[ad_1]

NASDAQ 100 FORECAST:

- Nasdaq 100 has risen sharply this year, boosted by the “artificial intelligence frenzy, but the rally has not been homogenous

- A few megacap tech players have been the main source of strength for the market

- Overbought conditions suggest a pullback could be coming soon

Recommended by Diego Colman

Get Your Free Equities Forecast

Most Read: Nasdaq 100 Outlook – Bulls Dominate but Pullback Looms, Bearish Signals to Watch

The Nasdaq 100 has rallied significantly this year, bolstered by the “artificial intelligence” frenzy following the launch of ChatGTP, shrugging off numerous macroeconomic headwinds, including rising interest rates, persistently high inflation, and growing recession risks, to name a few.

Companies engaged in the development of AI or supplying semiconductors for its creation have reaped enormous benefits, while firms with little or no exposure to this revolutionary technology have lagged behind. It is therefore not surprising that Microsoft, Alphabet and Nvidia have shined in 2023.

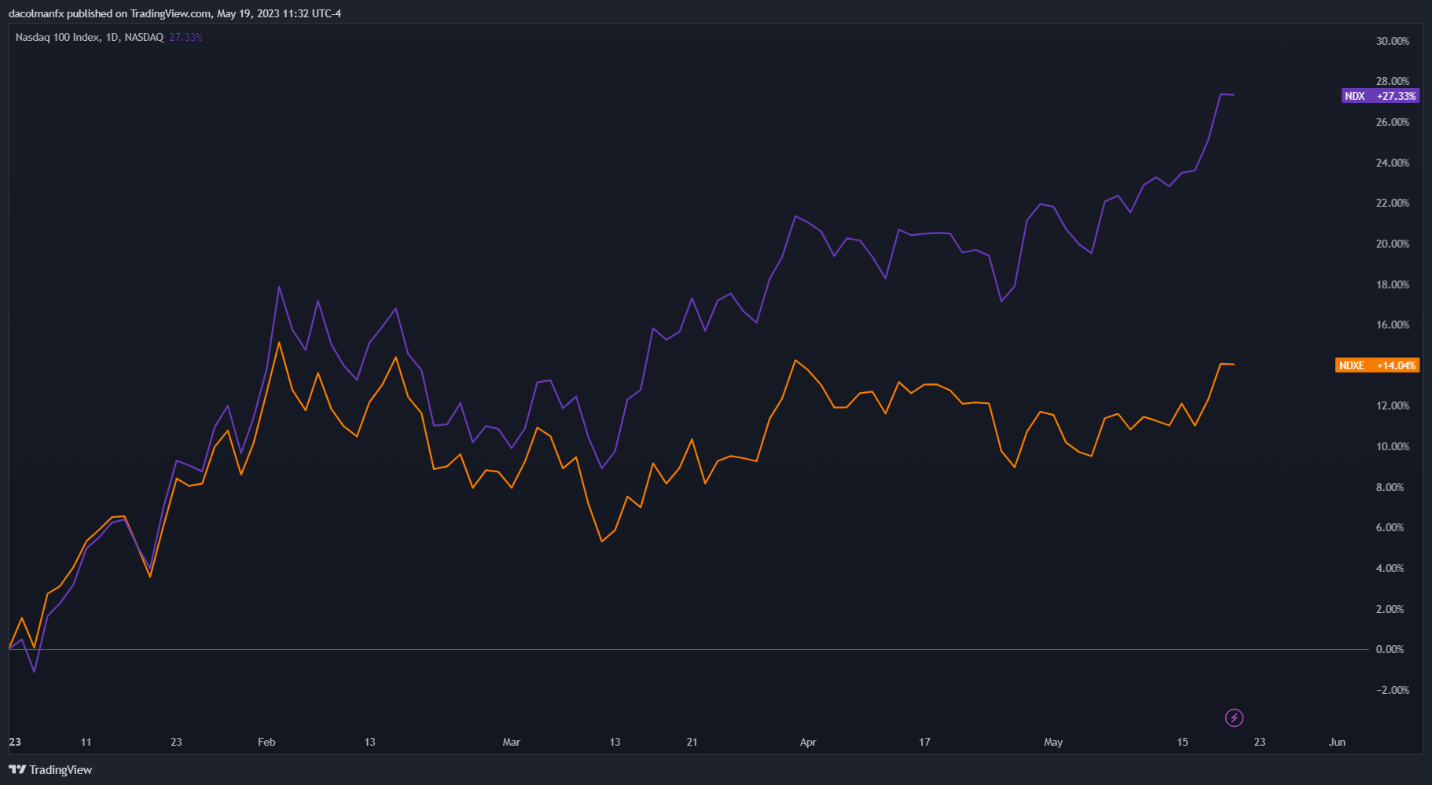

With mega-cap tech being the main source of bullish impetus, the market-cap weighted Nasdaq 100 (NDX) has dramatically outperformed its equal-weighted counterpart (NDXE), with the former up 27% and the latter gaining just 14% YTD. This divergence can be appreciated in the chart below.

Nasdaq 100 (Market-Weighted) vs (Nasdaq 100 Equal-Weighted)

Source: TradingView

The chart above is clear evidence that breadth has been narrow under the surface – a sign of poor market internals. This means a few big names in the equity space are skewing results and masking the uneven performance. For a rally to be durable, strong participation is necessary.

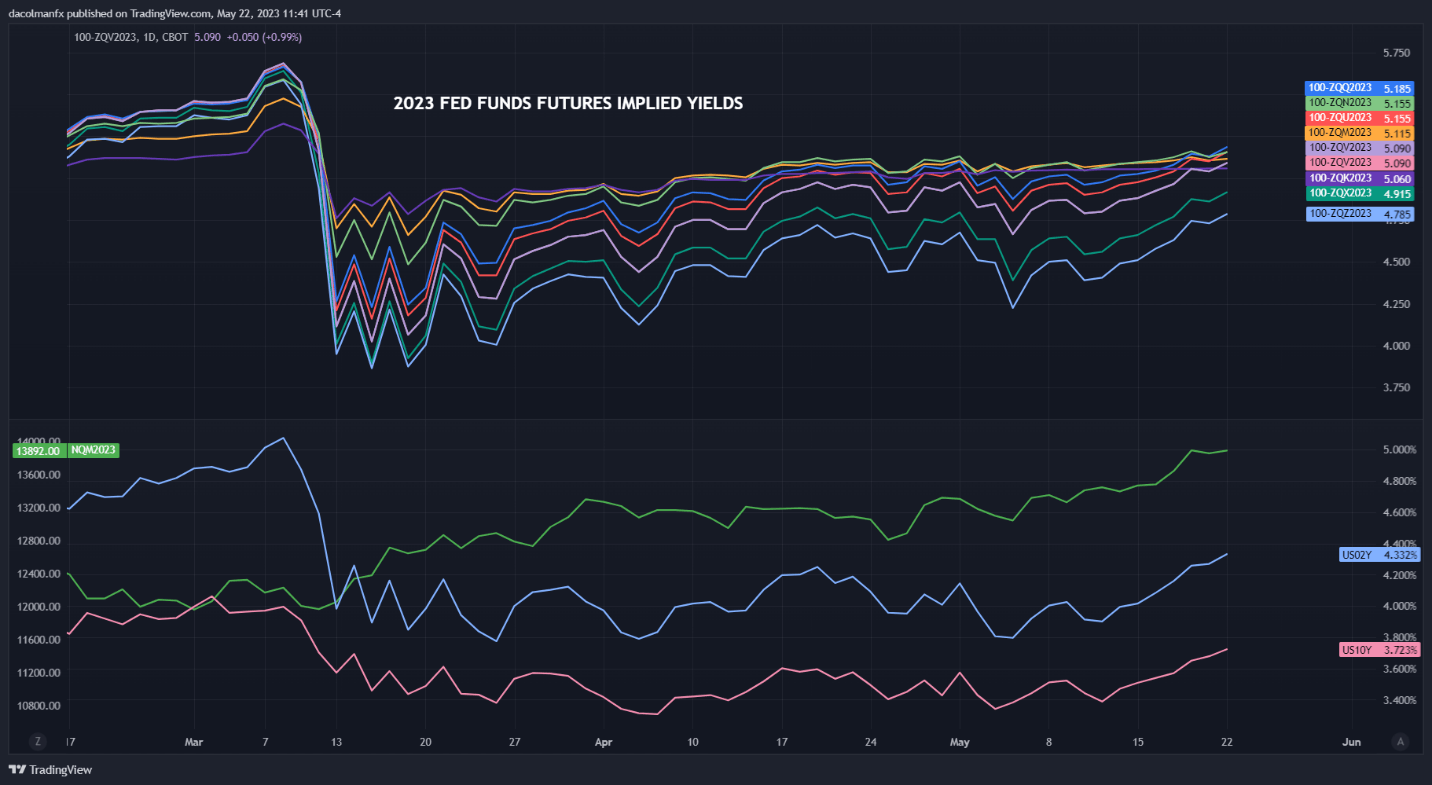

Another troubling development is the disconnect between bonds and stocks. In recent weeks, the FOMC’s monetary policy outlook as reflected by the Fed funds futures has turned more hawkish, with traders pricing out the easing that was discounted for the second half of the year after the banking sector crisis.

Despite the hawkish repricing of interest rate expectations, the Nasdaq 100 has continued its trek upwards, surprising investors and reaching its best levels since April 2022. This dislocation is unlikely to last long.

Recommended by Diego Colman

Get Your Free Top Trading Opportunities Forecast

Nasdaq 100, Fed Funds Futures Implied Yields and Treasury Yields Chart

Source: TradingView

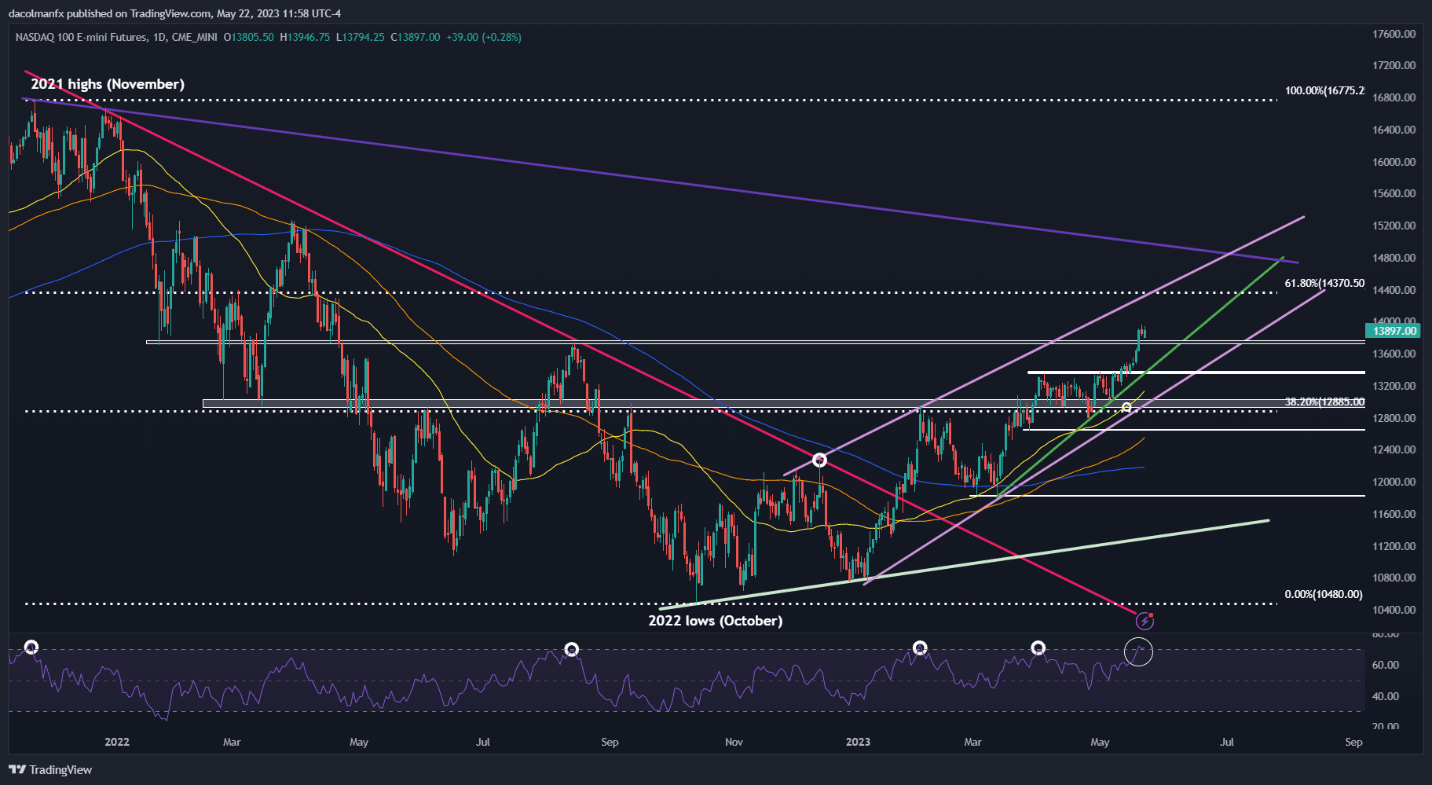

From a technical standpoint, the Nasdaq 100 is entrenched in an undisputable uptrend, with prices forging higher highs and higher lows, while also trading above key moving averages. However, traders should exercise caution as the market appears stretched and overbought according to the 14-day RSI.

The chart below shows that the last four times the relative strength index yielded extreme overbought readings near or above 70, a pullback occurred shortly thereafter. If history is any guide, sellers could soon regain the upper hand.

In the event of a setback, initial support appears at 13,750. A move below this floor could offer an additional signal that a deeper retrenchment is in the offing, with the next downside target located near 13,350. On further weakness, the bears’ crosshair could be set on the psychological 13,000 level.

On the flip side, if the Nasdaq 100 sustains the recent breakout and stays above 13,750, the bulls could become emboldened to launch an assault on 14,370 over the coming weeks, a major resistance area created by the 61.8% Fib retracement of the 2021/2022 slump. This, however, is the baseline case.

| Change in | Longs | Shorts | OI |

| Daily | 11% | 5% | 7% |

| Weekly | -9% | 5% | 0% |

NASDAQ 100 TECHNICAL CHART

[ad_2]

Source link