[ad_1]

U.S. oil prices moved back close to the $100-a-barrel mark on Monday, as investors took advantage of last week’s steep losses to scoop up the commodity on the view that President Joe Biden’s visit to Saudi Arabia would not yield quick supply fixes.

Price action

-

West Texas Intermediate crude for August delivery

CL.1,

+1.85%

CLQ22,

+1.85%

rose $2.28, or 2.3%, to $99 a barrel, touching a high of $100.57 a barrel. The contract rose 1.9% on Friday to close at $97.59 a barrel, but slumped 6.9% on the week. -

September Brent crude

BRN00,

+2.10% BRNU22,

+2.10% ,

the global benchmark, gained $2.61, or 2.6%, to $103.79 a barrel. The contract gained 2.1% to $101.16 on Friday, but fell 5.5% for the week. -

August gasoline

RBQ22,

+1.77%

rose 6 cents, or 1.9% to $3.2749 a gallon, while August heating oil

HOQ22,

+0.07%

slipped 0.3% to $3.6866 a gallon. Gasoline rose 6.8% last week. -

August natural gas

NGQ22,

+2.25%

rose nearly 2.2% to $7.177 per million British thermal units, after gaining 16.3% last week.

Market drivers

Crude prices have been trending lower since mid-June, amid rising concerns over a recession that will cut demand. The sharp retreat has seen both WTI and Brent sink below the $100-a-barrel threshold, with the U.S. benchmark at one point last week temporarily erasing gains stemming from Russia’s Feb. 24 invasion of Ukraine.

A four-day Middle East tour that included meetings with Saudi Crown Prince Mohammed bin Salman and King Salman bin Abdulaziz failed to yield any promises on increasing oil production. Reuters reported that Washington was hanging hopes on an Aug. 3 meeting of OPEC+ — the Organization of the Petroleum Exporting Countries and their allies.

“Traders got one clear message from Biden’s recent visit to Saudi Arabia, during which President Biden spoke to a number of Arab leaders. The message is that it is OPEC+ that makes the oil supply decision, and the cartel isn’t remotely interested in what Biden is trying to achieve,” said Naeem Aslam, chief market analyst at AvaTrde, in a note to clients.

“OPEC+ will continue to control oil supply, and one country alone cannot determine the oil supply—at least that is the message that traders have taken from Biden’s visit to Saudi Arabia,” Aslam added. “Brent oil prices crossed above the $100 price mark earlier today, and if the price continues to trade above this price mark, then it is highly likely that the path of the least resistance will be skewed to the upside.”

Meanwhile, a top White House energy adviser, Amos Hochstein. said Sunday that U.S. gas prices should continue to fall in the coming weeks to around $4 a gallon, on average, after peaking at above a record $5 a gallon in June. He added that the Biden administration’s measures amid “extraordinary circumstances” are working.

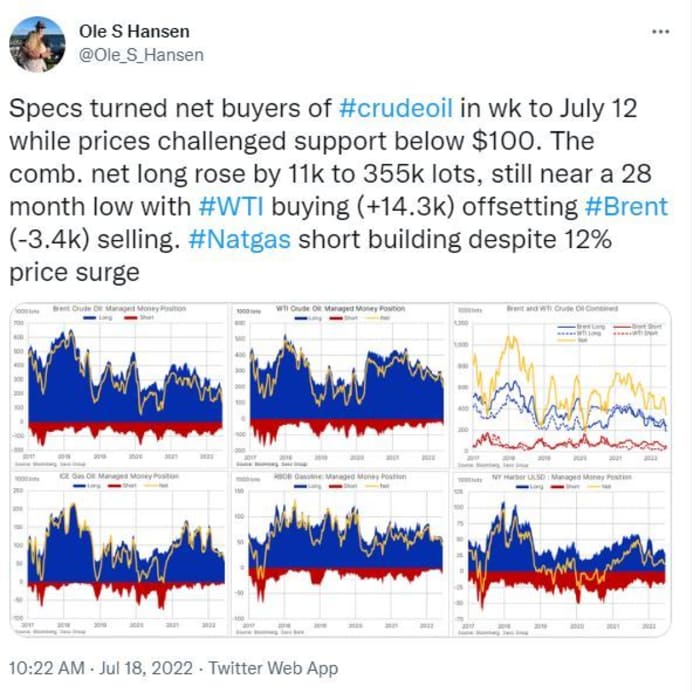

Speculator and hedge fund selling slowed in the week to July 12 according to the latest Commitment of Traders update from the US Commodity Futures Trading Commission, noted Saxo Bank. “Speculators turned net buyers of crude oil, copper and sugar with selling concentrated in natural gas, soybeans, corn, wheat and coffee,” Saxo told clients in a note.

[ad_2]

Source link