[ad_1]

New Zealand Dollar, NZD/USD, RBNZ, APAC, Sentiment, China – Talking Points

- New Zealand posted surprisingly strong Q2 GDP numbers, bolstering the Kiwi Dollar

- APAC sentiment to benefit from Wall Street recovery and easing China lockdowns

- NZD/USD is rising, but the technical outlook remains bearish after steep losses

Recommended by Thomas Westwater

Get our Forex for Beginners Guide

Thursday’s Asia-Pacific Outlook

New Zealand’s second-quarter gross domestic product (GDP) growth rate crossed the wires. The Kiwi Dollar was largely unfazed by the print, with NDZ/USD holding onto modest overnight gains. The island nation saw annual GDP growth of 0.4%, down from 1.0% in Q1. From the prior quarter, GDP grew 1.7% after a 0.2% contraction in the first quarter. The third quarter should offer a better gauge for the New Zealand economy, as travel curbs remained in place until August. Rate traders see the Reserve Bank of New Zealand (RBNZ) hiking by 50-basis points next month.

Asia-Pacific markets may open mixed following a rebound in New York. US stock indexes closed slightly higher, with the benchmark S&P 500 posting a 0.34% gain. Short-term Treasuries sold off, while the 10- and 30-year tenors saw some buying. That deepened the 2s10s yield curve inversion, indicating higher recession odds. The US producer price index (PPI) for August fell 0.1% from the prior month, dragging the annual rate down to 8.7% versus the 8.8% consensus estimate and down from 9.8% in July. The PPI data offers an optimistic signal for broader inflation. Gold fell despite the weaker USD, and bullion remains at risk of a larger breakdown.

The Japanese Yen rose against the Dollar, although USD/JPY remains above the 143 level, near its multi-decade low. In the biggest action yet, the Bank of Japan performed a rate check on Wednesday. The Yen rose after the news crossed the wires, serving as a possible precursor to direct intervention. JPY shorts are likely reducing their bets against the currency, with the 145 level identified as a potential line in the sand for the Ministry of Finance.

The city saw 35 local Covid cases for Tuesday, down from 44 the day prior. Industrial metals and demand-sensitive commodities responded to the positive news. Iron ore prices closed higher in China, rising to 732 Yuan a ton. The Australian Dollar stands to benefit if iron ore prices continue rising. WTI crude and Brent crude oil prices gained, moving over 1% higher. The US Energy Information Administration reported a 2.4-million-barrel build in crude oil stocks.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from DailyFX

Subscribe to Newsletter

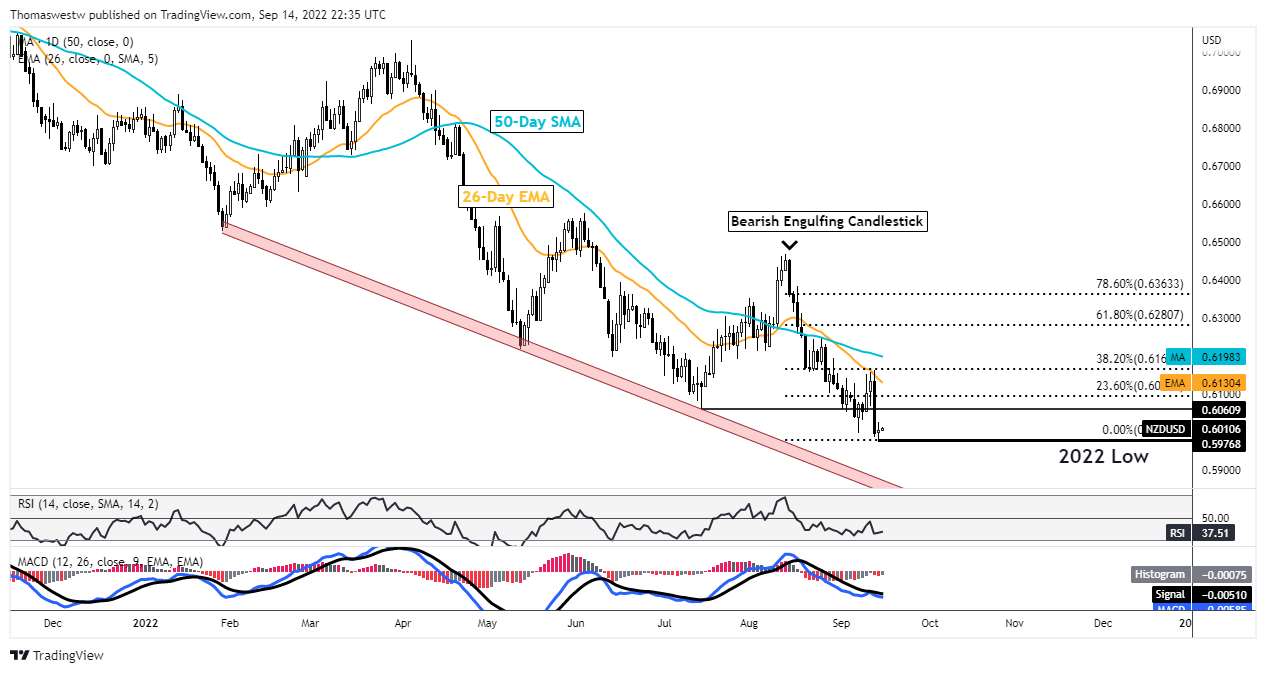

NZD/USD Technical Outlook

NZD/USD is trading within 1% of its 2022 low set yesterday at 0.5976. A break below that level would expose prices to levels not traded since May 2020. And the short-term outlook is bearish, with prices below their major moving averages.

Bulls would need to rally above the 26-day Exponential Moving Average (EMA) before attacking the 50-day Simple Moving Average (SMA). However, the MACD and RSI oscillators are tracking below their respective midpoints. A break below 0.5976 would threaten a trendline from January.

NZD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwater on Twitter

[ad_2]

Source link