[ad_1]

Technical analysts are warning that markets are poised to retest June lows, with 3,640 on the S&P 500

SPX,

in the spotlight.

“Investors have become much less comfortable with this tighter liquidity environment, with many realizing it will stay in place for a much longer period of time than initially expected, which ultimately leads to the current decreasing appetite for riskier assets,” said Pierre Veyret, technical analyst at ActivTrades.

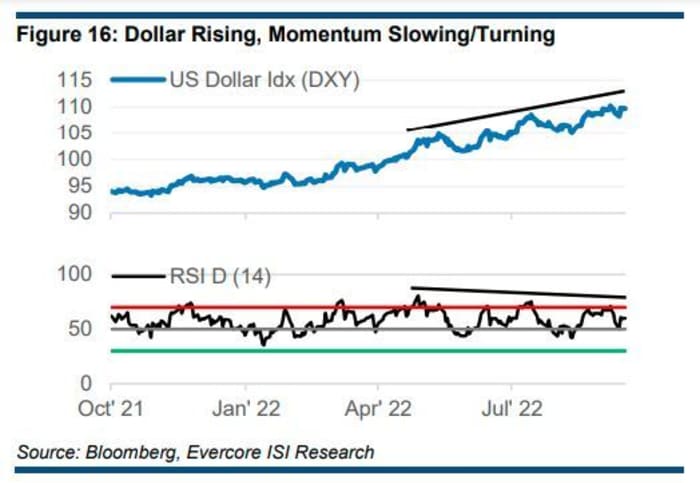

One result has been a steady push by investors into the dollar, which Citigroup strategists have described as “one of the only places to hide.” While the greenback is looking overvalued and a turning point is inevitable, Citi says either “global growth expectations need to turn or the Fed needs to pivot,” for that to happen.

Our call of the day comes from Julian Emanuel, Evercore ISI’s chief equity and quantitative strategist, who thinks the Fed will drag the dollar lower sooner than many think.

Emanuel tells clients in a note that last week’s FedEx

FDX,

profit gloom and the inverted yield curve between the two- and 10-year Treasurys are red flags for a global recession reaching U.S. shores.

With that, Emanuel expects “the Fed could (and should) guide markets on Wednesday that ‘data dependency’ for the central bank’s Nov. 1-2 FOMC decision is 0-75bp in hikes, not 50-75.” Given the Fed will be assessing enormous tightening already in place and potential for messy midterm elections, the strategist thinks U.S. dollar will “continue to temper its strength.”

The dollar index is up about 1.3% so far for September, after a blistering 2.6% gain in August.

Evercore ISI

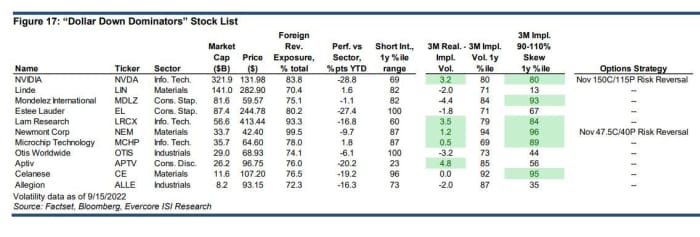

The Evercore team offers up a list of “Dollar-Down Denominators” — S&P 500

SPX,

names that could outperform in case of a dollar pull back, alongside “Buck Backsliders” equities that could underperform amid a weakening dollar.

From the “Denominators” list are export-oriented sectors with more than 70% foreign revenue exposure and high short interest, that have underperformed their peers in 2022. NVIDIA

NVDA,

Linde

LIN,

Mondelez International

MDLZ,

and Estee Lauder

EL,

are just a few of those names.

Evercore ISI

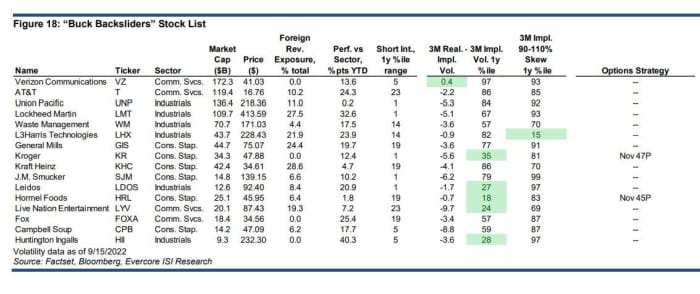

On the “Backsliders” list are Verizon Communications

VZ,

AT&T

T,

Union Pacific

UNP,

and Lockheed Martin

LMT,

to name a few.

Evercore ISI

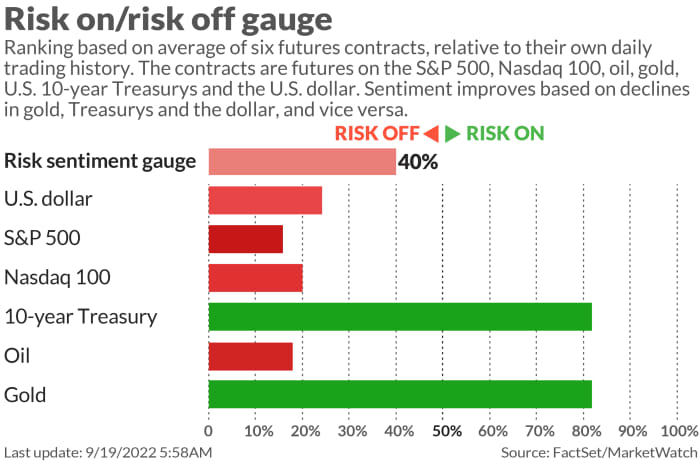

So far for Monday it’s dollar up.

Hear from Ray Dalio at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The hedge-fund pioneer has strong views on where the economy is headed.

The markets

It’s not just stock futures

ES00,

NQ00,

Oil

CL.1,

is dropping, while bitcoin

BTCUSD,

and Ethereum

ETHUSD,

prices are getting hit particularly hard, following the latter’s so-called “merge” last week. Bond yields

TMUBMUSD02Y,

TMUBMUSD10Y,

are climbing, while gold prices

GC00,

are down.

Best of the web

The ordinary heroes invited to the Queen’s funeral.

Losing macro hedge fund offers investors the chance to exit, recoup some losses.

Nobel Prize–winning economist Peter Diamond says workers have the power.

China tells citizens not to touch foreigners over monkeypox threat.

The buzz

Some 2,000 global dignataries, along with perhaps a billion people worldwide have been watching the funeral of Queen Elizabeth II. For those who missed it, here are key moments and details from the final farewell for Britain’s beloved monarch. And catch our live blog recap.

The National Association of Home Builders sentiment index is due after the market open in a week that will see plenty of data on the sector, with existing home sales and housing starts. Apart from the Fed decision on Wednesday, the end of the week will bring PMI data for September.

A hacker who claims to be behind the recent Uber

UBER,

data breach may have leaked dozens of gameplay videos from the upcoming “Grand Theft Auto VI” videogame from Take-Two interactive’s

TTWO,

Rockstar Games.

President Joe Biden declared the pandemic over in a Sunday interview, to the surprise of some of his health advisers. He also said the U.S. would defend Taiwan against a China invasion.

The chart

Zoom Video Communications

ZM,

has not just been a “poster child” for stocks hitting new lows on the Nasdaq, “but one of the greatest leading indicators of where the market is going overall,” says Michael Kramer, the founder of Mott Capital Management.

The video-conferencing group that surged during the pandemic, made a new low on Friday, and “probably isn’t finished falling either, with the following significant support at $76.45 and then $70,” he said.

Here’s his chart, and full blog post.

Mott Capital

The tickers

These are the top-searched tickers as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

BBBY, |

Bed Bath & Beyond |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

HKD, |

AMTD Digital |

|

APE, |

AMC Entertainment preferred shares |

|

CHPT, |

ChargePoint Holdings |

|

AMZN, |

Amazon.com |

Random reads

Queue actually. Couple meets while waiting to view Queen.

Farmer finds stunning Byzantine-era mosaic while planting olive trees.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

[ad_2]

Source link