[ad_1]

S&P 500, SPX, NASDAQ 100, NDX – OUTLOOK:

- While the uptrend remains intact, US equities have yet to clear past their recent highs.

- Better-than-expected earnings have provided a floor to equities.

- What is the outlook for the S&P 500 index and Nasdaq 100 index?

Recommended by Manish Jaradi

Traits of Successful Traders

US equities have struggled to clear past their recent highs even as the US Federal Reserve hinted at a pause in the hiking cycle. As the earnings season draws to a close, banking sector concerns appear to be taking center stage, posing a risk to the multi-week uptrend. On technical charts however, there are no signs of reversal of the bullish structure.

As of Thursday, 417 out of 500 companies have reported Q1 earnings in the S&P 500 index, and results have beaten expectations, providing a floor for equities. So far, 69% of companies in the S&P 500 have reported sales surprise, while 78% have reported earnings surprise, according to Bloomberg data. The solid earnings season is being overshadowed by the widening banking sector stress.

PacWest Bancorp shares plunged after it confirmed it was exploring strategic options, including a sale. Western Alliance Bancorp fell sharply before recouping some losses after it denied reports that it is exploring a potential sale. Last week, regulators seized the troubled First Republic Bank and JPMorgan Chase agreed to buy a majority of its assets.

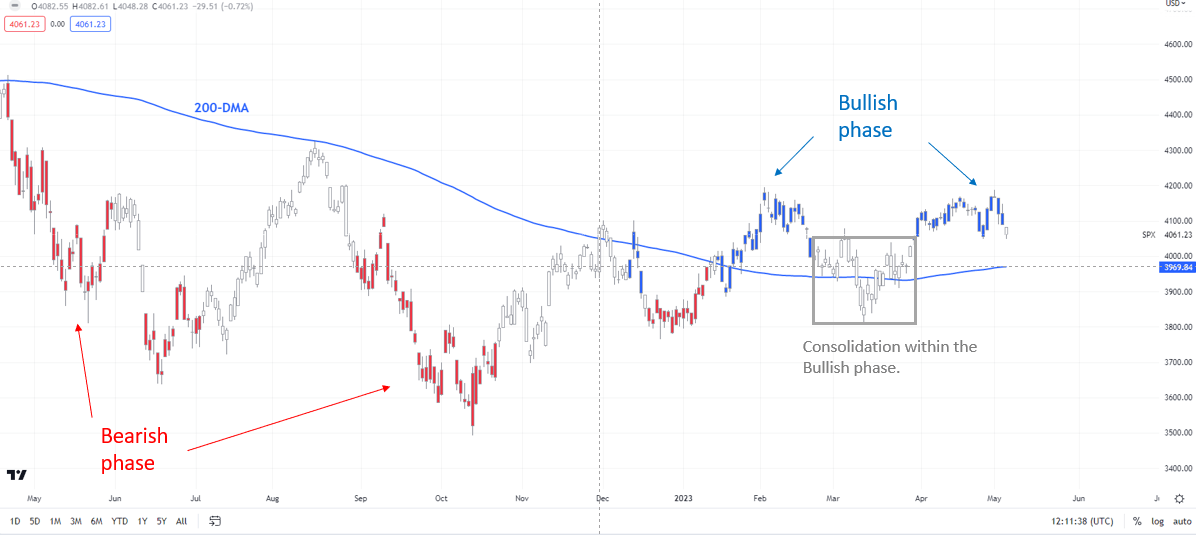

S&P 500 Daily Chart

Chart Created by Manish Jaradi Using Tradingview

A potential fallout from the troubles in the financial sector is that banks will tighten credit, worsening the economic downturn. As a result, the market now expects the Fed to cut by 75 basis points by the end of this year – a view that probably reflects financial conditions have tightened too much and too fast, and that the Fed may have to reverse some of the tightening.

For equity markets, the key question is to what extent is the tightening priced, which obviously can be tricky. In this regard, the Fed’s quarterly Senior Loan Officer Survey on bank lending (due on Monday) and CPI report (due on Wednesday) will be closely watched. If these reports point to the need for further rate hikes, then equities could start to feel the pain.

So far, on technical charts, there are no signs of a reversal of the uptrend, even though the rally appears to have stalled in recent weeks. For more discussion, see “S&P 500 and Nasdaq Weekly Forecast: Climbing the Wall of Worry”, published April 29.

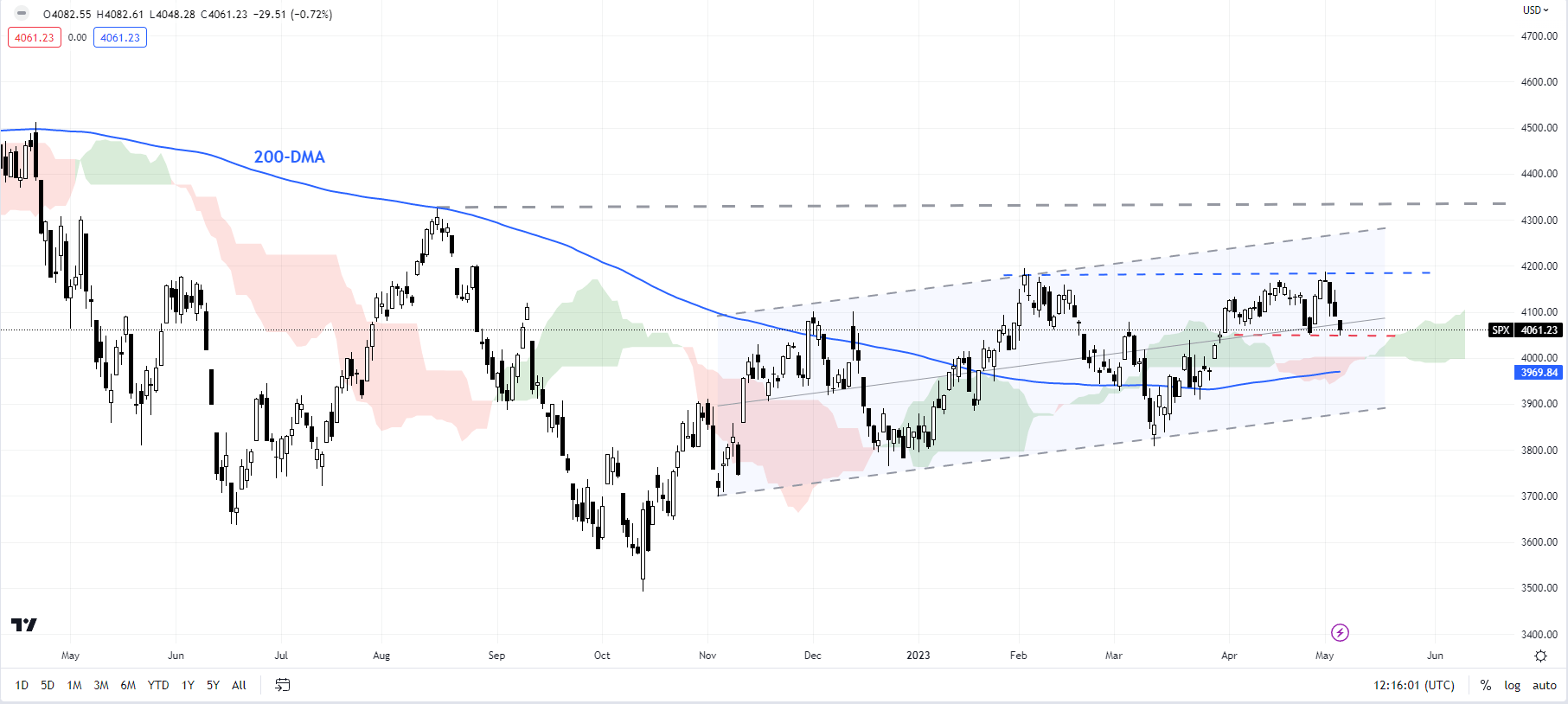

S&P 500 Daily Chart

Chart Created by Manish Jaradi Using Tradingview

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, around a support/resistance, and/or in a sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

S&P 500: Approaching key support

From a trend perspective, the S&P 500 index bullish structure is intact — first highlighted in January (see “S&P 500 and Nasdaq 100 Index Technical Outlook: Turning Bullish”, published January 28. Most recently, the S&P 500 index’s failure to rise toward the upper edge of a rising channel from the end of 2022 and the February high of 4195 can be interpreted as a sign of fatigue.

The index is now testing immediate support at the end-April low of 4050. Any break below would trigger a minor double top (the mid-April and the early-May highs), opening the way toward the lower edge of the channel (now at about 3925). Having said that, only a break below the March low of 3809 would disrupt the higher-top-higher-bottom sequence from the end of 2022.As long as 4050 remains holds, the index could attempt to test the August high of 4325.

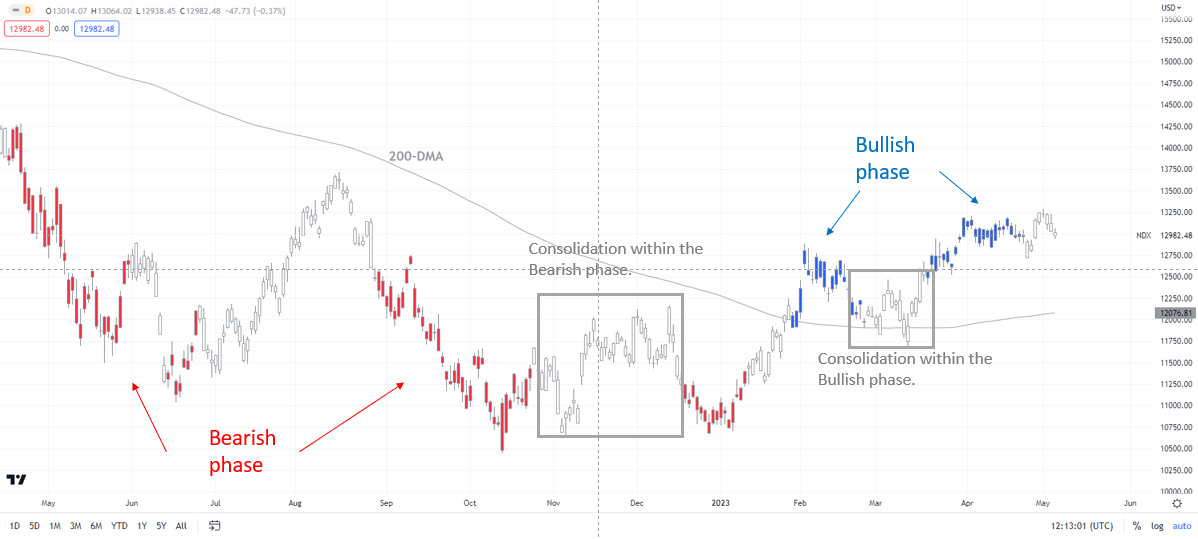

Nasdaq 100 Daily Chart

Chart Created by Manish Jaradi Using Tradingview

Note: In the above colour-coded chart, Blue candles represent a Bullish phase. Red candles represent a Bearish phase. Grey candles serve as Consolidation phases (within a Bullish or a Bearish phase), but sometimes they tend to form at the end of a trend. Note: Candle colors are not predictive – they merely state what the current trend is. Indeed, the candle color can change in the next bar. False patterns can occur around the 200-period moving average, around a support/resistance, and/or in a sideways/choppy market. The author does not guarantee the accuracy of the information. Past performance is not indicative of future performance. Users of the information do so at their own risk.

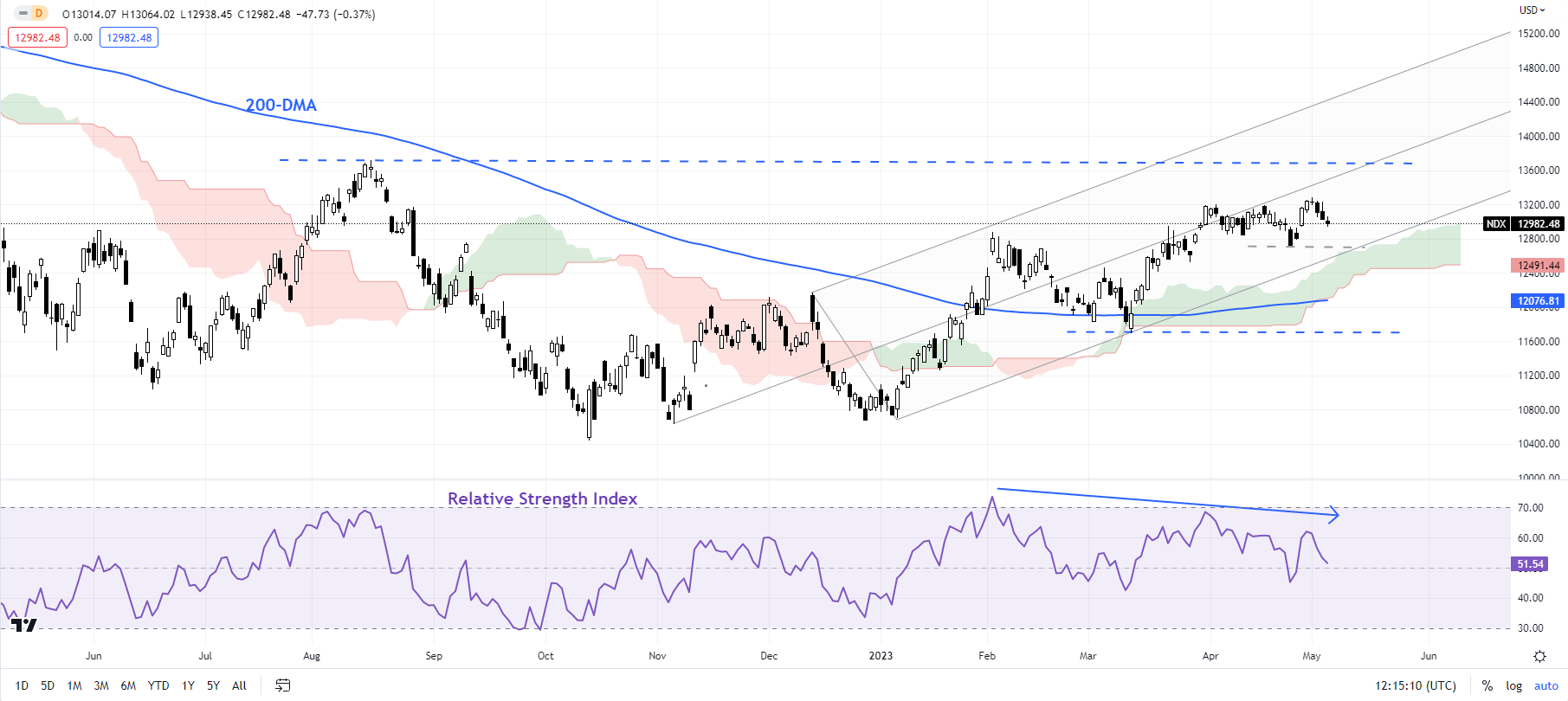

Nasdaq 100: Rally stalls at key resistance

Likewise, the Nasdaq 100 index’s trend has been up. The index has been flirting with key resistance at the early-April high of 13205. As mentioned in the previous update, as long as the index remains above immediate support at the April 25 low of 12725, a retest the August high of 13720 is likely.

Nasdaq 100 Daily Chart

Chart Created by Manish Jaradi Using Tradingview

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

[ad_2]

Source link