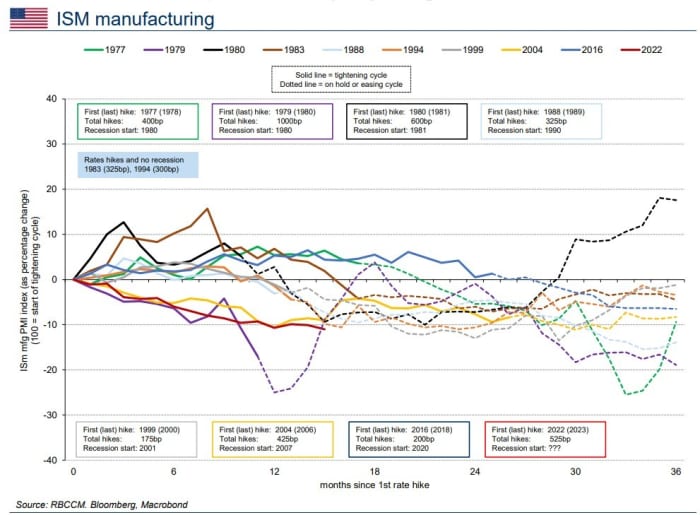

ISM manufacturing data during the current rate-hike cycle (in red) has lagged other periods.

Even compared to other rate-hike cycles, the ISM manufacturing series has been one of the worst in history, points out Jason Daw, head of North America rates strategy at RBC Dominion Securities. Daw makes the case that the U.S. economy overall is not very strong for this period of the cycle, and the manufacturing data, not just ISM but also industrial production, has been particularly feeble.

But the call of the day comes from JPMorgan’s economic team. They note that while global manufacturing stalled in the first half, the non-manufacturing components rose at a 3.2% annualized rate, allowing the global economy to grow at an above trend 2.7% rate.

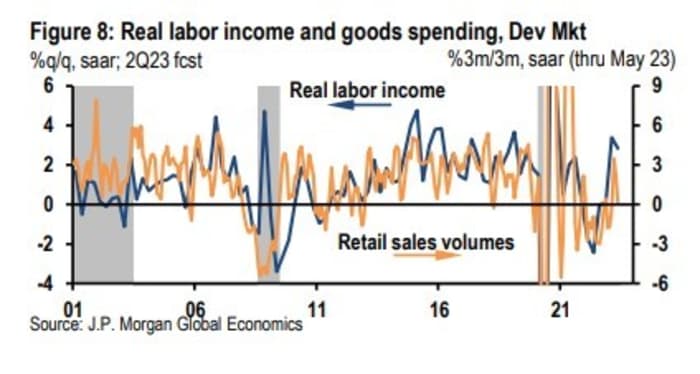

The team led by Bruce Kasman say that the typical channels through which weak manufacturing would bring down the broader economy haven’t materialized. “A major channel by which weakness in goods sectors broadens out is through depressing corporate income and pricing power. While our start-of-year outlook anticipated elevated wage gains to pressure corporate profits, the surprising strength in [first-half] global GDP was accompanied by upside surprises to inflation,” they say. In turn, there have been solid gains in both labor income and profits, and while margins have come off their peaks, they are well above pre-pandemic levels.

Business hiring, they add, is the ultimate signal of confidence, and employment growth has continued even though expectations have soured.

Now, say the JPMorgan team, the stage is set for a goods sector recovery. Labor income, when adjusted for inflation, is rising, while finished goods inflation is falling sharply.

Also, business capital spending continues to expand, particularly in emerging economies outside of China. And importantly, inventories are swinging from a drag to a lift. In the first half, the step down in the pace of stock building depressed global industrial production by 3.4 percentage points.

“Even if the pace of stockbuilding was only to level off, the impulse to global industry would be material. Add to that a potential desire to align the pace to firming demand growth and the boost could generate a jump in factory output in the coming months,” they say.

Finally, they note, the tech spending decline after the 2020 to 2021 surge looks to be ending, and global motor vehicle production is picking up as supply-chain bottlenecks ease.

The markets

After an okay finish for the S&P 500

SPX,

to a strong July, U.S. stock futures

ES00,

NQ00,

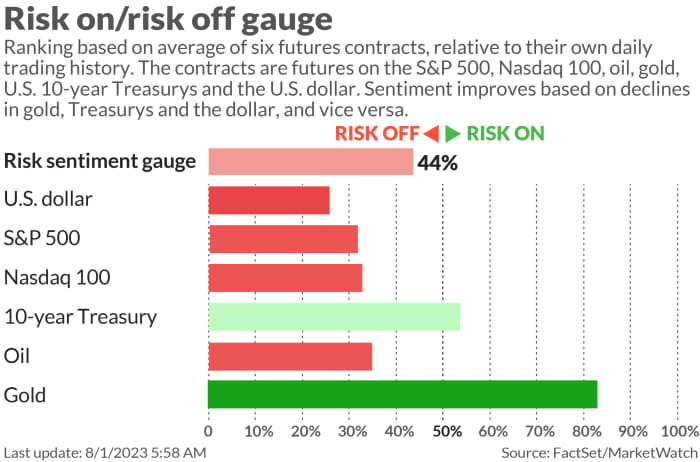

were a bit lower as the seasonally weak month of August commenced. Gold futures

GC00,

were trading below $2,000 an ounce. The dollar

DXY,

rose.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The ISM report is due out at 10 a.m. Eastern, when the job openings and construction spending reports also come out. Monthly auto sales also will be released throughout the day.

Pfizer

PFE,

Caterpillar

CAT,

Uber Technologies

UBER,

and after the close, Starbucks

SBUX,

and Electronic Arts

EA,

highlight the day’s earnings reports. Pfizer lowered its sales guidance while Caterpillar beat Wall Street earnings estimates.

JetBlue Airlines stock

JBLU,

slumped as the airline says it no longer expects to report a profit in the third quarter, owing to what it called a challenging environment in the northeast, as well as a preference by consumers for long-haul international flights.

CVS Health

CVS,

is going to cut 5,000 corporate jobs, according to The Wall Street Journal.

Best of the web

BlackRock

BLK,

and MSCI

MSCI,

are targets of a Congressional probe into facilitating U.S. investment in China.

The first new U.S. nuclear reactor in nearly seven years starts operations.

Modern-day Oppenheimers see the future of nuclear energy — and it’s mobile.

Top tickers

Here were the most active stock-market tickers as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

TUP, |

Tupperware Brands |

|

NIO, |

Nio |

|

AMC, |

AMC Entertainment |

|

PLTR, |

Palantir Technologies |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

AAPL, |

Apple |

|

NKLA, |

Nikola |

|

AMSC, |

American Superconductor |

The chart

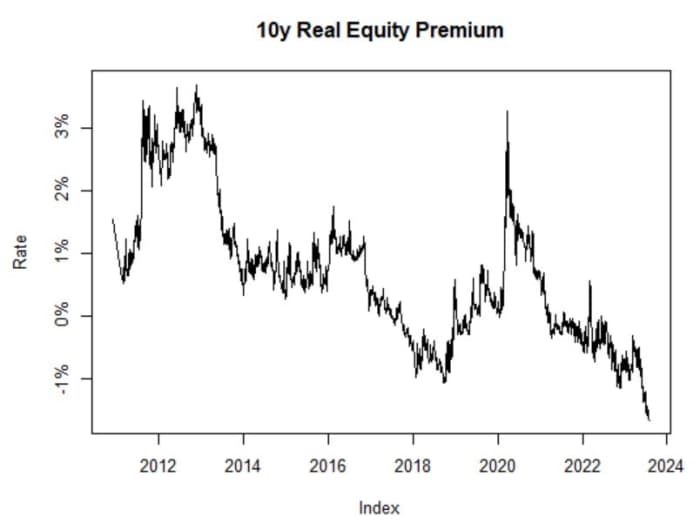

The inflation-adjusted equity premium is looking pretty bleak. That’s calculated by taking the expected return to the S&P 500 and subtracting 10-year TIPS yields. “While admittedly this graphic is skewed by the few megacaps trading at huge multiples, it’s sobering nonetheless,” says Michael Ashton, better known as the Inflation Guy.

Random reads

Granted, Philadelphia’s a big sports town, but there were actual tailgates to get the Eagles’ throwback Kelly green jerseys that went on sale.

A Chinese zoo has denied that a bear is human after video of the creature standing on two feet.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch financial columnist James Rogers and economist Stephanie Kelton.

[ad_2]

Source link