[ad_1]

WTI, Brent Crude Oil Analysis

- Brent crude attempts test of $100 – inventories at reduced levels and demand remains strong

- WTI crude oil reveals slight pullback from the intra-day high but trend very much intact

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Brent Crude Attempts Test of $100

Brent crude oil has surged higher ever since Saudi Arabia and Russia announced voluntary production cuts with the goal of stabilizing the oil market at a time when the jury was still out regarding global economic growth and, by association, global oil demand. Since July when the cuts went into force, Brent prices have shot up over 27% and robust oil demand continues to weigh on current inventories.

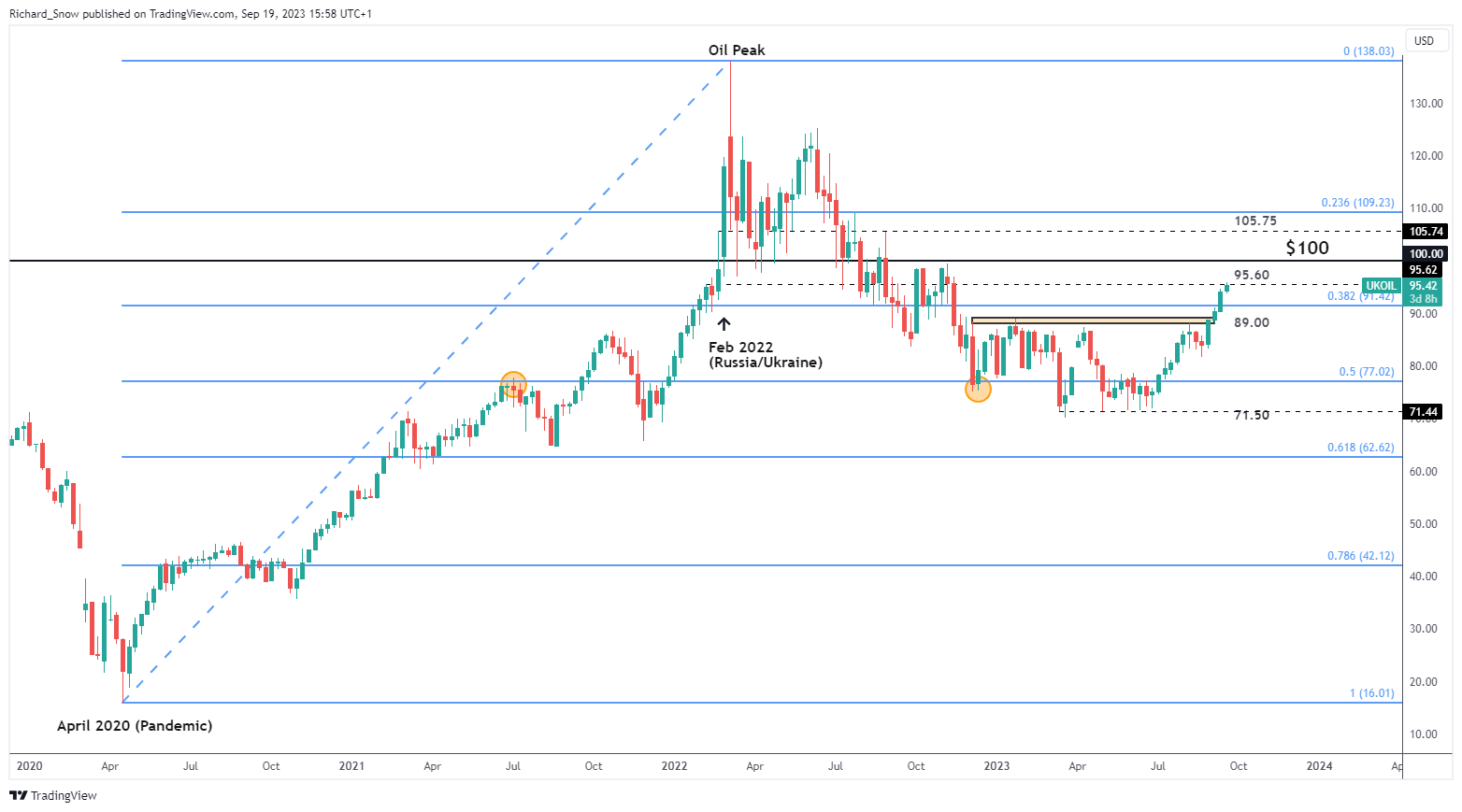

Looking at the weekly chart below it is clear to see that while the recent rise has been significant over a short period of time, it pales in significance to the post Covid rebound and the Russia-Ukraine war.

Oil prices currently test $95.60 with early signs of fatigue appearing on the daily chart – confirmation via a close on the daily candle is preferred before further assessment can be made on potential bullish fatigue. Given the dominance of the bull trend thus far,

UK Oil Weekly Chart

Source: TradingView, prepared by Richard Snow

The oil market is rather unique in that it requires a solid grasp of the fundamentals that dictate the commodities price. Read out comprehensive guide below:

Recommended by Richard Snow

Understanding the Core Fundamentals of Oil Trading

Pullback from Intra-day High Hints at Possible Resistance at $93

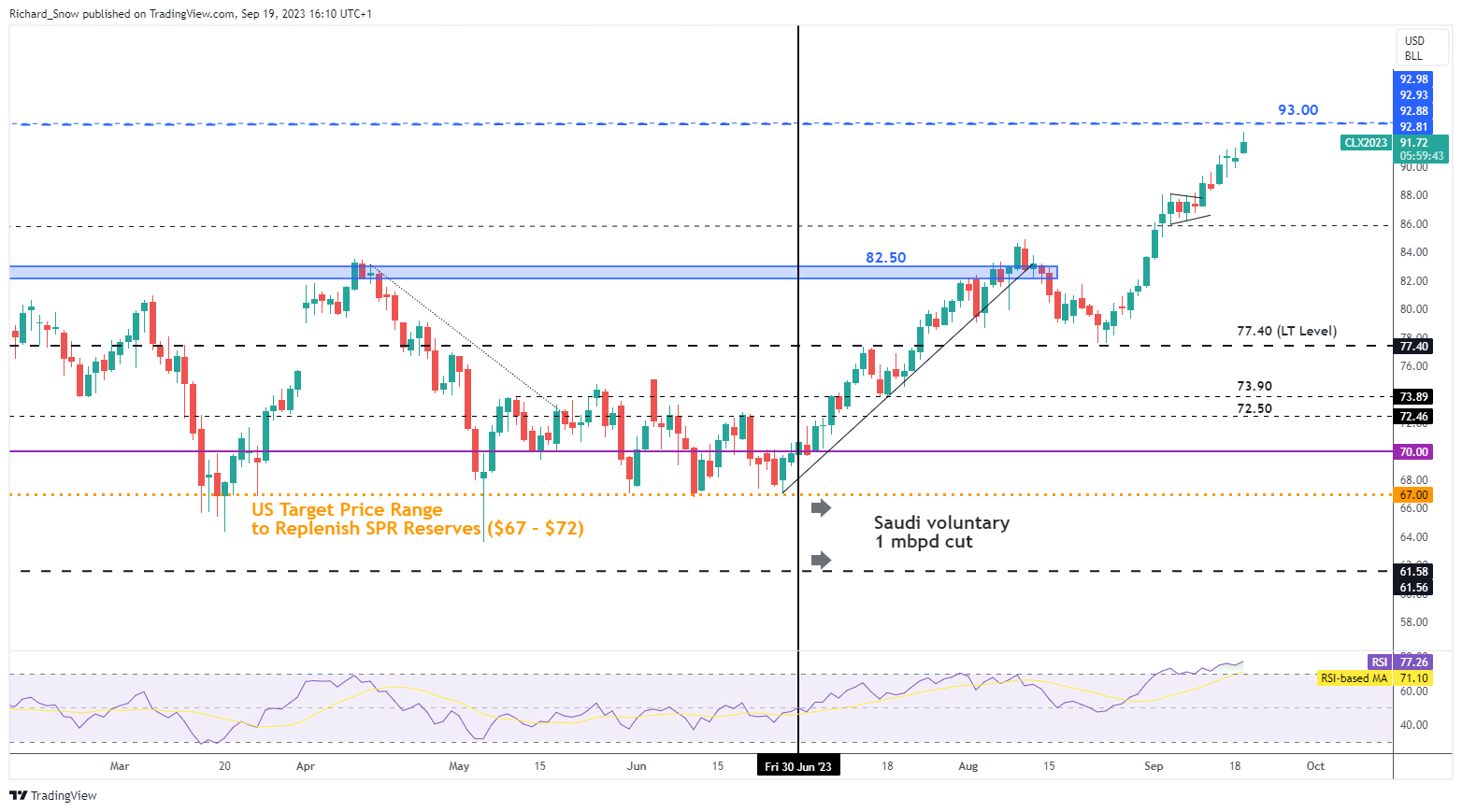

WTI oil revealed an intra-day pullback from the daily high, although, it must be noted that a candle close is required before any further assessment ought to be made. Prices are still up on the day and the trading day is not over but the upper wick developing below $93 could depict a slowing of the runaway trend.

However, the fundamental landscape still heavily favours continued upside given that oil supply remains extremely tight and global oil demand has proven robust. Such a combination weighs on inventory levels which are at relatively low levels, adding to the bullish tailwind.

WTI Crude Oil Daily Chart

Source: TradingView, prepared by Richard Snow

Will the FOMC meeting tomorrow disrupt the persistent bull trend? While the Fed is expected to leave rates unchanged, updated quarterly forecasts are due and oil market participants will keep an eye on GDP growth? US GDP has recovered phenomenally but the rest of the developed world is struggling with low or zero growth.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link