[ad_1]

A sigh of relief is billowing around Wall Street, for now, with stocks higher after CPI data showed some ease in inflationary pressures.

A too-hot number may have been too much for investors to handle as they watch for further fallout from SVB and Signature Bank collapses and ensuing stress on the financial sector. And some are indeed warning of that.

JPMorgan’s Marko Kolanovic, told clients on Monday that many carry trades — basically borrowing at a lower interest rate and investing in one that offers higher return — that have developed during cheap financing “can’t all be bailed out.” Commercial real estate, auto loans, levered loans and credit cards among others, are all potential worry zones, said the strategist.

Onto our call of the day from Stock Traders Daily and portfolio manager at Equity Logic, Thomas H. Kee Jr., who in January warned about fallout for markets from liquidity leaving the financial system thanks to Fed tightening that could upset markets in 2023.

Kee has talked about similarities between current markets and 2019. A crisis emerged in the latter part of that year as big banks questioned liquidity levels amid a Fed drain, which led to a surge in overnight lending rates and ultimately required massive injections by the Fed to steady markets at the time.

In a fresh interview, Kee says his concerns are now materializing about a repeat of liquidity-linked stress, though he fears risks are much higher now. “This time, the FOMC does not have stimulus as a tool, at least not like it did back in 2019,” he said.

And he also doesn’t see the current crisis as finished playing out. “This is a sign, a precursor to a much more serious decline…and investors need to have something that controls risk. They should not wait until it is obvious to get it done. That would be way too late,” said Kee.

“Once an investor prepares his portfolio so that it can handle anything that happens, he won’t ever need to change,” he adds.

His big message is that investors must “simplify” their portfolios. The first step, he said, is to ascertain which market their portfolio tracks, whether it be the Nasdaq

COMP,

the S&P 500

SPX,

the Dow industrials

DJIA,

or the Russell 2000

RUT,

“Then use the ETFs [exchange-traded funds] for those markets to efficiently manage risk,” such as the SPDR S&P 500 ETF Trust

SPY,

Invesco QQQ Trust Series

QQQ,

ProShares Ultra S&P 500

SSO,

ProShares UltraShort S&P 500

SDS,

ProShares UltraShort QQQ

QID,

and ProShares Ultra QQQ

QLD,

Not without risk of course, Ultra ProShares are leveraged ETFs that magnify the performance of the stock market. The above magnify once or twice, which is as risky as Kee said he would get.

The simplest way he said is to just “sell all existing stocks and ETFs, buy SPY with 100% of the portfolio. Then, when risk-signals come, sell it all. That creates a completely protected portfolio,” he said.

That’s also the most nimble option, using the most liquid instrument available, completely cutting out market risk at times, and the emotional factors, said Kee, though he adds that that may not be the best solution for taxable accounts.

Kee points to his CORE investment approach, which he says has been working for clients during these volatile times(see more here). “The portfolio is a simple as it can get. SPY is the most liquid equity instrument in the world, and that makes it even better. CORE tracks the S&P 500 when it is exposed and it does not have market risk when it is neutralized,” he said.

His CORE strategy was in cash all last week, said Kee, protecting from the rout seen for stocks. The strategy has gained over 20% year to date, he said. The S&P 500 has dropped 4% over the last three months.

Read: Banking industry jitters could mean more pain for stocks by dragging out Fed’s battle with inflation

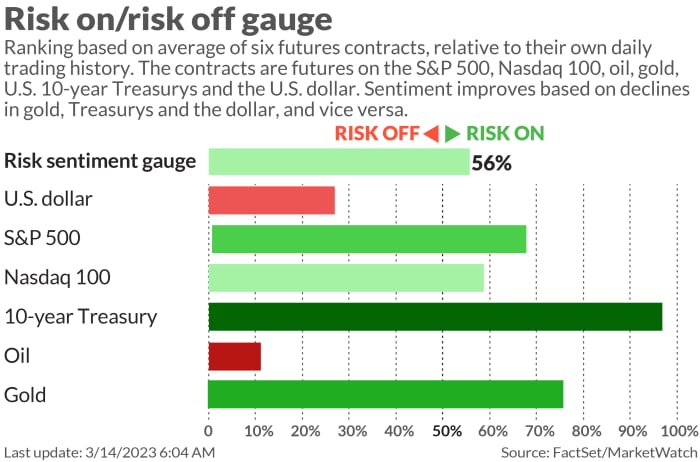

The markets

Stocks

DJIA,

COMP,

have opened higher as banks rebound and CPI data largely met forecasts. The 2-year Treasury note

TMUBMUSD02Y,

has surged 31 basis points following the biggest one-day plunge since 1987. The dollar

DXY,

is barely up after three days of selling, but oil

CL.1,

continues to drop on SVB-fueled recession worries.

Asia had an ugly session with financials getting hit hard in Japan — Mitsubishi UFJ Financial

8306,

MUFG,

fell more than 7% as government bond yields

TMBMKJP-02Y,

slumped. Bitcoin

BTCUSD,

is up another 0.5% to $24,248.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

U.S. consumer prices rose 0.4% in February, meeting forecasts, though core prices came in slightly higher at 0.5%. The annual rate slowed to 6% from 6.4% and to 5.5% from 5.6% on the core side. Fed fund futures are now predicting an 88% chance of a March quarter-point hike.

More bad news from the tech sector as Facebook parent Meta

META,

says it’s cutting 10,000 more jobs and cancelling 5,000 job listings. Shares are up.

Moody’s Investors Service has put six regional U.S. banks under review for downgrades — First Republic

FRC,

Intrust Financial Corp. , UMB Corp.

UMBF,

Zions Bancorp

ZION,

Western Alliance

WAL,

and Comerica

CMA,

And: After Silicon Valley Bank collapse, startups describe ‘roller coaster of emotions’

Read: Regional banks are seeing flight of deposits to too-big-to-fail megabanks

GitLab shares

GTLB,

are down 30% after the code-hosting platform’s revenue forecast fell short of expectations.

United Airlines shares

UAL,

are off 7% after guiding for a quarterly loss as it saw weaker Jan.-Feb. travel demand and higher fuel prices.

Univar stock

UNVR,

is up 14% as chemical company got a $8 billion buyout by Apollo Global Management.

Cvent

CVT,

says it has agreed to be bought by Blackstone in a $4.6 billion deal. Shares of the events technology platform were halted in premarket trading.

AMC Entertainment’s Preferred Equity

APE,

units are up 7% as investors wait for a key shareholder vote from the theatre chain owner that may allow the company to raise capital.

Momentive Global stock

MNTV,

is up 19% on news the SurveyMonkey maker is being acquired by private-equity firm Symphony Technology Group LLC for $1.5 billion.

Uber

UBER,

Lyft

LYFT,

and DoorDash

DASH,

have emerged victorious in their California battle to keep treating drivers as independent contractors.

Best of the web

‘The spirit of Dodd-Frank is dead.’ Regulators swore off bailouts, until they didn’t.

A U.K. biotech is using bacteria to dye fabrics and cutting fashion waste.

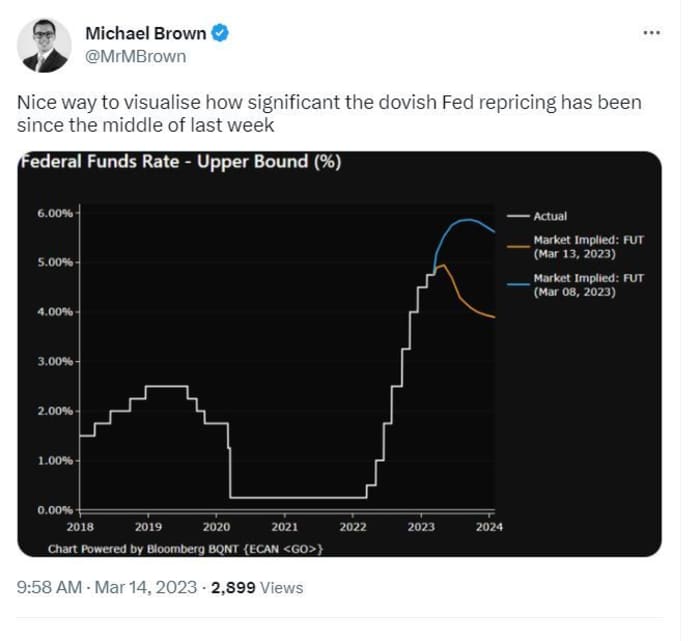

The chart

@MrMBrown

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

FRC, |

First Republic Bank |

|

BBBY, |

Bed Bath & Beyond |

|

AMC, |

AMC Entertainment Holdings |

|

SIVB, |

SVB Financial Group |

|

GME, |

GameStop |

|

WAL, |

Western Alliance Bancorp |

|

AAPL, |

Apple |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

TRKA, |

Troika Media |

Random reads

Former Treasury Secretary Larry Summers gets dragged on the internet after opining on SVB’s collapse.

Texas woman wakes from surgery with three different foreign accents — a rare syndrome.

Bali is banning misbehaving tourists on motorbikes.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch

writers.

[ad_2]

Source link