[ad_1]

Still reeling from Fed Chairman Jerome Powell’s higher-for-longer remarks last week, riskier asset like equities look set for another battering, on Monday.

“You can’t have the stock market collapse over 5% on the words of one man,” grumbled FWDBONDS ‘ chief economist Chris Rupkey, who sees a major credibility problem for the central bank. “Fed officials set the inflation fire ablaze with too much QE and now they say they know what to do now that inflation is out of control. No one believes that.”

And as we head into the worst calendar month for Wall Street, economists expect more hawkishness out of the Fed, and say a strong jobs report on Friday will only shore up rate-hiking resolve.

So where are the havens? Dividend stocks, the front end of credit markets and Latin American currencies and bonds are just some of the suggestions floating around.

Our call of the day from Goldman Sachs offers another. They see a buying opportunity via a recent soft patch in commodities and reduce risk elsewhere. They see equities threatened by sticky inflation and a potentially hawkish Fed surprise.

Commodities are “the best asset class to own during a late-cycle phase where demand remains above supply. Physical fundamentals signal some of the tightest markets in decades,” said a team led by senior commodities strategist Sabine Schel in a new note.

Goldman Sachs

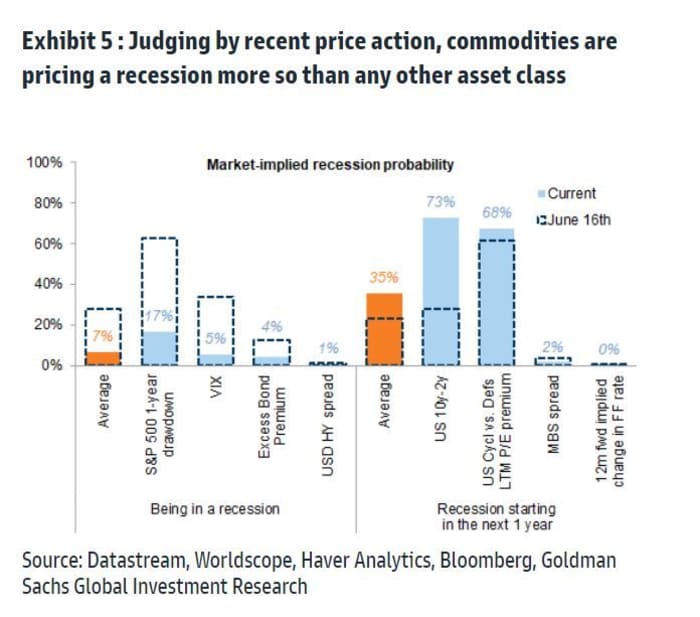

The recent pullback in agricultural and industrial commodities was due to a global recession being priced in by traders. Recession fears have had more of an impact on commodities than on any other asset class, Goldman said. However, the bank believes a recession will be mostly confined to Europe, with the U.S. and China avoiding one.

Goldman Sachs

It’s a matter of just not enough commodities to go around, they say.

“As further inventory falls trigger depletion risks, commodity returns for investors are likely to strengthen. Put differently, with the risk of inventory exhaustion significantly greater than the risk of an imminent global economic recession in our view, we believe commodity index backwardation should steepen,” said Schels.

Backwardation refers to futures prices tied to a given commodity trading higher than the current spot price.

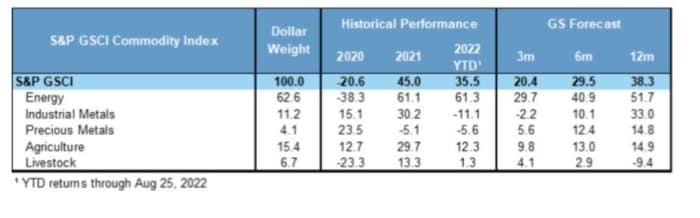

In keeping with this view, Goldman has raised its forecasts for the S&P GSCI commodity index on a 12-month basis to 38.8%. The bank also sees 12-month returns of 51.7% for the energy sector.

Goldman Sachs

Goldman says drivers for this commodity run will be “micro in nature as further price spikes are required to bring demand back in line with supply in the absence of inventories,” adding that those spikes will create “extreme” bouts of backwardation.

“In 2000 or [2007-2008], for instance, the depletion of inventories shifted oil markets into a highly volatile pricing regime where extreme price spikes generated substantial backwardation. Even in the absence of significant price appreciation, this can produce exceptionally high returns for investors,” said Goldman.

And while backwardation has been most commonly seen in energy, the Goldman team sees it spreading to base metals, notably copper, corn and soy where volatility is likely to increase.

Specifically, despite strong year-to-date returns, they see energy and agriculture leading. “With oil the commodity of last resort in an era of severe energy shortages, we believe the pullback in the entire oil complex provides an attractive entry point for long-only investments.”

A McKinsey report recently highlighted a worsening situation for global food supply in 2023, owing to war in one of the world’s breadbasket — Ukraine — and climate change. The USDA’s recent corn report downgraded next year’s yield.

Read: There’s a new supercycle emerging for the economy, and these are the stocks that would benefit

The markets

Stock futures

ES00,

NQ00,

are underwater, the 2-year Treasury yield

TY00,

TMUBMUSD02Y,

is at a level not seen since 2007, the dollar

DXY,

is climbing and gold

GC00,

is down. Oil

CL.1,

is slightly higher, while natural-gas prices

NG00,

are surging. Asian and Europe stocks are following Wall Street’s lead and bitcoin

BTCUSD,

has dropped under $20,000.

The buzz

After Powell’s market-shattering remarks, expect lots of focus on data. Monday is quiet, but the rest of the week will bring consumer confidence, the latest Institute for Supply Management index, and most important payrolls data on Friday. New York Fed President John Williams is among a handful of Fed speakers expected this week.

Pinduoduo

PDD,

is soaring after the China based agricultural company that connects consumers to producers reported surging revenue and profit.

Best of the web

‘Climate catastrophe’ in Pakistan as floods kill more than 1,000, wipe out crops

UN nuclear watchdog monitors are finally on the way to the Zaporizhzhia plant

The chart

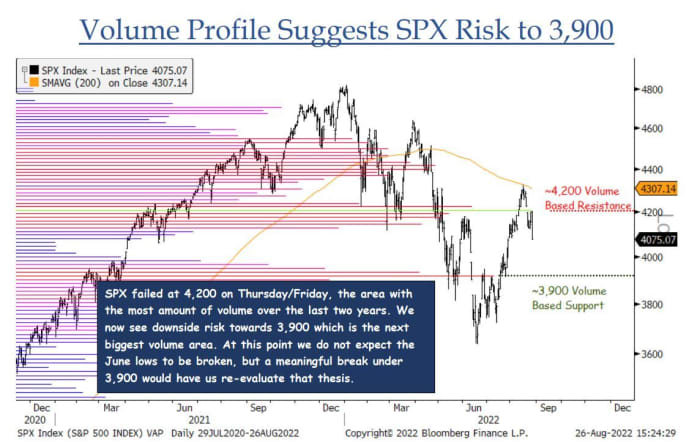

After the S&P 500 failed late last week at 4,200, which has seen the most volume in the last two years, all eyes are on 3,900, Jonathan Krinksy, chief market strategist at BTIG, tells clients.

“While we remain cautious near-term, we think the June lows will hold as weakness under 4,000 should see sentiment and positioning get bearish enough to create a decent entry point heading into the fourth quarter,” he said. But if that breaks, they will be tearing up the playbook a bit, he says.

BTIG

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

APE, |

AMC Entertainment preferred shares |

|

AAPL, |

Apple |

|

NIO, |

NIO |

|

NVDA, |

Nvidia |

|

AMZN, |

Amazon |

|

BABA, |

Alibaba |

Random reads

Activists mourn ‘man in the hole,’ the last of his Brazilian Amazonian tribe

NASA’s new moon rocket ready for liftoff on Monday

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

[ad_2]

Source link