[ad_1]

Consumer discretionary stocks were headed sharply lower for a second straight week on Friday, as investors worried the Federal Reserve’s plan to keep interest rates high next year could hurt the U.S. economy.

The S&P 500’s consumer discretionary sector, which tracks companies that make things people might want but probably don’t need, was on pace to book a weekly loss of nearly 4%, according to FactSet.

It has been dragged down by shares of Amazon

AMZN,

and Tesla

TSLA,

top constituents of the index by weight, with shares of Tesla down over 15% for the week. The broader consumer discretionary sector was down about 8.1% in the last two weeks, on pace for its worst two-weeks in nearly three months, according to Dow Jones Market Data.

The Federal Reserve on Wednesday slowed its pace of interest-rate hikes by 50 basis points, but forecast a higher peak benchmark interest rate in the range of 5.25%.

Chair Powell said in his post-statement press conference that the central bank is still waiting for the labor market to pull back notably to stop aggressively adjusting its policy. The Fed sees unemployment rising from 3.7% in November to 4.6% in 2023 and remaining almost unchanged for two years after that.

David Waddell, CEO and chief investment strategist at Waddell and Associates, a wealth management firm, thinks such a rise in unemployment would be equivalent to about four million people losing their jobs in 2023, which raises concerns that the Fed’s current plan risks pushing the world’s biggest economy into recession.

“If you know going into next year Powell wants four million Americans unemployed, you probably don’t want to own a bunch of high-end retailers [stocks]” Waddell said via phone.

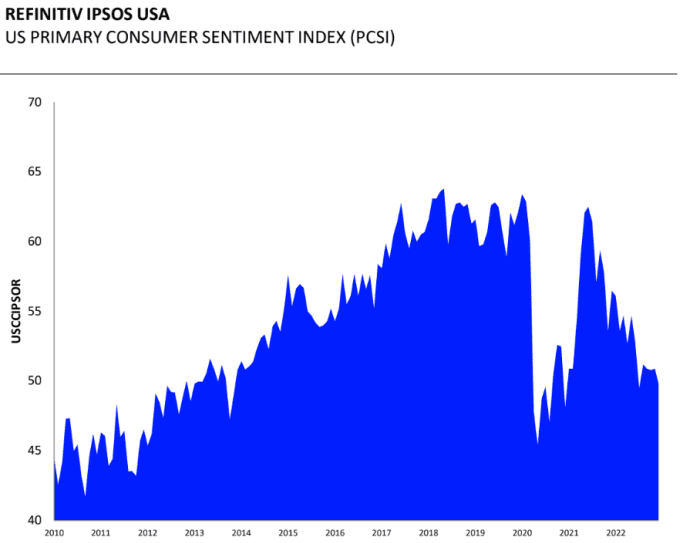

Data collected by Refinitiv and Ipsos showed that consumer confidence fell to the second-lowest point of 2022, in the week ending December 9.

SOURCE: REFINITIV IPSOS

Each of the 11 major S&P 500 sectors were deep in the red on Friday afternoon, with the consumer discretionary, energy and utilities stocks falling over 2% as the worst performing of the session.

Consumer discretionary

SP500.25,

was down 1.9%, while the energy sector

SP500.10,

dropped 1.3%, and the utilities sector

SP500.55,

was off by over 1.8%. The S&P 500

SPX,

declined by 1.2% as stocks headed for their first back-to-back weekly losses since late September.

The Dow Jones Industrial Average

DJIA,

was dropping over 300 points, or 1.1%. The Nasdaq Composite

COMP,

was down 1.1%.

[ad_2]

Source link