[ad_1]

There’s a lot of analysts who say stocks, in the tech sector in particular, have priced in too much enthusiasm this year. Count Josh Wolfe, co-founder and managing partner of Lux Capital, among them. Through Thursday, the S&P 500

SPX,

is up 5% this year, and the tech-heavy Nasdaq Composite

COMP,

has gained 11%.

In its quarterly letter to investors that Wolfe posted on Twitter, the firm warns that investors might not be properly discounting the serious risks of massive misallocation and excess indebtedness.

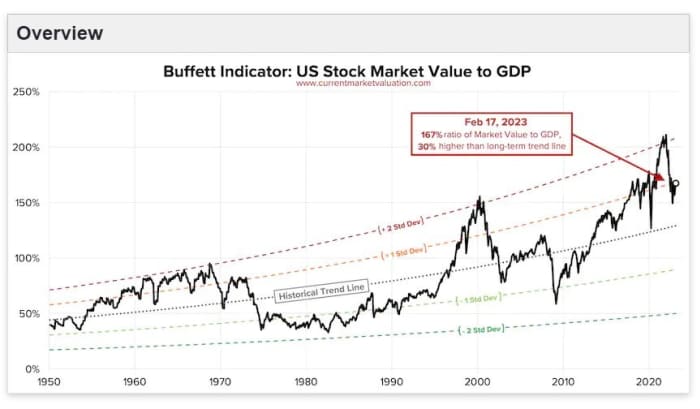

The fund points out that the ratio between S&P 500 market cap and GDP — a simple ratio made famous by Warren Buffett — might have 30% or more to fall in order to revert to trend. The cyclically adjusted price-to-earnings ratio is at 29 times, which also would have to fall 30% to return to its historic trend. The 2-year to 10-year spread is inverted, and sitting at the highest levels since the 1980s.

CurrentMarketValuation.com

The fund says this heralds the hangover from the excess in recent years. “Rising rates means falling price-earnings multiples, falling tech spending and thus falling earnings. Unsurprisingly, labor is the logical and first target for cost-cutting to cushion the double blow of falling ratios (P/E) and rationing (customer spending),” fund writes.

Also read: More than 107,000 tech-sector employees have lost their jobs since the start of 2023

Their view is what has hit tech is coming for others. “While blue-collar work has seen high demand, it may be a trailing indicator from post-COVID reopenings when middle-and-upper-class demand exceeded labor supply. As layoffs metastasize from white to blue, the pain in the next two years will be disproportiontely felt by the worst off amongst us, sowing the sweeds for social unrest,” the fund says.

From an investment perspective, interests emerge out of conflicts, and right now the battleground is emerging in artificial intelligence. The big tech giants like Amazon

AMZN,

Microsoft

MSFT,

and Alphabet’s Google

GOOGL,

want to monetize their computing power, but given the costs to train a foundational AI model, Lux sees a shift among entrepreneurs and developers to a decentralized network, akin to what has been built in the crypto frenzy.

“The supply of highly advanced computational clusters once used for bitcoin mining is being repurposed toward the new demand for training open-source AI models,” the firm says, adding it’s invested in a key player “that will come out of stealth soon.”

Lux also is an investor in Hugging Face, which hosts AI models; RunwayML, a machine-learning tool for artists; and MosaicML, which provides infrastructure and software tools for machine learning.

One bellwether for where the world is headed: Chinese President Xi Jinping, the fund says. As vice president under Hu Jintao, XI signaled support for building up tech behemoths in e-commerce, social media, mobile, payments, edtech, delivery and logistics — and now is sanctioned hard sciences and deep tech: biotech, aerospace, defense, space, satellittes and semiconductors. Xi has ushered in a focus from Made in China to invented in China, “and global capital will be wise to competitively follow his hints.”

[ad_2]

Source link