[ad_1]

Wall Street’s excitement over a possible rebound in the IPO market tells us more about analysts’ exuberance than what’s actually happening.

That’s because activity in the IPO market so far this year is indistinguishable from the comparable period of early 2022 and 2023, and those years were the slowest for IPOs since the 2008 Global Financial Crisis. There have been just four IPOs so far this year through January 23, according to Renaissance Technologies, which is the same as how many came to market during the same period in January of a year ago.

Nor does the IPO pipeline appear to be materially more crowded. Thirteen IPOs have filed their paperwork so far this year, according to Renaissance Technologies, 13.3% below the number during the comparable period of a year ago.

The year is just beginning, of course, and it’s entirely possible that the IPO market will experience a significant rebound in coming months. But analysts are getting ahead of themselves in declaring that the IPO market is experiencing a “revival” — which is the word I’ve seen several times in news stories about the IPO market.

Furthermore, since IPO volume is heavily dependent on whether the major trend of the stock market is up, Wall Street’s excitement about a strong IPO trend really boils down to optimism that the bull market will continue through 2024. This optimism may turn out to be well-founded, but market timing judgments are a dime a dozen and rarely the occasion for special celebration.

Apart from normal cyclical factors impacting IPO volume, there are several longer-term secular trends worth noting, according to Jay Ritter, a finance professor at the University of Florida and one of academia’s leading experts on the new issue market. He mentioned three in particular:

1. Startups are waiting longer to go public: This trend started a number of years ago when startups began having little trouble accessing private capital. Ritter says he doesn’t see this trend reversing itself anytime soon, since the amount of venture capital funds raised increased from $22-25 billion per year in the 2011-2013 period to $155-163 billion per year in 2021-2022 period, according to the 2023 Pitchbook/NVCA annual yearbook. Furthermore, there is currently a record level of so-called “dry powder” among venture capital and private equity funds — unspent cash that those funds are eager to invest.

2. Going public is not the only exit strategy: It used to be that the standard exit strategy for a startup was to go public. But since the tech bubble bust in 2000, Ritter said, more than 80% of successful exits have been via acquisitions. He added that he also doesn’t see this trend reversing itself anytime soon.

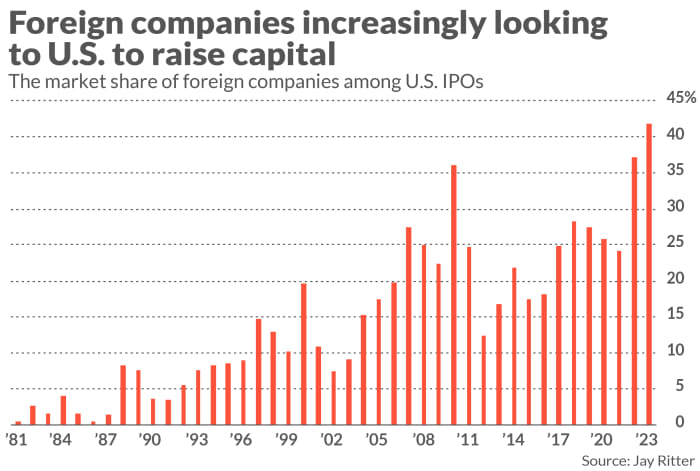

3. An increasing share of U.S. IPOs are coming from foreign companies: One bright spot is the increasing share of U.S. IPOs from foreign companies, as illustrated in the chart above (courtesy of data from Ritter). This is an encouraging sign, since some in recent years had predicted that excessive legal and regulatory requirements would discourage foreign companies from using the U.S. markets to raise capital. That doesn’t appear to be the case.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

Also read: IPO market continues its revival with investors looking to Amer Sports, BrightSpring — and Reddit

More: The IPO market looks ready to rebound, says Nasdaq CEO

[ad_2]

Source link