[ad_1]

US STOCKS OUTLOOK:

- Nasdaq 100 and S&P 500 finish the day sharply lower as Tesla’s rally fades

- Soaring bond rates weigh on stocks, prompting traders to jump ship

- U.S. yields jump across the Treasury curve on expectations that the Fed will aggressively tighten monetary policy, a scenario that may trigger a hard landing of the economy

Most Read: Will Arkk Continue to Sink as the Federal Reserve Hikes Interest Rates?

U.S. stocks sold off on Thursday, completely erasing a strong morning rally, pressured by monetary policy jitters amid soaring bond rates.

The major averages opened with solid gains on bullish sentiment following robust quarterly results from Tesla and upbeat comments from several airlines that indicated they could soon be profitable on increased bookings amid pent-up travel demand. However, Wall Street reversed the initial advance later in the day after the U.S. Treasury curve shifted sharply higher, with the 2-year and 10-year yield rising to 2.70% and 2.95% respectively, their highest level since December 2018.

When it was all said and done, the S&P 500 dropped 1.48% to 4,393, as Amazon, Meta and Nvidia suffered heavy losses. The Nasdaq 100, for its part, plummeted 1.99% to 13,720 during a turbulent session, wiping out a 2% gain and reaching its lowest level since March 16, just as Tesla retraced the bulk of its morning surge.

Focusing on catalysts, recent moves in the bond market came in response to bets that the Federal Reserve will aggressively withdraw stimulus to counter mounting price pressures and ensure inflation expectations do not become unmoored. There is no doubt that the Fed’s normalization cycle can undermine risk assets and weigh on valuations, but the main fear now is that the hawkish tightening roadmap could lead to a hard landing of the economy and, in a worst-case scenario, a recession, an event that can have a detrimental effect on corporate earnings.

FOMC Chairman Powell was unable to assuage concerns during his appearance at an IMF public panel, in fact, he poured fuel to the fire by indicating thatit is appropriate to front-load interest rate increases to restore price stability, statements that helped cements forecasts for a steep hiking path.

Looking ahead, the ongoing earnings season will be front and center, with traders anxiously awaiting reports from mega-caps, including Apple (AAPL), Microsoft (MSFT), Amazon (AMZN) and Alphabet (GOOGL), all scheduled to announce their numbers next week.

Based on what has transpired recently, stocks may struggle to sail higher on a sustained basis due to Fed and inflation jitters, even if Corporate America delivers good results and offer constructive profit guidance. With volatility expected to stay elevated and traders selling every rally, conservative investors will be reluctant to deploy more capital into equities, preventing any meaningful recovery in risk assets, at least for now. The situation could certainty change, so it is important to closely follow sentiment.

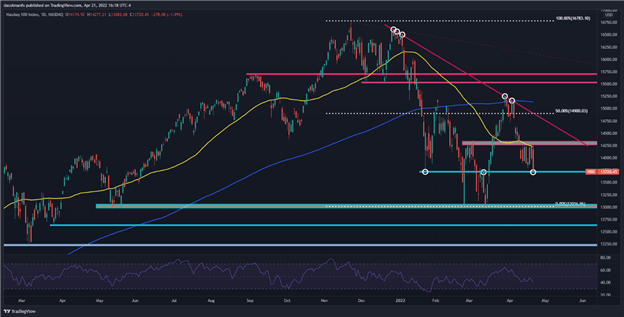

NASDAQ 100 TECHNICAL ANALYSIS

The Nasdaq 100 rallied aggressively in the morning hours after Tesla’s shares surged more than 10% at the market open following better-than-expected earnings. However, the index reversed lower after reaching a key resistance near 14,275, falling towards critical support around 13,720 as sellers resurfaced to fade the rip. With appetite for tech shares on the decline, the balance of risks is tilted to the downside, but to have more conviction in the bearish assessment, a decisive break below 13,720 is required. If sellers manage to breach this floor on weekly closing prices, a retest of the 2022 lows near the psychological 13,000 level could be in the cards. On the other hand, if selling pressure fades and the Nasdaq 100 pivots higher, initial resistance spans from 14,250 to 14,340. If this barrier is eventually cleared, the focus will shift up to trendline resistance near 14,900, which also happens to be the 50% Fibonacci retracement of the November 2021/March 2022 decline.

Nasdaq 100 (NDX) chart prepared in TradingView

EDUCATION TOOLS FOR TRADERS

- Are you just getting started? Download the beginners’ guide for FX traders

- Would you like to know more about your trading personality? Take the DailyFX quiz and find out

- IG’s client positioning data provides valuable information on market sentiment. Get your free guide on how to use this powerful trading indicator here.

—Written by Diego Colman, Contributor

[ad_2]

Source link