[ad_1]

The biggest takeaway from Friday’s jobs report is that the Federal Reserve is going to freak out because average hourly wages went up 18 cents in November and 46 cents since August.

Breaking news: U.S. adds 263,000 jobs in November and wages rise sharply—far too much for the Fed’s liking

It’s heartbreaking, because what should be treated as good news — bigger paychecks for struggling American families — will instead lead to more misery for those families as the Fed tightens the screws on the economy in the false belief that the economy’s biggest problem is that Americans have too much money.

Economists’ reactions: November jobs report is most important data for inflation this year, and not in a good way

You see, what sounds like good news to you and me and every working person is bad news to the Fed — and to the financial markets

DJIA,

COMP,

that were counting on a quick return to the lower interest rates they are addicted to.

Dashed hopes for a ‘pivot’

Those hopes were dashed by the wage figures in the November jobs report. The Fed is now likely to boost interest rates

TMUBMUSD10Y,

even higher in coming months, starting with another big hike in the federal funds rate

FF00,

during its Dec. 12-13 meeting.

Fed Watch: U.S. jobs data puts jumbo interest rate hike back on table at Fed’s December meeting

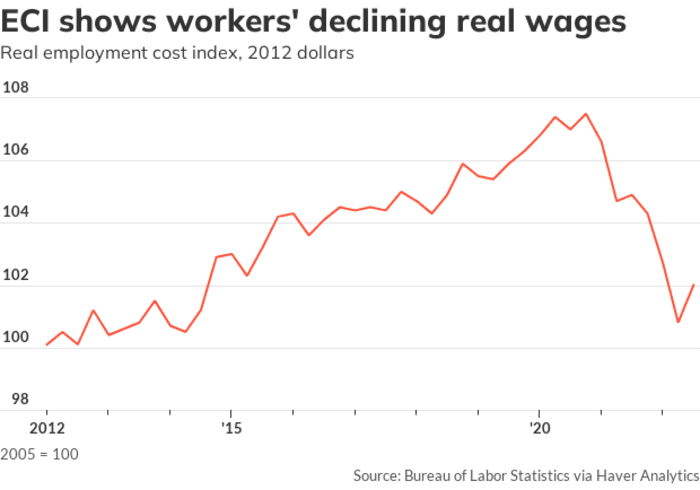

See that little uptick at the far right? That’s what’s freaking out the Federal Reserve.

MarketWatch

It’s madness. Typical American families don’t have too much money, but they are paying the price for the inflation that’s eroding their paychecks and their meager wealth.

In real terms, the average paycheck has no more purchasing power today than it did in February 2020 when the pandemic was getting ready to clobber the economy. The employment cost index (ECI), which economists say is the best measurement of compensation, shows working families are no better off than they were in 2014.

The employment cost index confirms that compensation has fallen behind inflation.

MarketWatch

Whatever gains workers have made in their paychecks have been eaten up by the higher prices they are paying for necessities like food, rent, gasoline, motor vehicles and health care. Over the past few months as inflation has moderated, paychecks have finally begun to grow a little faster than prices are rising, but workers have lost a lot of ground since 2020.

On the other hand, company profits have soared. It’s plain to see that workers don’t have too much bargaining power.

The Fed’s (flawed) view

The Fed doesn’t see it that way. Fed Chair Jerome Powell insisted in a speech this week that there’s nothing he’d like more than to see American workers get paid more, but he just can’t let that happen because it would only fuel more inflation and ultimately cause them more suffering.

Better to let the economy crash. The Fed has been doing everything it can to weaken the jobs market in order to break the power of workers to win bigger wages. They want to bring the labor market back into “balance” (which means pitting lots of unemployed people against each other in a race to the bottom).

But the jobs report shows the Fed hasn’t succeeded. The economy is still creating more than a quarter of a million jobs every month, the official unemployment rate is still just 3.7%, and — worst of all — workers are getting raises that are finally beginning to catch up with inflation.

The Fed is in thralled to an outdated ideology. It won’t end well.

Rex Nutting is a columnist for MarketWatch who has been writing about the economy and the Federal Reserve for more than 25 years.

Inflation insights from Rex Nutting

What NASA knows about soft landings that the Federal Reserve doesn’t

[ad_2]

Source link