[ad_1]

Stubbornly high inflation hasn’t hit every U.S. household in the same way, but renters struggling to keep a roof over their head could see some relief heading in their direction.

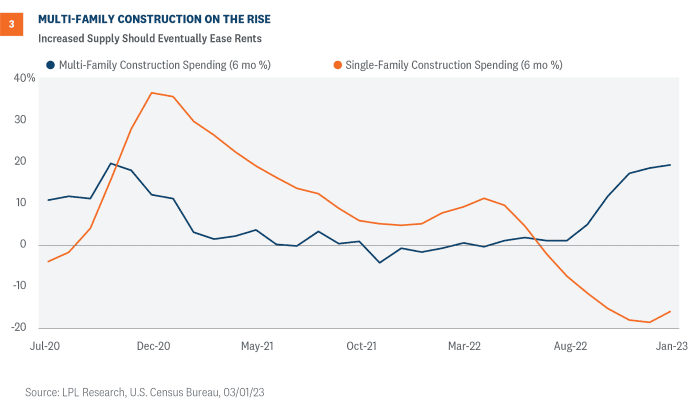

Construction spending on U.S. apartment buildings and condos has surged since last March (see chart), when the Federal Reserve began aggressively raising interest rates to combat high inflation.

Construction on multifamily housing is soaring since the Federal Reserve began raising interest rates from almost zero

LPL Financial, U.S. Census

While construction spending on new U.S. homes over the same stretch has plunged, helping to support prices for existing homeowners, multifamily developers have ramped up construction spending to meet the expected need for rentals in the face of a continued affordability crisis in America for first-time homeowners.

“With a massive amount of spending on multifamily projects, eventually those come online,” Jeffrey Roach, chief economist for LPL Financial told MarketWatch. He said more multifamily supply, including more choices for renters, should eventually lead to lower rents.

“There’s a light at the end of the tunnel for the rental component of inflation,” Roach said.

Fed Chairman Jerome Powell on Tuesday rattled markets with a renewed vow to continue battling inflation until it has been wrestled back toward the central bank’s 2% annual target, while also keeping the door open to a 50 basis point rate hike in March, in the first day of semiannual Congressional testimony.

Roach said that while the Fed’s official inflation readings focus heavily on owner-equivalent rent to gauge shelter costs, not actual market rents, a pipeline of new multifamily properties in need of renters should help individuals with rental costs that have skyrocketed during the pandemic.

The closely followed consumer-price index in January showed the cost of living rose 0.5% for the month, the biggest increased in three months, while the annual rate edged down to 6.4% from 6.5% a month before, a slower pace than many hoped.

As a gauge of actual rents on new leases, The Zillow Observed Rent Index, showed asking rents rose 0.3% in February from January, the first monthly increase in five months to a $1,976 typical monthly rent, even though the 17% annual rent growth recorded in February 2022 appears to have been the peak.

Roach said tracking construction spending serves as a key leading indicator of where supply is headed. He also said that at least a portion of increases in multifamily construction costs since March can be attributed to increased wages, particularly for lower-wage earners helping build properties. Those concerns will keep investors glued to Friday’s jobs data for February, particularly after last month’s report blew past expectations.

See: Powell leaves door open for faster pace of interest rate rises at March meeting

“In pretty much anywhere you look in this economy, there are winners and losers,” Roach said, adding that while rents have surged, the “vast majority of households have fixed-rate mortgages,” keeping them largely immune to the toll of rising shelter costs since the onset of the pandemic in 2020.

While U.S. home sales have sputtered in recent months, with the 30-year fixed rate mortgage climbing back near 7%, lofty pandemic home prices still add up to eye-watering increases in household wealth, at least on paper.

The Urban Institute estimated the total the value of the housing market increased about 75% since the pre-crisis peak in 2006 through the third quarter of 2022, while household equity rose to record $31.4 trillion.

“Remember, these are all aggregate numbers and there is a personal story that’s underneath each data point,” Roach said.

The Dow Jones Industrial Average

DJIA,

shed 574 points Tuesday, while the S&P 500 index

SPX,

fell 1.5% and the Nasdaq Composite Index

COMP,

closed 1.3% lower, according to FactSet.

Related: The bond market’s worst-case scenario isn’t a Fed rate of 6%. It’s this.

[ad_2]

Source link