[ad_1]

Hello! This is MarketWatch reporter Isabel Wang bringing you this week’s ETF Wrap. In this week’s edition, we look at ETF strategies that have exploded in popularity in 2023, and whether they will continue to gain momentum in the year ahead.

Please send tips or feedback to isabel.wang@marketwatch.com or to christine.idzelis@marketwatch.com. You can also follow me on X at @Isabelxwang and find Christine at @CIdzelis.

Sign up here for our weekly ETF Wrap.

U.S. exchange-traded funds have had a strong 2023, attracting around $580 billion in net inflows with assets climbing to a record $8.1 trillion as of December 27, according to FactSet data.

ETFs tracking the large-cap benchmark S&P 500 index

SPX,

which has risen 24.6% this year, have seen the strongest net inflows in 2023 among the nearly 700 funds MarketWatch tracks, according to FactSet data.

The SPDR S&P 500 ETF Trust

SPY,

the world’s largest and oldest ETF with $493 billion assets under management, has recorded the largest net inflows of over $47 billion this year to date, followed by the Vanguard S&P 500 ETF’s

VOO

$41 billion and the iShares Core S&P 500 ETF’s

IVV

$36 billion over the same period, according to FactSet data.

In terms of year-to-date performance, technology-related stock funds have shown a remarkable turnaround in 2023 after facing a tumultuous bear market the year before. Some of the ETFs tracking the tech-heavy Nasdaq 100 index

NDX

as well as semiconductor stocks are on pace to finish 2023 with gains of more than 50%, thanks to the rise of the “Magnificent Seven” stocks.

The Fidelity Blue-Chip Growth ETF

FBCG

has jumped 58.7% in 2023 to become the best-performing U.S. fund, excluding ETNs and leveraged products, according to FactSet data. The WisdomTree U.S. Quality Growth Fund

QGRW

is up 56.2% this year, while the Invesco QQQ Trust Series I

QQQ

has risen 55.6% in 2023. Gains in all of these funds were fueled by a massive rally in mega-cap technology stocks such as Apple Inc.

AAPL,

and Nvidia Corp.

NVDA,

which have surged 49% and 239% this year, respectively, according to FactSet data.

Will these ETF strategies continue to thrive in 2024? Will others emerge to deliver greater returns next year? Here’s how one CFRA ETF analyst sees things shaping up in the new year.

Tech-driven growth ETFs will continue to stand out in 2024

The recent strong performance of technology and growth-driven ETFs is likely to continue in 2024, although with higher volatility, according to Aniket Ullal, senior vice president and head of ETF data and analytics at CFRA.

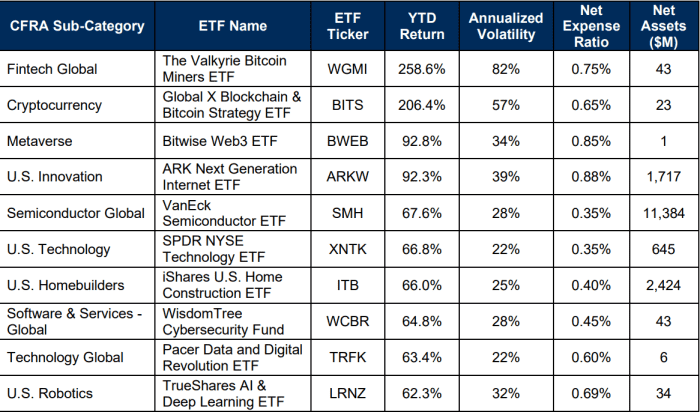

The table below summarizes the best performing ETF sub-categories in 2023, excluding leveraged and inverse ETFs. The best ETF sectors have featured tech- and growth-related themes like fintech, cryptocurrency, semiconductors, software and the metaverse. “These themes are very likely to continue to have a strong year in 2024,” said Ullal.

SOURCE: CFRA ETF DATABASE, DATA AS OF DECEMBER 18, 2023

One concern for investors is whether ETFs linked to technology sectors can continue to appreciate in 2024. But CFRA’s analysts think that some of the largest tech firms have strong balance sheets and cash flows, so they should be “safe havens” with “a growth tilt” next year.

“Despite the AI-driven recent run-up, the tech sector is still growing into its multiple, and ETFs like the Technology Select Sector SPDR Fund

XLK

do not yet have frothy multiples,” Ullal said in a Friday client note.

See: ‘Magnificent Seven’ up for another bull run? What to expect from technology stocks in 2024.

Meanwhile, the massive amounts of cash parked at U.S. money-market funds could also keep the bull-market rally chugging along next year.

As of December 20, there was still $5.9 trillion sitting in U.S. money-market funds, according to data compiled by the Investment Company Institute. But given the stock-market rally in 2023 and the “likely pivot” to interest-rate cuts next year by the Federal Reserve, Ullal and his team see investors moving money out of cash-like instruments and migrating back to 60/40 portfolios by increasing their equity exposure next year, he wrote.

Continued growth in options-based ETFs

ETFs using options-based strategies, such as covered-call ETFs or defined-outcome ETFs, have exploded in popularity in 2023. They have “long-term staying power” in sustaining investor interest in the year ahead, said Ullal.

Specifically, the largest U.S. covered-call ETF, the $31 billion JPMorgan Equity Premium Income ETF

JEPI,

has seen $13 billion in net inflows so far this year and is among the top-five funds attracting the most capital in 2023, according to FactSet data.

A covered-call ETF, or an option-income ETF, is a fund that uses an options strategy called covered-call writing to generate income through collecting premiums. In a covered-call trade, investors sell a call option on an asset they hold, which gives the buyer of the option the right, not the obligation, to purchase the asset from them at a specified “strike” price on or before a certain date.

When the price of the asset goes down and doesn’t reach the “strike” price before the expiration date, the call option will expire as buyers walk away, but investors could still keep the premium as their payout.

That’s why the covered-call strategy usually performs well in a sideways or choppy market environment, because investors will be compensated for giving up the upside in stocks with a higher options premium.

More on covered-call ETF: This type of ETF is designed to hedge against volatility and help investors navigate a stormy stock market

Ullal attributed the growing popularity of options-based ETFs to the success of JEPI as well as ETF firms relentlessly expanding their covered-call and buffer-ETF suites in 2023, even though these strategies tend to underperform in a rapidly rising stock market.

“The flows are probably moderate [in 2024] relative to what we’ve seen so far, but I don’t think the flows will be negative or this category will go away,” Ullal said in a follow-up interview with MarketWatch on Thursday. “What’s happening is there are investors who are willing to trade off or sacrifice some [stock] performance for income or downside protection.”

With that backdrop, Ullal sees options-based ETF strategies continuing to grow in 2024, though they will be put to the test if the current bull-market trend continues.

Emerging-markets ETFs without China-related drag

ETF investors may want to “unbundle” their emerging-market exposure by reconsidering China-related assets in their ETF portfolios, according to Ullal.

Having a high exposure to China in emerging-market holdings was challenging for ETF investors in 2023, as China significantly underperformed other emerging markets this year due to a slower-than-anticipated post-Covid economic recovery, weakness in the country’s property sector and geopolitical tensions with the U.S., Ullal said.

China exposure in two of the most popular emerging-market ETFs, the Vanguard FTSE Emerging Markets ETF

VWO

and the iShares Core MSCI Emerging Markets ETF

IEMG,

stands at 31% and 24.4%, respectively, according to FactSet data. In turn, VWO has risen 8.3% this year, while IEMG has climbed 10.7% in 2023.

Meanwhile, the SPDR S&P China ETF

GXC

has slumped 12.8% year to date, per FactSet data. But the iShares MSCI Emerging Markets ex China ETF

EMXC,

which has no China exposure, has advanced 18.9% over the same period.

One option for investors would be to calibrate their exposure by combining emerging-market ex-China ETFs like EMXC with China-focused ETFs, Ullal said.

Alternatively, investors could construct the EM sleeve of their portfolios with country-specific ETFs, or use active ETFs like the KraneShares Dynamic Emerging Markets Strategy ETF

KEM,

as that fund’s China exposure is dynamically adjusted based on fundamental, valuation, and technical signals, he added.

Rising demand and competition in active bond ETF category

The U.S. fixed-income ETF sector is dominated by funds passively tracking Treasury bonds like the 10-year Treasury note

BX:TMUBMUSD10Y,

which has seen declining yields lately as discussions around the Fed’s interest-rate path, and a possible pivot to rate cuts, continue to take center stage heading into 2024.

But MarketWatch reported last week that demand for active bond ETFs has picked up, with Vanguard launching two new active bond funds earlier this month. The desire for active bond ETFs among the firm’s clients has grown significantly over the past two years, John Croke, Vanguard’s head of active fixed-income product management, told MarketWatch.

Meanwhile, the firms that dominate the indexed and active bond ETF categories are different, Ullal noted. In the indexed bond ETF category, Vanguard competes with traditional rivals BlackRock and State Street, while in the active bond ETF category where it is now expanding its footprint, Vanguard is competing with managers like JPMorgan, First Trust and PIMCO.

“This competition will put pressure on the incumbent players, but will be good for investors, and will be an important trend to watch in the next year,” said Ullal.

As usual, here’s your look at the top- and bottom-performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Top Performers | %Performance |

|

AdvisorShares Pure U.S. Cannabis ETF MSOS |

12.7 |

|

Amplify Transformational Data Sharing ETF BLOK |

10.5 |

|

SPDR S&P Biotech ETF XBI |

9.9 |

|

ARK Genomic Revolution ETF ARKG |

8.3 |

|

ARK Innovation ETF ARKK |

6.4 |

| Source: FactSet data through Wednesday, Dec 27. Start date Dec 21. Excludes ETNs and leveraged products. Includes NYSE-, Nasdaq- and Cboe-traded ETFs of $500 million or greater. | |

…and the bad

| Bottom Performers | %Performance |

|

iMGP DBi Managed Futures Strategy ETF DBMF |

-2.9 |

|

Vanguard Total International Bond ETF BNDX |

-2.2 |

|

iShares 20+ Year Treasury Bond BuyWrite Strategy ETF TLTW |

-2.1 |

|

VanEck BDC Income ETF BIZD |

-1.2 |

|

Vanguard Short-Term Inflation-Protected Securities ETF VTIP |

-1.2 |

| Source: FactSet data | |

New ETFs

- TCW Group filed to convert its TCW Artificial Intelligence Equity Fund TGFTX into the TCW Artificial Intelligence ETF, and is seeking to convert its TCW New America Premier Equities Fund TGUSX into the TCW Compounders ETF, according to the fund’s prospectus filed with the Securities and Exchange Commission on Tuesday.

Weekly ETF Reads

[ad_2]

Source link