[ad_1]

FX markets are susceptible to a range of factors which affect their volatility, and many traders look to tailor their strategies to capitalize on the most volatile currency pairs.

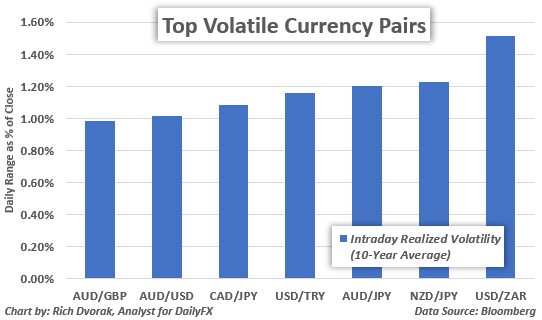

Currency volatility, often measured by calculating the standard deviation or variance of currency price movements, gives traders an idea of how much a currency might move relative to its average over a given time period. Traders can also gauge volatility by looking at a currency pair’s average true range or by looking at range as percent of spot.

The higher the level of currency volatility, the higher the degree of risk, and vice versa. Volatility and risk are usually used as interchangeable terms.Different currency pairs have different levels of volatility on average.

Some traders enjoy the higher potential rewards that come with trading volatile currency pairs. Although, this increased potential reward does present a greater risk, so traders should consider reducing their position sizes when trading highly volatile currency pairs.

What are the most volatile currency pairs?

The most volatile major currency pairs are:

Other major currency pairs, like EUR/USD, USD/JPY, GBP/USD and USD/CHF, are generally more liquid and less volatile as a result. That said, emerging market currency pairs, such as USD/ZAR, USD/TRY and USD/MXN, can clock some of the highest volatility readings.

MOST VOLATILE CURRENCY PAIRS

Majors – AUD/JPY, NZD/JPY, AUD/USD, CAD/JPY, GBP/AUD

Emerging Markets – USD/ZAR, USD/TRY, USD/MXN

Aside from relatively low liquidity, emerging market currencies tend to be highly volatile in particular due to inherent risk underpinning emerging market economies. The chart below gives an example of how volatile emerging market currencies can be, which shows USD/ZAR (US Dollar/South Africa Rand) exploding nearly 25% higher in just over a month’s time. There are several other examples of emerging market currency pairs swinging drastically like this throughout history.

What about the least volatile currency pairs?

The least volatile currency pairs tend to be the major currency pairs which are also the most liquid. Also, these economies tend to be larger and more developed. This attracts more trading volume and facilitates greater price stability in turn. To that end, considering EUR/USD, USD/CHF and EUR/GBP trade with high volumes of liquidity, it comes as little surprise they are among the lease volatile currency pairs.

Illustrated below, the average true range (ATR) on USD/CHF ranges between 45-pips and 65-pips, a low average true range compared to other pairs. The average true range of a currency is one of the many ways to measure the volatility of a currency pair. Bollinger Band width is another popular technical indicator used to measure volatility.

Correlation between two currencies can also have an impact on their volatility. The more positively two currencies are correlated to one another might lead to less volatility. Continuing with our USD/CHF example, we note that the US Dollar and Swiss Franc are both viewed as safe-haven currencies.

The US Dollar and Swiss Franc tend to strengthen against their sentiment-linked peers when the market experiences episodes of risk aversion, but the two currencies may not deviate much from each other. This contributes to relatively low volatility readings for USD/CHF.

How to trade currency pair volatility

Forex traders should take into account current readings of volatility and potential changes in volatility when trading. Market participants should also consider adjusting their position sizes with respect to how volatile a currency pair is. Trading a volatile currency pair might warrant a reduced position size.

Awareness of volatility can also help traders determine appropriate levels for stop loss and take profit limit orders. Furthermore, it is important to understand the key characteristics separating themost volatile currencies from currencies with low volatility readings. Traders should also know how to measure volatility and have an awareness of events that might create big changes in volatility.

The difference between trading currency pairs with high volatility versus low volatility

- Currencies with high volatility will normally move more pips over a certain period than currencies with low volatility. This leads to increased risk when trading currency pairs with high volatility.

- Currencies with high volatility are more prone to slippage than currency pairs with low volatility.

- Due to high-volatility currency pairs making bigger moves, you should determine the correct position size to take when trading them.

There are several ways to measure volatility

To determine the correct position size, traders need to have an expectation of how volatile a currency can be. A variety of indicators can be used to measure volatility like:

Traders can also look at implied volatility readings, which reflect the level of expected volatility derived from options.

Key things traders should know about volatility:

- Big news events like Brexit or trade wars can have a major impact on a currency’s volatility. Data releases can also influence volatility. Traders can stay ahead of data releases by using an economic calendar.

- Volatile currency pairs still obey many technical aspects of trading, like support and resistance levels, trendlines and price patterns. Traders can take advantage of the volatility using technical analysis in combination with strict risk management principles.

- Staying up to date with the latest forex pair news, analysis and rates can help you predict possible changes in volatility. We provide comprehensive trading forecasts to help you navigate the market.

- DailyFX hosts daily webinars to answer questions and help traders prepare for volatile market conditions.

- Supplement your forex learning and strategy development with the DailyFX Education Center.

[ad_2]

Source link