[ad_1]

Investors always face contradictory forces in the stock market, and this recovery year of 2023 has been marked by a “bad news is good news” mentality, with sentiment directed toward an eventual decline in interest rates. For investors who grew used to better returns in the U.S. during the long bull market that ended last year, the best path forward may be one that is more spread out geographically.

Nicole Kornitzer manages the Buffalo International Fund

BUFIX,

which has a five-star rating (the highest rating) from Morningstar in its “foreign large growth” category. The fund has $594 million in assets under management.

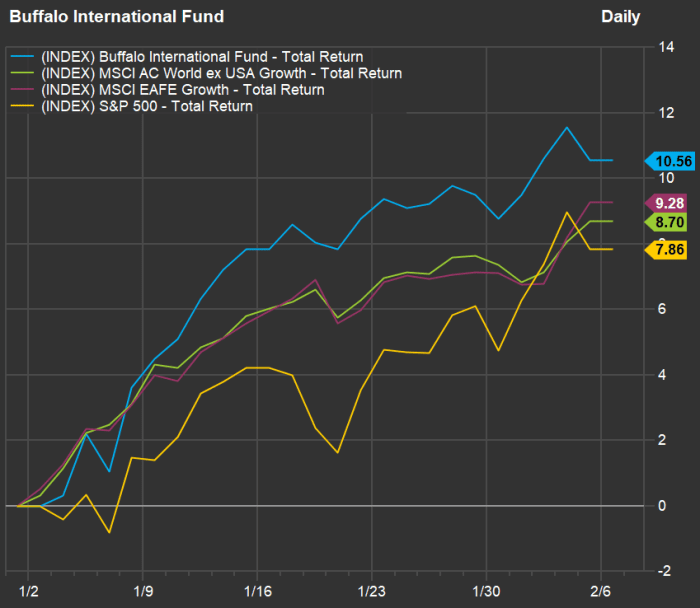

Here’s a look at how the Buffalo International Fund has performed this year through Feb. 3, against two broad non-U.S. indexes and the S&P 500:

FactSet

(All index and stock returns in this article include reinvested dividends.)

Kornitzer described the fund as “index agnostic,” but also said it could be useful to look at the MSCI EAFE Growth Index, which includes large-cap and midcap companies in developed markets outside the U.S. and Canada; and the MSCI ACWI ex USA Growth Index, which includes emerging markets (EM), for comparison.

The Buffalo International Fund, is mainly focused on developed markets outside the U.S. Stocks listed outside the U.S. have been leading a worldwide recovery for prices this year. Many U.S. investors might think their index funds are diversified enough, but having some exposure to stocks listed outside the U.S. might lead to better overall performance, especially as central banks continue to push back against inflation and global supply markets continue their long recovery.

Kornitzer said its exposure to EM is usually not above 8% and is capped at 10%, so the fund might underperform during times of particular strength for EM.

Kornitzer Capital Management, the investment adviser for the Buffalo Funds, is headquartered in Mission, Kan. Founded in 1989 by Kornitzer’s father, John C. Kornitzer, KCM is responsible for about $6.5 billion in assets under management.

Growth with “moats”

Kornitzer said the fund looks for stocks that are attractively priced for long-term growth, focusing on companies that have “strong moats.” This means pricing power or strong relationships with customers to protect against economic downturns.

For tech-oriented companies, she also emphasized the “stickiness” of a business — that is, how difficult it might be for a corporate customer to switch to a competing technology and retrain its staff. She also stressed the importance of research and development, for the companies she invests in to maintain these advantages.

Here are some examples of stocks Kornitzer favors now:

STMicroelectronics

STMicroelectronics N.V.

STM,

STM,

is based in Geneva and makes circuits for auto and smartphone manufacturers, as well as other industrial customers. The stock has been on quite a tear in 2023, returning 36% so far, following a 15% decline last year.

Kornitzer said STM has an advantage in silicon carbides, which she calls “the next tech in semiconductors” that is being adopted already by makers of electric vehicles, including Tesla Inc.

TSLA,

one of STM’s customers. She said the company’s sales of silicon carbides totaled about $700 million in 2022 and were expected to increase to about $1 billion in 2023. She added that STM’s management expects to capture a third of the silicon carbide market as it expanded to annual sales of about $10 billion by 2030.

Nicole Kornitzer, portfolio manager of the Buffalo International Fund.

Kornitzer Capital Management

Kornitzer called the semiconductor industry “wonderful,” because the use of chips in electric vehicles “will be a multiple” of what is used today for cars and trucks with internal combustion engines.

She also said that STM is trading at a forward price-to-earnings ratio of 13, based on the consensus 2024 earnings estimate among analysts polled by Bloomberg. This is “at the low end of historic multiples,” she said, probably reflecting the weakness in smartphone sales. But over time, she likes the stock for improved free-cash flow as the silicon carbide market expands, and shorter-term, as the phone market recovers.

Renesas

Kornitzer called Renesas Electronics Corp.

6723,

of Japan

RNECY,

“a real bargain,” with a forward price-to-earnings ratio of 8, based on the Bloomberg consensus earnings estimate for 2024.

She liked Renesas long-term because of the company’s expansion of its semiconductor offerings beyond microcontroller chips to include power management as well, in order to offer “an integrated power solution” that improved profit margins and the ability to retain customers.

LVMH Moet Hennessy Louis Vuitton SE

LVMH Moet Hennessy Louis Vuitton SE

MC,

had a volatile 2022, with shares sliding as much as 31% through mid-June, before recovering to end the year with a 10% decline. So far in 2023, the stock is up 23%.

Kornitzer liked the company as a long-term play on the growing number of affluent people around the world. When asked about a possible decline in luxury purchases during a time of economic uncertainty, she said LVMH would continue to have pricing power because of the demand for its brands, which include Tiffany, Christian Dior, Fendi and many others, noting its “ability, in the face of a downturn, to cut costs.”

“LVMH is very good at keeping their brands on top. And they generate free-cash flow to continue buying brands,” she said, adding that the company’s purchase of Tiffany has ended up well, because they “elevated it” and improved its profit margins.

Merk KGaA

According to Kornitzer, all three divisions of Merk

MRK,

are “backed by nice, long-term secular growth trends.” The divisions are pharmaceutical: medications to treat cancer, multiple sclerosis and infertility; life sciences, which makes equipment used to make biopharmaceuticals; and performance materials, which makes chemicals used in the semiconductor industry.

She said financial comparisons in 2022 were difficult because of reduced revenue tied to the Covid-19 pandemic, as well as the pressure in the semiconductor industry.

Looking ahead, she said she expects improvement, with “new pipeline products for health care” at the end of the year. This means she expects earnings estimates to be too low heading into 2024. Upward revisions from analysts can support higher share prices.

Hexagon

Hexagon AB

HEXA.B,

of Sweden provides services and equipment used in high-tech manufacturing. Some of the trends the company is tied to include the use of artificial intelligence for manufacturing quality control.

According to Kornitzer, about 40% of the company’s revenue is recurring, and continual acquisitions of software businesses that can be integrated into its services “have improved margins over time,” while stabilizing the business and increasing cash flow.

Top holdings

Here are the largest 10 holdings (out of 80) of the Buffalo International Fund as of Dec. 31:

| Company | Ticker | Country | % of portfolio |

| Linde PLC |

LIN, |

U.K. | 2.8% |

| Aon PLC Class A |

AON, |

Ireland | 2.4% |

| Merk KGaA |

MRK, |

Germany | 2.3% |

| Schneider Electric SE |

SU, |

France | 2.2% |

| Ashtead Group PLC ADR |

ASHTY, |

U.K. | 2.1% |

| Hexagon AB Class B |

HEXA.B, |

Sweden | 2.0% |

| ICICI Bank Ltd. ADR |

IBN, |

India | 2.0% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR |

TSM, |

Taiwan | 2.0% |

| Thales SA |

THLEF, |

France | 2.0% |

| AstraZeneca PLC |

AZNCF, |

U.K. | 1.8% |

| Source: FactSet | |||

Click the tickers for more about each company.

Most of the stocks on the list have the local tickers where they are listed. Linde PLC

LIN,

LIN,

will be delisted from the Frankfurt stock exchange on Feb. 27 because of a company reorganization, but the stock will continue to be traded on the New York Stock Exchange under the ticker LIN.

[ad_2]

Source link