[ad_1]

The bond market looks ready to settle down a bit for Tuesday as more forecasters shift to the likelihood of the first U.S. rate cut coming in summer. Another wobbly stock day is building though as investors try to adapt to this new line of thinking.

It’s thanks to recent blowout jobs and growth data, and more caution from Fed Chairman Jerome Powell over the weekend, that those heady rate cut forecasts have been walked back.

The pessimists might be in for a rough ride this year, based on our call of the day from Deutsche Bank, where strategists say they are no longer expecting a mild recession in the first half of the year.

The bank was one of the first to call for a slowdown back in April 2022, when its economists predicted a U.S. recession within two years.

Fast forward and Deutsche Bank now expects 2024 growth at a “solid 1.9%” (fourth quarter to fourth quarter) rate, with the first Fed rate cut coming in June, but with a total of just 100 basis points.

“When we first adopted a mild recession as our baseline forecast, a key element was that, with an economy far from the Fed’s objectives, the history of central bank-induced disinflations showed the path to a soft landing was narrow if not unprecedented. We now think the economy will land on this narrow path and that a recession will be averted with limited

cost in the labor market,” said a team led by Matthew Luzzetti, chief U.S. economist.

They say the U.S. economy performed as well as hoped for in 2023, with the jobs market holding up and core PCE (personal consumption expenditures) inflation falling below 2% annualized in the second half of the year.

“We see virtuous dynamics at play that could extend these positive developments, including an easing of financial conditions that has trimmed downside risks to growth,” they said.

Luzzetti and co. note the pace of credit condition tightening “has eased noticeably” and financial conditions have grown more supportive. “Households have weathered these conditions and the return of student debt payments and sentiment has rebounded as inflation declined, real income growth picked up, and risk assets remain buoyant.”

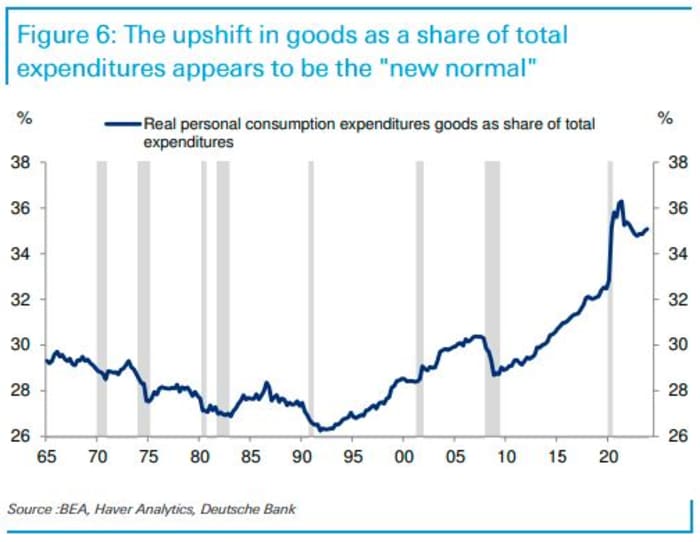

The strength of consumer spending has been “surprising,” notes Deutsche Bank economists, who expected goods spending would revert to a pre-COVID trend eventually. Instead that higher expenditure on goods seems to be “the new normal,” they say.

What are the risks to their new prognosis? The possibility of “greater pass through” from prior Fed tightening and increased geopolitical risks.

“Conversely, we see reasonable prospects that growth continues to surprise to the upside, particularly as financial conditions have eased and with the potential for stronger productivity to continue to provide a boost,” said the Deutsche Bank economists.

Note, Deutsche Bank’s year-end S&P 500 forecast of 5,100 is among the highest on Wall Street, and it included their expectation for a mild short recession. Time to lift that view?

The markets

Stock futures

ES00,

YM00,

are mixed, with the Nasdaq-100 contract

NQ00,

pointing higher. Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

are steady after bolting higher for two straight days. China stocks rallied

HK:HSI

CN:SHCOMP

after a government investment fund pledged to buy more equities. That’s lifting U.S.-listed shares of Alibaba

BABA,

PDD

PDD,

and others in premarket trading.

| Key asset performance | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 4,942.81 | 0.36% | 3.92% | 3.63% | 18.70% |

| Nasdaq Composite | 15,597.68 | 0.57% | 4.98% | 3.91% | 28.76% |

| 10 year Treasury | 4.165 | 13.08 | 14.94 | 28.37 | 48.73 |

| Gold | 2,039.80 | 0.35% | 0.28% | -1.54% | 8.49% |

| Oil | 72.85 | -5.37% | 2.72% | 2.13% | -2.15% |

| Data: MarketWatch. Treasury yields change expressed in basis points | |||||

The buzz

DuPont

DD,

stock is getting lifted by a forecast-beating profit, with . Eli Lilly

LLY,

stock surging to another record on an upbeat outlook and earnings beat. Ford

F,

Chipotle

CMG,

Amgen

AMGN,

and Snap

SNAP,

which announced job cuts a day ago, will report after the close.

Palantir Technologies

PLTR,

stock is up 17% after the software company beat forecasts and said its AI products had seen “unrelenting demand.”

BP

BP,

BP,

is up 7% after the oil major posted a forecast-beating profit and more buybacks. Elsewhere, German chipmaker Infineon

IFX,

cut guidance on chip sales.

It’s all Fed speakers for Tuesday, with Cleveland President Loretta Mester speaking at 12 noon, Minneapolis President Neel Kashkari at 1 p.m., Boston President Susan Collins at 2 p.m. and Philadelphia President Patrick Harker at 7 p.m.

Treasury Secretary Janet Yellen appears before the House Financial Services Committee at 10 a.m. Eastern, to discuss financial stability.

Best of the web

Living in shadow of Putin’s Russia feeds fear on NATO’s border.

L’Oréal just went there: Mandated Fridays in the office.

Is the presidential race encouraging ageism?

The chart

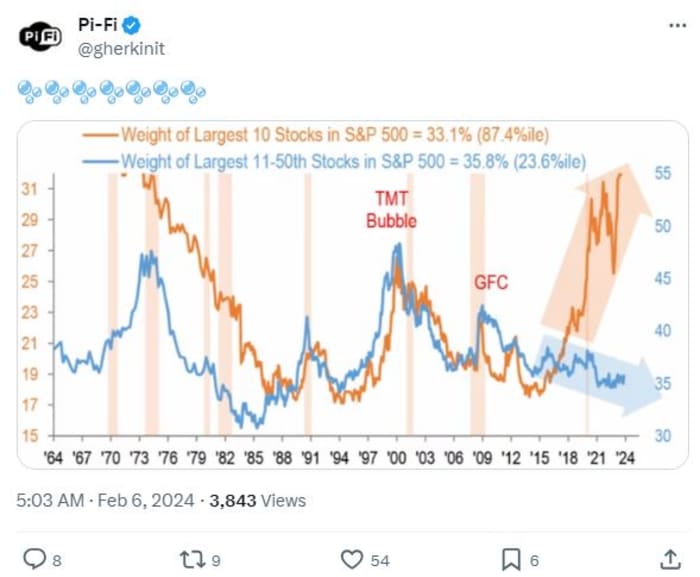

A bubble warning? Here’s another way of looking at the dramatic rise and rise of Big Tech. The X account Pi-Fi tracked the timeline of the 10 biggest stocks in the S&P 500 since the early 70s — it’s clear what stands out:

Top tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

PLTR, |

Palantir Technologies |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

BABA, |

Alibaba |

|

META, |

Meta Platforms |

|

AMZN, |

Amazon |

|

AMD, |

Advanced Micro Devices |

|

GME, |

GameStop |

Random reads

The $200, 40-minute skincare regime of tweens.

Students use AI to crack famed Herculaneum scroll, charred by 79AD Mount Vesuvius eruption.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast about the financial news we’re all watching – and how that’s affecting the economy and your wallet. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and offers insights that will help you make more informed money decisions. Subscribe on Spotify and Apple.

[ad_2]

Source link