[ad_1]

U.S. Indices Technical Outlook:

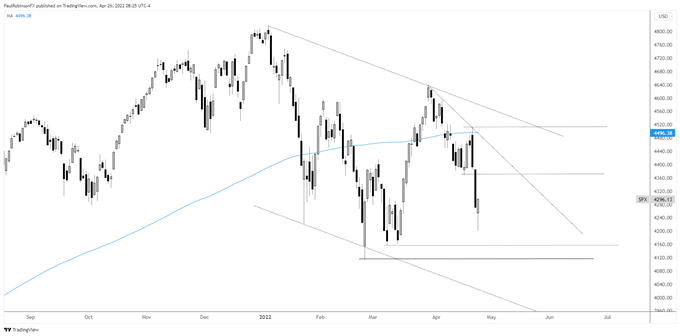

- S&P 500 reversed yesterday but poised to test Feb/March lows

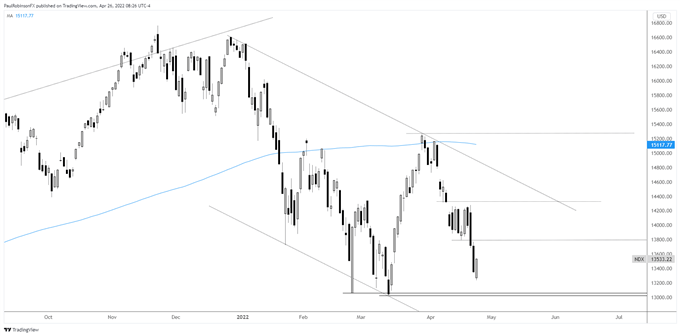

- Nasdaq 100 weaker and looks poised to first test last month’s lows

S&P 500 and Nasdaq 100 Outlook: March Low Test Looks Near

The S&P 500 reversed with vigor yesterday, but it’s just a one-day reversal within a weak trend. It appears the market is set to test the March lows soon or worse. This could lead to a sustainable bottom or only a bounce, we will need to monitor price action should those key levels get tagged soon.

The first level to watch is at 4157, a higher low that was created after the panic low set on Feb 24. This is seen as possibly setting a low for a bounce, but it is the February 24 low at 4114 that has the most attention. The Russian invasion low is obviously significant.

A reversal at or from just under that low could set off another powerful bounce at the least. It would be ideal to see the VIX spike on such a move, indicating panic/capitulation in the market. Whether it leads to a major low or something more intermediate that fails will need to be monitored should the lows become relevant.

On the top-side, at this time any strength from here is viewed as likely to be transient. A failure to maintain a rally is seen as probable.

S&P 500 Daily Chart

The Nasdaq 100 is very close to the March low, which exceeded the Feb 24 low by a small amount. The low is 13020, and as is the case with the S&P a small flush through support and reversal could set the market up nicely to rally.

At this time the general trading bias remains lower with a bounce from here viewed as likely to fail soon. Watch the near-term low at 13788 as a level for the market to turn lower off of.

Nasdaq 100 Daily Chart

Nasdaq 100 Chart by TradingView

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

—Written by Paul Robinson, Market Analyst

You can follow Paul on Twitter at @PaulRobinsonFX

[ad_2]

Source link