[ad_1]

Carnage in the office sector isn’t yet bad enough to spur more housing development, according to a new Goldman Sachs report.

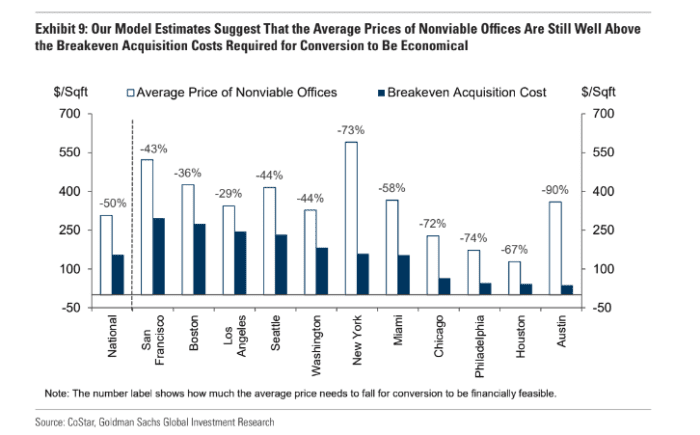

Older office buildings still need to drop about 50% in price to make turning former workplaces into homes feasible for developers, said a team of economic researchers led by Jan Hatzius, in a client note Monday.

Many U.S. cities have been exploring new uses for obsolete office buildings in the wake of the pandemic, while also hoping to chip away at the affordability crisis in housing.

To gauge the potential development opportunity, the Goldman

GS,

team looked at vacancy rates, rents, ages of properties and what share of offices no longer look economically “viable.”

They found that roughly 4% of office buildings could be candidates to be turned into housing, with the share expected to rise as the office-vacancy rate climbs to an estimated 18% in 2033 from about 14% this year.

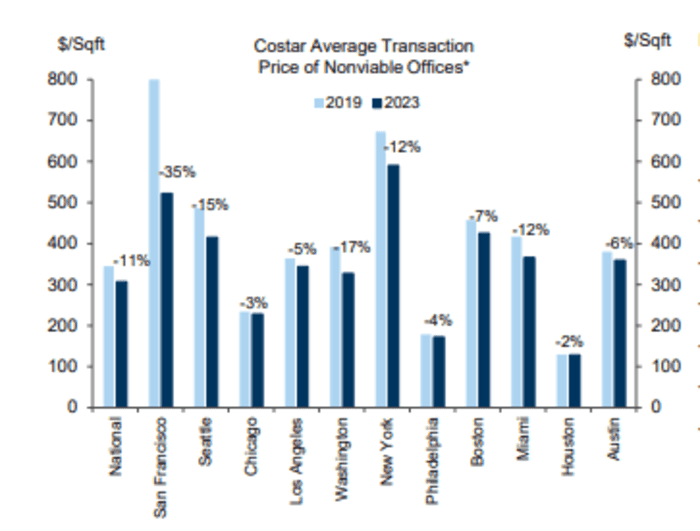

But “nonviable” buildings still aren’t yet cheap enough to fully cover conversion and financing costs, even in hard-hit cities like San Francisco, where prices have fallen an estimated 35% since 2019, versus 11% nationally, the team said.

Prices for “nonviable” office buildings fell an estimated 11% nationally since 2019.

Goldman Sachs Global Investment Research, CoStar

To fit Goldman’s criteria as “nonviable,” an office building must be in a suburban area or central business district. They also must be built before 1990, but not renovated since 2000, and have a vacancy rate above 30%.

Based on the national price average, the Goldman model “suggests that converting a nonviable office that is priced at the average current level will result in a $164 loss” per square foot, the team wrote. “This means that current office prices would need to fall by that much, to around $154 per [square foot] or by 50%, for the cost to be fully covered by the stream of discounted future revenues.”

“Break-even” prices are much closer in Los Angeles than New York, but still have a ways to go.

Goldman Sachs Global Investment Research

San Francisco, Boston, Los Angeles and Seattle were getting closer to “break even” levels, but developers in those markets still need building prices to fall over 30% more for conversions to make financial sense, the Goldman team said.

The White House in October kicked off an initiative to help spur conversion projects for affordable housing near transit hubs, including by opening up lower-cost federal loans to developers.

As part of the initiative, the U.S. Department of Housing and Urban Development recently announced nearly $4 million in grants to study initiatives.

The Goldman model also relied on a developers receiving financing at a 7% rate. Mortgage rates have come off the highs of October, but still remain elevated from pandemic lows, with the benchmark 10-year Treasury yield

BX:TMUBMUSD10Y

at 4.31% on Tuesday.

[ad_2]

Source link