[ad_1]

Oil futures edged lower early Wednesday as investors awaited official data on U.S. crude inventories and weighed concerns over the global demand outlook versus the threat of an escalation of Middle East tensions.

Price moves

-

West Texas Intermediate crude for March delivery

CL00,

-0.95% CLH24,

-0.95%

fell 82 cents, or 1.1%, to $77 a barrel on the New York Mercantile Exchange. -

March Brent crude

BRNH24,

-0.91% ,

the global benchmark, was down 87 cents, or 1%, at $82 a barrel on ICE Futures Europe. April Brent

BRN00,

-0.88% BRNJ24,

-0.88% ,

the most actively traded contract, was off 81 cents, or 1%, at $81.69 a barrel.

Market drivers

“The market is trading cautiously ahead of the potential U .S.response to the recent assault in Jordan and how Iran will react in turn,” said Ewa Manthey and Warren Peterson, strategists at ING, in a note.

Oil futures have seen choppy trade this week, dropping Monday on worries about the outlook for crude demand from China after the ordered liquidation of Evergrande stoked worries about the drag from the country’s troubled property sector on the world’s second largest economy.

Those concerns appeared to outweigh worries over an escalation of tensions in the Middle East that could threaten crude supplies after a weekend drone attack by Iran-backed militants killed three U.S. troops in Jordan.

Inventories data will also be in focus Wednesday.

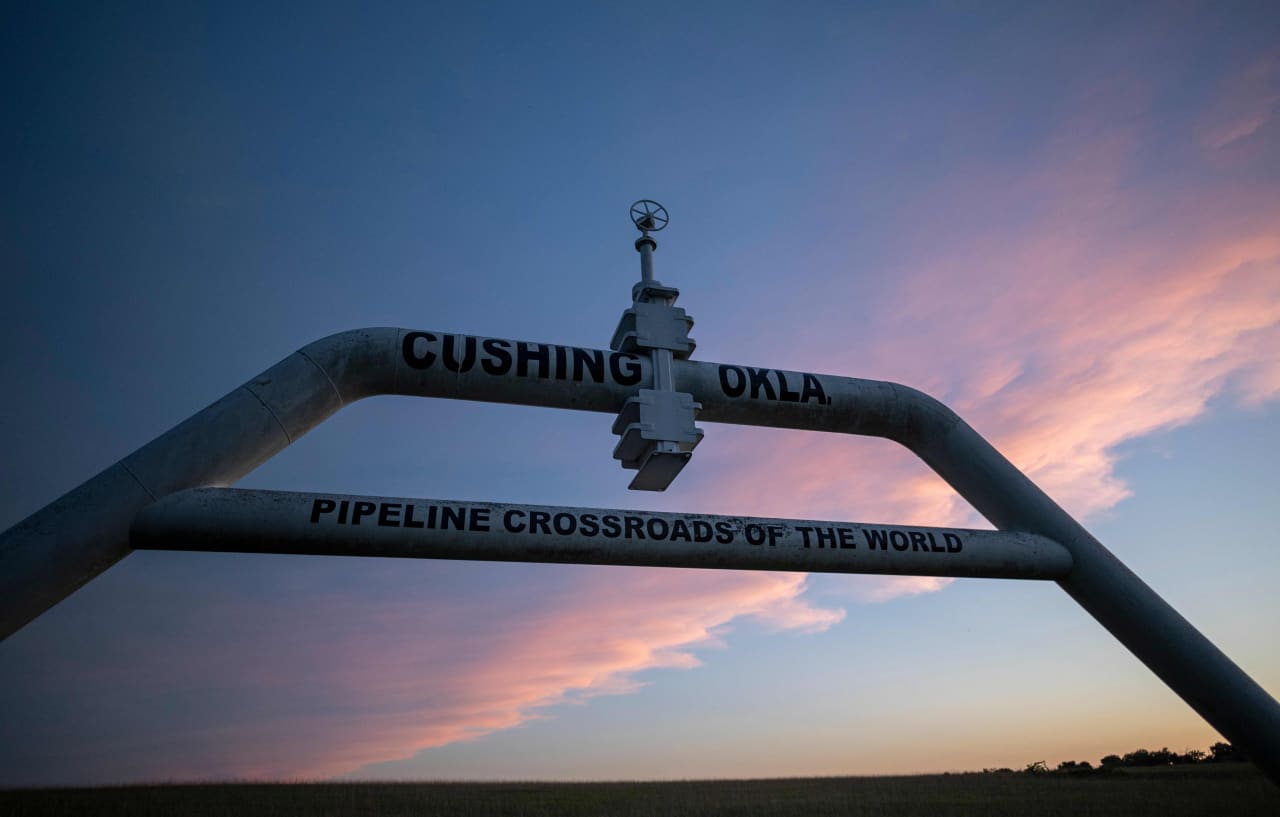

The American Petroleum Institute, an industry trade group, late Tuesday reported that U.S. crude inventories fell by 2.5 million barrels last week, analysts said, while stocks at the Nymex delivery hub in Cushing, Oklahoma, dropped by 2 million barrels. Gasoline inventories, however, were up 600,000 barrels, while distillate stocks dropped 2.1 million barrels.

More closely watched inventory data from the Energy Information Administration is due Wednesday morning. Analysts polled by S&P Global Commodity Insights forecast declines of 2.3 million barrels in domestic commercial crude supplies for the week ended Jan. 26, along with inventory decreases of 450,000 barrels for gasoline and 700,000 barrels for distillates.

[ad_2]

Source link