[ad_1]

Short USD/ZAR: Top Trade Opportunities

The South African rand has been one of the worst performing currencies this year and reached all-time highs in early June 2023. The primary drivers for this move are not unfamiliar to ZAR traders and consists of the ever lingering political and economic headwinds as well as external risk sentiment and the US dollar.

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

South African Fundamental Backdrop

Persistent issues including loadshedding and corruption remain as a hindrance to the local currency but recent improvements regarding less frequent and severe blackouts have brought an air of optimism in the short-term. Whether or not this can be sustained remains to be seen but for now, business activity is picking up alongside investor sentiment. A new variable that has been added to the equation comes via South Africa’s relationship with Russia and the refusal to arrest President Vladmir Putin should he set foot in South Africa. Many western nations have lashed out at South Africa with threats of sanctions that could cripple the already fragile economy making this an important factor to monitor moving forward.

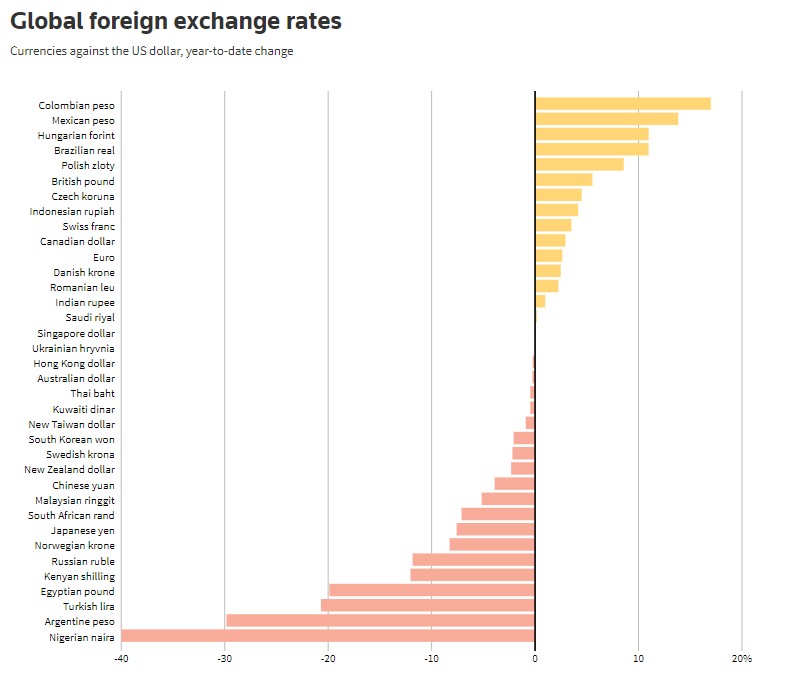

GLOBAL FX RATES VS USD

Source Thomson Reuters

From a South African Reserve Bank (SARB) perspective, the central bank has dutifully raised interest rates quite aggressively to protect the currency (one of their primary mandates). From these actions, the carry trade appeal for the ZAR has grown and could provide support in Q3 due to its renewed attractiveness for foreign investors.

Key local commodity prices have tapered off recently including gold, platinum, coal and iron ore but with optimism around China’s economic rebound as the PBoC looks to stimulate the economy through rate cuts, a China turnaround could bolster commodity demand and consequently the rand.

US Dollar in Q3

As always, the USD plays a vital role in rand analysis and could be reaching its peak as the Federal Reserve recently paused their hiking cycle. Despite Fed Chair Jerome Powell leaving the door open to future hikes, data dependency could see a less than anticipated path forward. Labor market cracks are starting to appear with inflation on a steady decline (albeit slower than intended) and may play into the hands of ZAR bulls should this continue.

Recommended by Warren Venketas

Get Your Free USD Forecast

USD/ZAR Technical Analysis

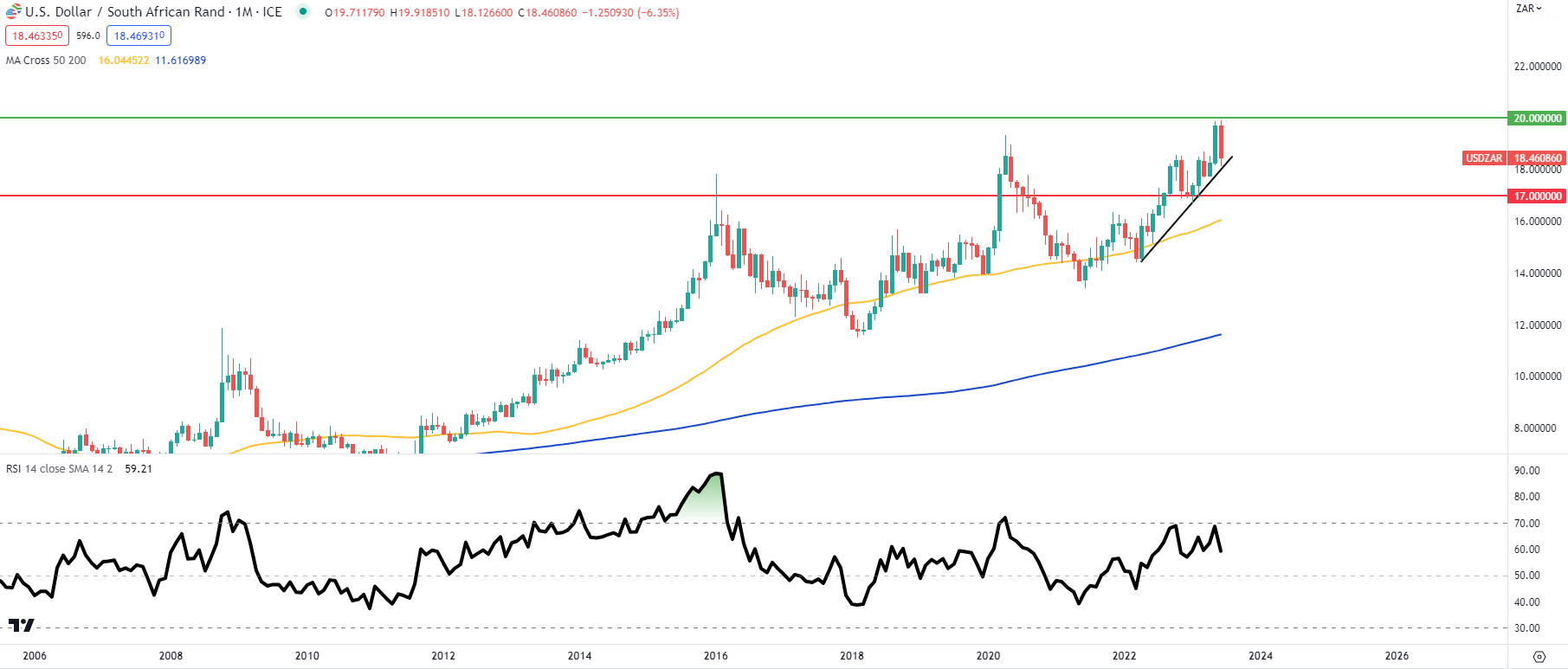

USD/ZAR MONTHLY CHART

Source TradingView, chart prepared by Warren Venketas, Analyst

The monthly USD/ZAR chart above shows the steep rally in 2023 with a strong appreciation for trendline support (black). Momentum remains in favor of bulls as prices stays above both the 50 and 200-month moving averages respectively. Looking at the Relative Strength Index (RSI) relative to monthly price action, there is a clear divergence between the two known as bearish/negative divergence. Traditionally, this points to subsequent downside to come although timing can be ambiguous.

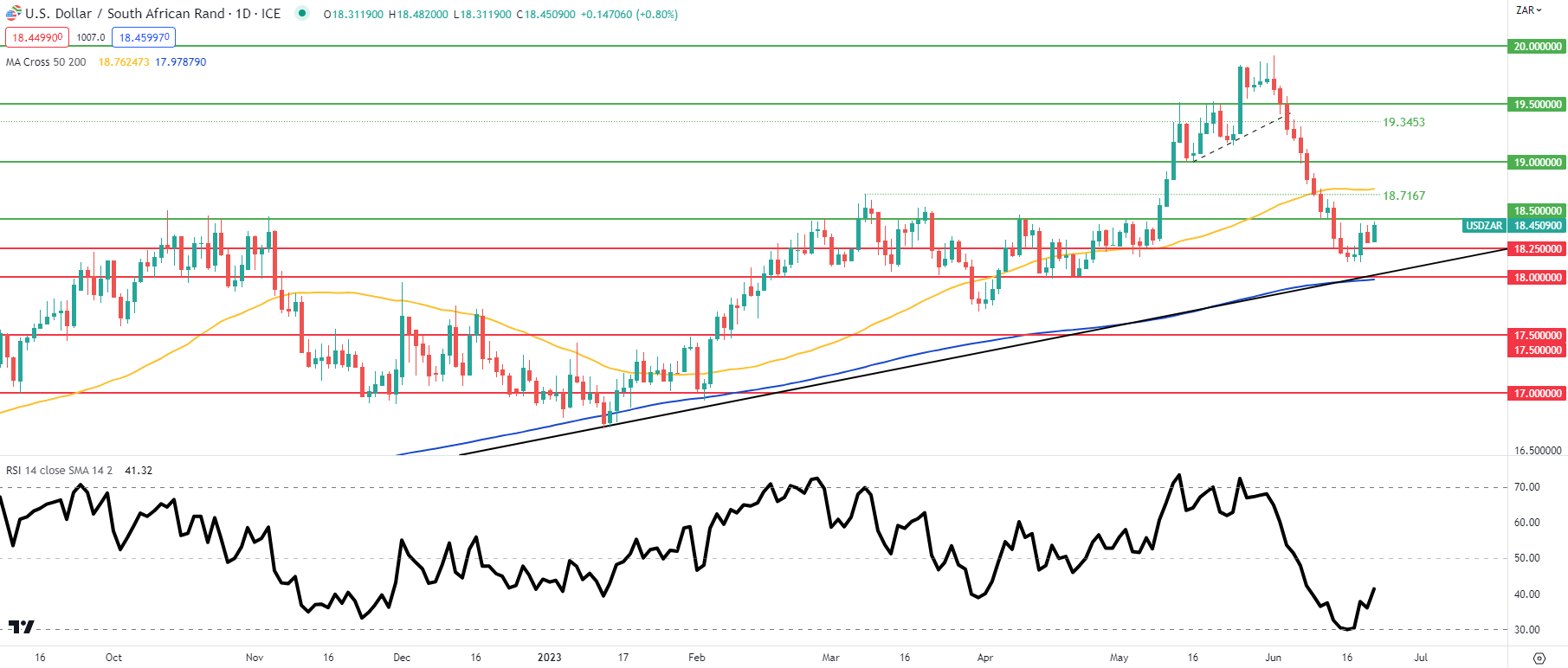

USD/ZAR DAILY CHART

Source TradingView, chart prepared by Warren Venketas, Analyst

Daily price action highlights the importance of the long-term trendline support that is moving in conjunction with the 200-day moving average (blue). The bearish bias could be catalyzed by a break below these two key support zones possibly exposing the R18/$ level once more. From a bullish perspective, a rejection at this inflection point may see a resumption of the uptrend as has been the case early this year. Ultimately, fundamental factors listed above will dictate terms for Q3.

Key resistance levels:

- 19.0000

- 18.7167/50-day MA (yellow)

- 18.5000

Key support levels:

- 18.2500

- Trendline support/200-daty MA (blue)

- 18.0000

[ad_2]

Source link