[ad_1]

Indices Talking Points:

Recommended by James Stanley

Get Your Free Equities Forecast

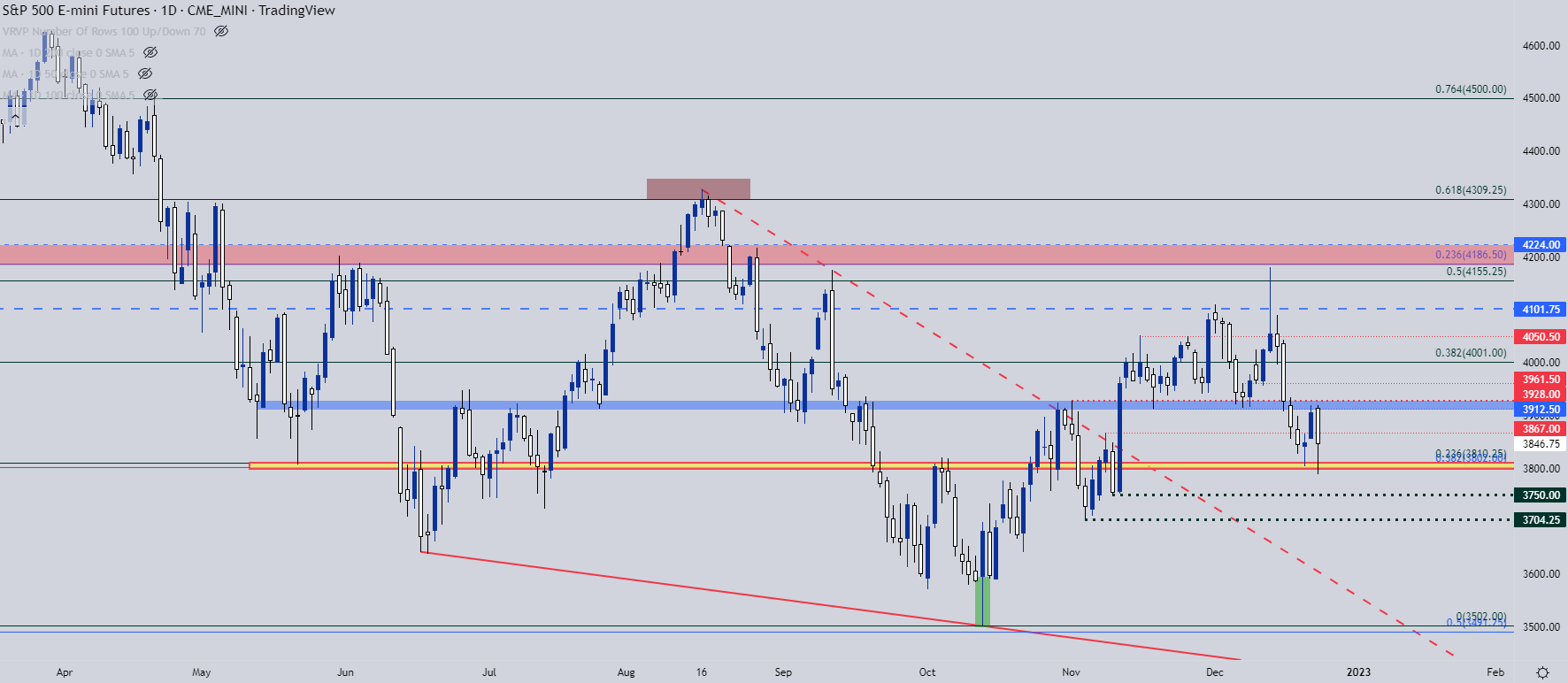

We’re winding down to the end of the year but volatility in stocks has continued to flow. Today brought a strong move to start the session as the S&P 500 put in a dead drop from the key zone of resistance that came into the picture yesterday at the 3912-3928 area on the chart. This was resistance in late-October before becoming support over a couple of different episodes in November. Last week’s FOMC-fueled sell-off broke through that area as the S&P touched down to the 3802-3810 zone that I had looked at over the weekend.

That support stopped the bleeding, at least temporarily, with a doji printing on Tuesday followed by considerable strength yesterday. Price had paused at this key juncture of prior support coming into this morning, but the GDP release out of the US came out to complete surprise as the Q3 Final read showed at 3.2% v/s the 2.9% that was expected. This illustrates continued strength in the US economy which comes along with the possibility of continued-hawkishness from the FOMC, much like Powell had warned of last week when sellers started to get to work.

At this point, there’s one more large batch of data before the holiday weekend and that’s tomorrow’s Core PCE release, set to drop at 8:30 AM ET. There’s also a release of Durable Goods orders at the same time which is also a high-impact release, and then we get Consumer Sentiment numbers at 10 AM. This could make for a busy backdrop in the US Dollar and US equities, as well.

At this point, the S&P 500 has put in another strong bounce from support in the 3802-3810 zone. This is a big spot as there’s two Fibonacci levels in close proximity and perhaps more importantly, it’s shown impact, helping to hold resistance in late-October and early-November before helping to set support through much of last month.

So, at the very least, the battle lines are very defined in the S&P 500 going into tomorrow. Resistance sits at 3912-3928 while support is at 3802-3810. Below that support 3750 and 3704, both of which were higher-lows as price was breaking out in November.

Recommended by James Stanley

Traits of Successful Traders

S&P 500 Daily Price Chart

Chart prepared by James Stanley; S&P 500 on Tradingview

Nasdaq

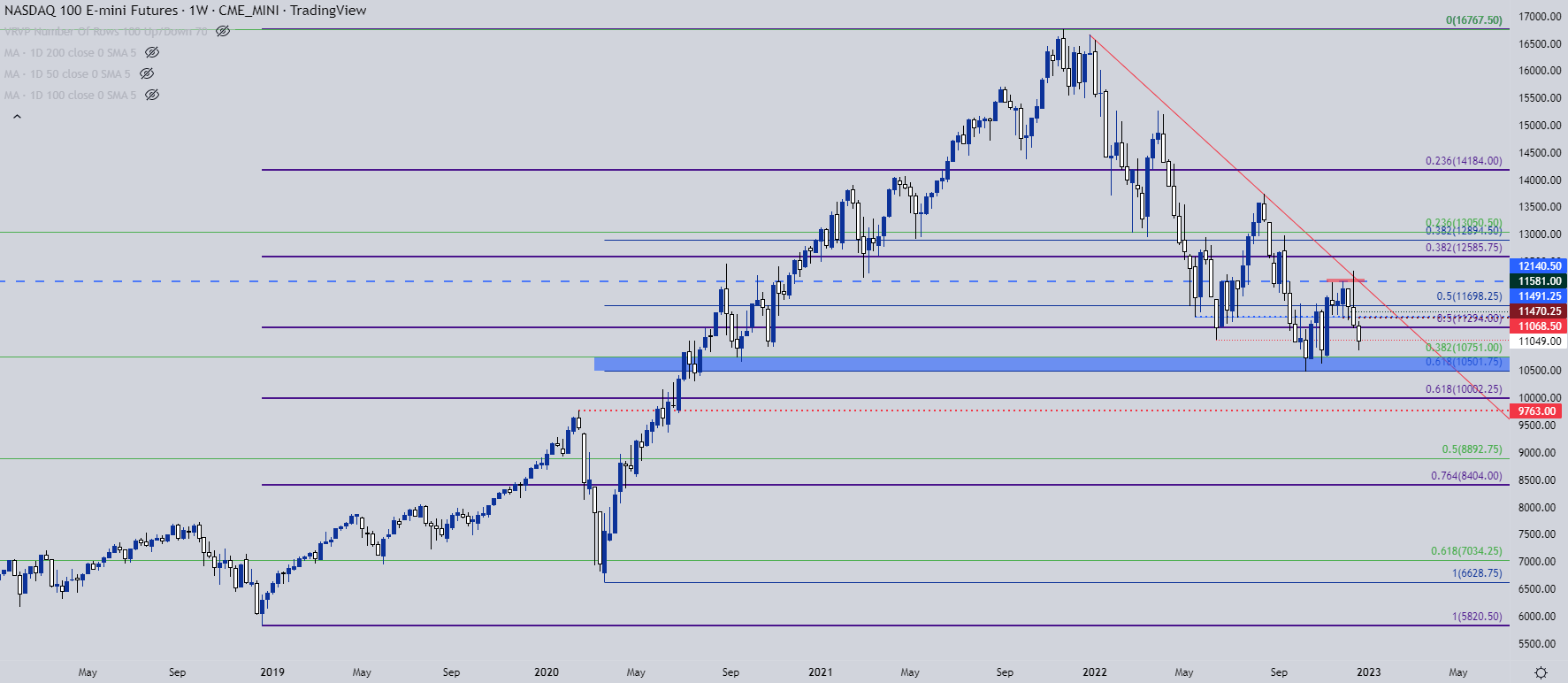

For bearish themes the tech-heavy index continues to carry a bit more attraction and, at this point, price remains very close to the 2022 swing lows which printed in a key zone. That zone runs from 10,501 up to 10,751 and this helped to mark the lows in both October and November. If sellers can make a deeper push, this becomes a massive test but if they can sink price through that, then there’s a big spot at the 10k psychological level, which is also the 61.8% Fibonacci retracement of the 2018-2021 major move which, perhaps ironically, spans the Fed’s last cutting cycle.

Nasdaq 100 Daily Price Chart

Chart prepared by James Stanley; Nasdaq 100 on Tradingview

Dow

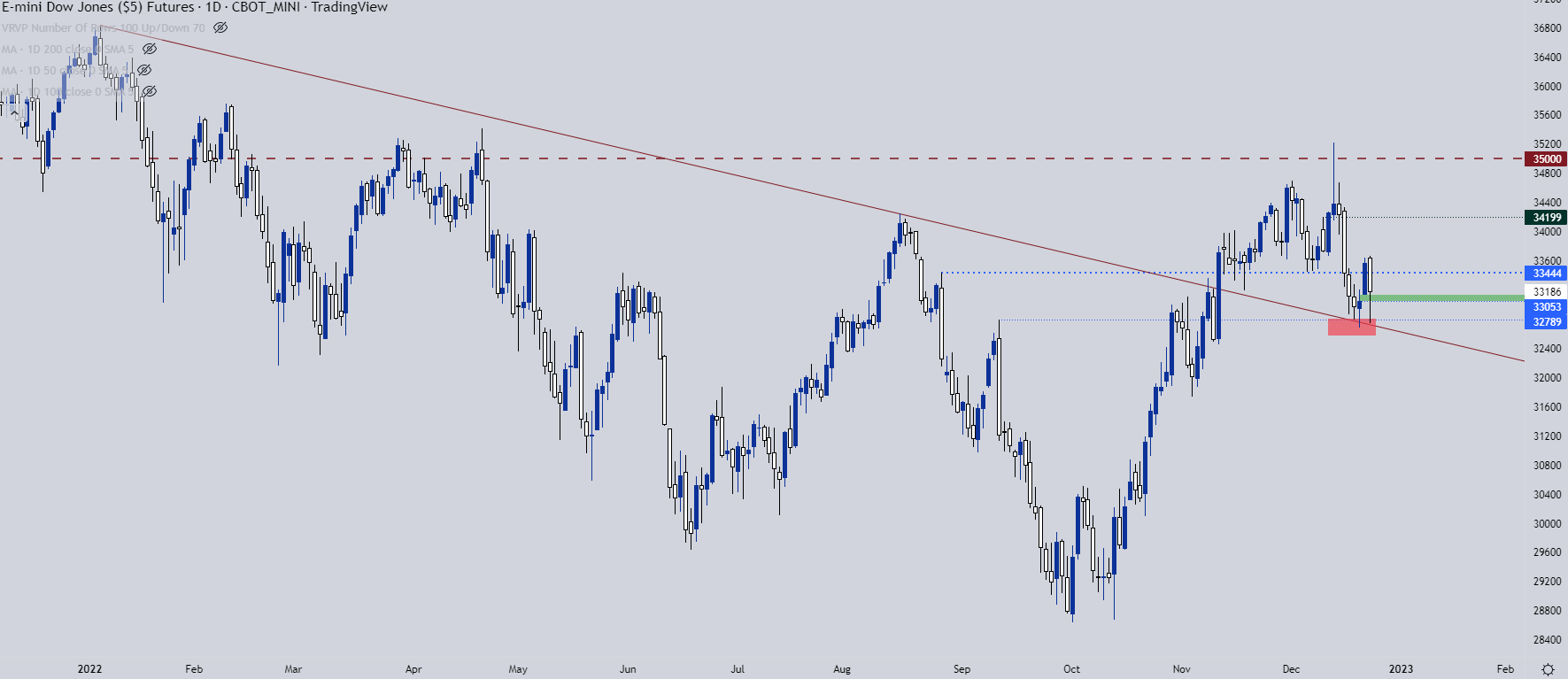

For bullish equity approaches, the Dow remains as more attractive than the Nasdaq and perhaps even the S&P 500. The Dow dropped to a massive spot on the chart today and this is the same spot that I had highlighted on in the weekly forecast, which came into play on Tuesday. This is a swing-high from September that’s confluent with a bearish trendline projection. I have that plotted at 32,789 and it helped to hold the lows again today.

Recommended by James Stanley

Building Confidence in Trading

Dow Daily Price Chart

Chart prepared by James Stanley; Dow Jones on Tradingview

— Written by James Stanley

Contact and follow James on Twitter: @JStanleyFX

[ad_2]

Source link