[ad_1]

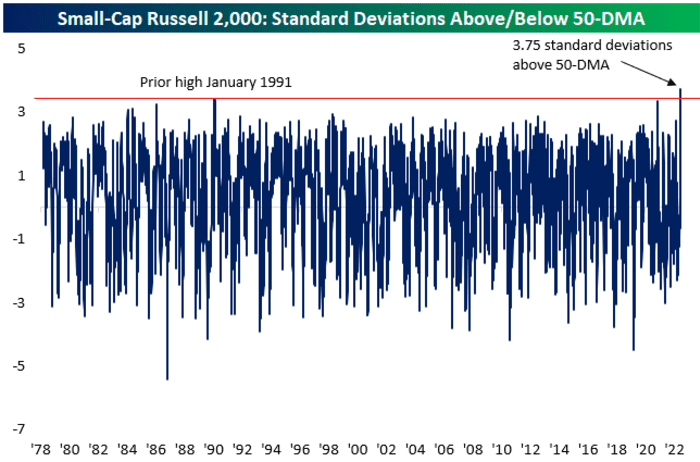

A closely watched gauge of small-cap U.S. stocks recently experienced its most explosive rally in history, according to one measure cited by Bespoke Investment Group.

The Russell 2000

RUT,

closed at its most overbought level ever on Wednesday after finishing the session 3.7 standard deviations above its 50-day moving average, according to analysts at Bepoke. The 50-day moving average is a popular momentum gauge used by technical analysts to determine the dominant trend in a stock or index.

The rally marks a sudden and stark change of fortune for the Russell 2000, a popular gauge of small-cap stock performance which has trailed the S&P 500

SPX,

in 2023.

Stocks and indexes are often measured against their moving averages to illustrate how dramatic a recent departure from trend has been.

Wednesday’s shift surpassed the previous record rally for the Russell which took place in 1991, the Bespoke team said.

BESPOKE INVESTMENT GROUP

For context, the index’s 50-day moving average stood at 1,773.84 on Wednesday. It finished the session at 1,888.45, its highest level since early March, according to FactSet data.

Wednesday’s gains marked the peak of what has been a major and much-discussed turnaround for previously unloved small-caps, which plunged in March as a chaos in the regional-banking sector dragged the broader index lower while other sectors were hammered by fears of a looming recession in the U.S.

As of the close of trading on May 31, the Russell was down slightly for the year.

But the index’s fortunes have changed dramatically in recent weeks.

Since the beginning of June, the Russell 2000 has risen 7.6% and is on track to log a second straight weekly gain of more than 3%, according to FactSet data.

Small-caps logged a modest 0.3% pullback on Thursday, slightly paring their gains from the past few weeks. But the Russell 2000 still managed to close well above its session low of 1,867.91, ultimately finishing Thursday trading at 1,881.12, according to FactSet data.

Sam Stovall, chief investment strategist at Standard & Poor’s Equity Research, told MarketWatch on Thursday that the rally in small-cap stocks has caused investors to wonder whether U.S. stocks are experiencing a potentially profound shift in market leadership after a handful of megacap technology names had led the market higher for most of the year.

“I think investors are starting to think ‘oh uh something is happening’,” he said during a phone interview.

While some investors have taken to Twitter to cheer the rebound in small-caps, others have cautioned investors against chasing the rally.

Jonathan Krinsky, chief market technician at BTIG, said in a recent note to clients that small-caps’ gains will likely soon peter out.

See: Why stock-market investors should beware of chasing small-cap rally

“Our view remains that we had a big run in the megacaps that led to a rotation/chase into the laggard stocks (i.e., small-caps), but that has likely run its course,” he said.

[ad_2]

Source link