[ad_1]

Euro, EUR/USD Analysis

- ECB policy minutes reveal a somewhat divided council regarding inflation

- ECB presser in focus next week, focus on ending stimulus and rate hike timelines

- Key EUR/USD technical levels considered and analyzed

ECB Policymakers’ Defining Moment

Next week the ECB will deliver their interest rate decision which is not expected to reveal a surprise rate hike but more importantly, market participants will be hanging on every word from ECB President Christine Lagarde regarding the end of APP (ECB’s version of QE) and the subsequent rate hike timeline.

The minutes from the March meeting were largely received as hawkish, much like the meeting itself but members of the governing council still differ in their views on inflation with some advocating for immediate normalization measures while others seemingly comfortable with inflation’s medium-term outlook.

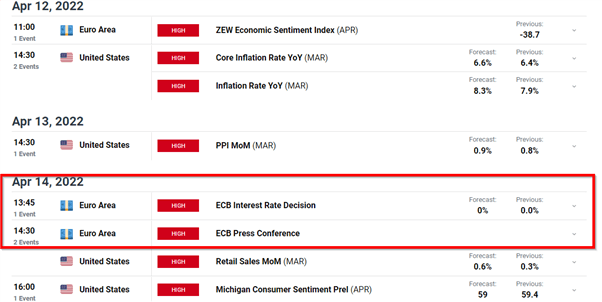

Major Risk Events for the Week Ahead

Apart from the obvious ECB interest rate announcement and press conference, EUR/USD risk events really heat up next week.

Customize and filter live economic data via our DaliyFX economic calendar

EUR/USD – Key Technical Levels

The euro continues to struggle from domestic fundamental factors (proximity to Russia-Ukraine war, reliance on Russian gas and relatively loose monetary policy during a global hiking cycle).

The other side of the pair, the US dollar, has really gained momentum since breaking out of the month-long range seen in the dollar basket index. The index is heavily weighted by EUR/USD price movement and shows the divergence between the strong dollar and susceptible euro.

The daily EUR/USD chart shows a strong rejection at the blue trendline resistance stemming from May 2021 which coincided with the upper bound of the rising channel. Since then, EUR/USD broke below the lower bound of the channel and now approaches the 2017 trendline acting as support. The trendline appears just before the March low of 1.0805 which is well within reach ahead of the ECB meeting. A deeper move would see 1.0635 appear as support – the March 2020 low.

Any euro defiance would be contained by 1.0940 before the psychologically important 1.1000 comes back into focus.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

The weekly chart helps to view significant levels and potential turning points. Continued euro weakness has a fair distance to run before any significant turning points appear. The nearest being the March 2020 low of 1.0635.

EUR/USD Weekly Chart

Source: TradingView, prepared by Richard Snow

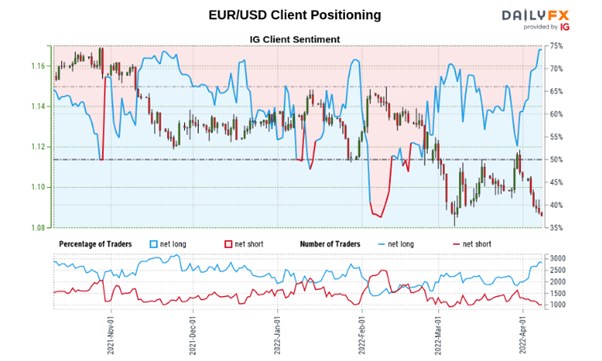

Massive Divergence Between Price Action and Client Sentiment

Massively long IG client sentiment weighed up against a relentless downtrend in EUR/USD opens the door to a continued move lower in the pair.

- EUR/USD: Retail trader data shows 73.81% of traders are net-long with the ratio of traders long to short at 2.82 to 1.

- We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall.

- Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a continued EUR/USD-bearish contrarian trading bias.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

[ad_2]

Source link