[ad_1]

One of the stories for markets this year has been the outperformance of European stocks relative to U.S. ones.

Through Thursday, the S&P 500

SPX,

has gained 7% in 2023, compared with a 10% advance for the Vanguard FTSE Europe ETF

VGK,

Analysts at Goldman Sachs say the outperformance can continue, and one reason is highlighted in this chart.

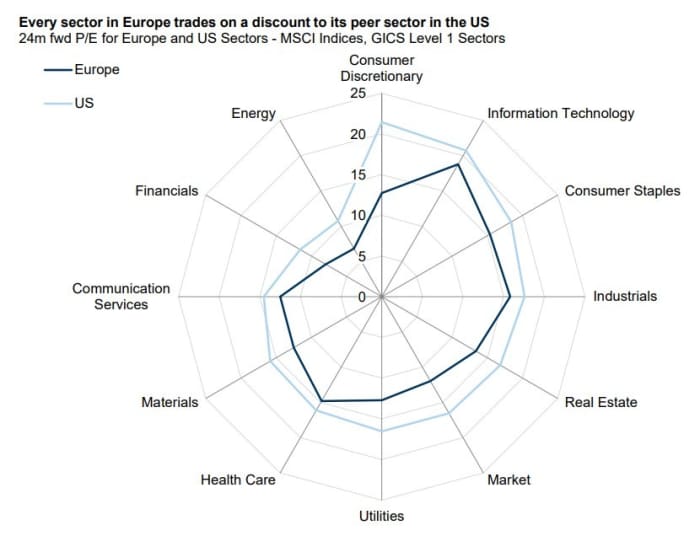

The U.S. market is led by technology stocks, which are relatively scarce in Europe, but every single sector trades more cheaply in Europe than in the U.S.

Goldman Sachs/FactSet

The Goldman strategists say what they call GRANOLAS — the grouping of GSK

GSK,

Roche

ROG,

ASML

ASML,

Nestlé

NESN,

Novartis

NVS,

Novo Nordisk

NVO,

L’Oreal

OR,

LVMH

MC,

AstraZeneca

AZN,

SAP

SAP,

and Sanofi

SNY,

— are enjoying premium margins, while the margins of U.S. megacap stocks have come under pressure.

The GRANOLAS account for 23% of the market cap of the Stoxx Europe 600, while Facebook parent Meta Platforms, Amazon, Apple, Microsoft and Google parent Alphabet account for 18% of the S&P 500.

[ad_2]

Source link