Wine might get better with age, but the market needs youth to survive.

The U.S. wine industry in the past three years has endured devastating wildfires, the pandemic and the ravages of a warning climate. It also faces the threat of irrelevance.

The top consumer group for American wine remains solidly in the category of people above 60 years of age, a population that’s being replaced at a pace of 10,000 a day with younger consumers, according to SVB’s 2023 annual wine industry report.

While direct sales of wine to older people have been growing over roughly the past 15 years (see chart), a more ominous trend has emerged in falling sales to younger age groups, where the industry needs to make headway to stay relevant.

Direct sales of wine to younger people have been falling in most age categories.

Customer Vineyard, Sovos ShipCompliant

The chart shows the share of sales grew 6.5% among people in the 70-to-80 age range since 2007, but fell in three categories of younger people during that same stretch, while edging up only 0.1% among those aged 21 to 30.

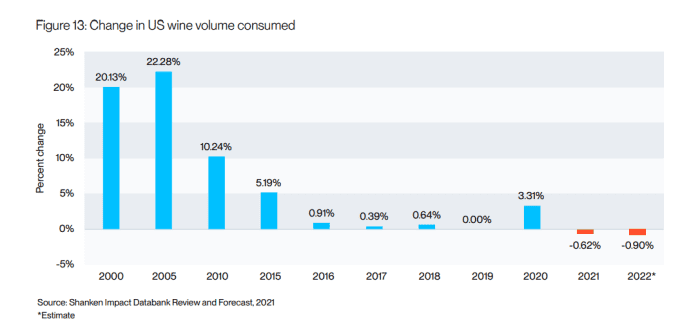

What’s worse, growth in the volume of U.S. wine consumed has been falling for years (see chart below), turning negative in the past two years after a brief 2020 pandemic spike, according to estimates from the Shanken Impact Databank Review and Forecast.

Growth in U.S. wine consumption turned negative in 2021 and 2022, after a brief jump in 2020 during pandemic lockdowns.

Shanken’s Impact Databank and Forecast, 2021

“We can’t just continue to wait,” said Rob McMillan, founder of Silicon Valley Bank’s wine division on Wednesday, about the hope that 21-year-olds will someday become the next big generation of wine buyers, during a virtual talk about the state of the U.S. wine industry.

“Whatever we are doing,” he said, “I would argue we should stop right now.”

The U.S. wine market was last estimated to be worth $83.5 billion, up 6% from a year before, according to Wines Vines Analytics.

SVB’s annual report found that bottles priced at $11 and below accounted for an estimated 73% of total U.S. wine sales, but also that consumers have been abandoning lower-priced wines for higher-quality and more expensive options.

Amy Hoopes, chief revenue officer at The Wine Group, said during the virtual talk that people have been drinking a little less, but opting for better quality wines.

Another suggestion was that wine needs to be marketed to millennials in ways that appeal to their values and lifestyles, instead of mostly focusing on its stable of older, wealthier buyers.

The U.S. wine industry also might want to reconsider advertising budgets, including by thinking about it as a collective, as was the case in the 1980s with federal agricultural “marketing orders,” McMillan said, which helped not only promote American beef and milk, but also gave wine sales a boost for decades.

After all, the beer industry in 2021 accounted for roughly 48% of annual advertising spending for alcoholic beverages, according to the Shanken Impact Databank, whereas wine spending was less than 5%.