[ad_1]

Bond yields were little changed early Wednesday as traders waited for minutes from the Federal Reserve’s end of January meeting to be published.

What’s happening

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

dipped 2.9 basis points to 4.589%. Yields move in the opposite direction to prices. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

fell less than 1 basis point to 4.274%. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

was unchanged at 4.543%.

What’s driving markets

Investors were eschewing bold bets ahead of the release at 2 p.m. Eastern of the minutes from the Federal Reserve’s policy meeting that concluded on Jan. 31.

Benchmark 10-year Treasury yields have in recent weeks moved toward the top of a three-month range of roughly 3.8% to 4.3% after firmer-than-expected inflation and jobs data encouraged Fed officials to indicate rate cuts were unlikely to begin in March.

Analysts expect the new minutes to reflect that stance.

There also are a number of Fed officials speaking on Wednesday, including Atlanta Fed President Raphael Bostic who will deliver opening remarks at 8 a.m. Eastern, Richmond Fed President Tom Barkin who will be interviewed on SiriusXM radio at 9:10 a.m., and Fed Gov. Michelle Bowman who will make comments at 1 p.m.

Markets are pricing in a 93.5% probability that the Fed will leave interest rates unchanged at a range of 5.25% to 5.50% after its next meeting on March 20th, according to the CME FedWatch tool.

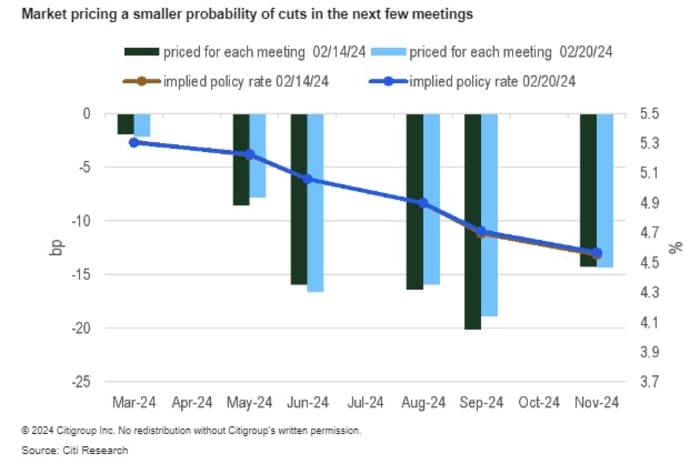

The chances of at least a 25 basis point rate cut by the subsequent meeting in May is priced at 37.2%, down from 84.7% a month ago. The central bank is expected to take its Fed funds rate target back down to around 4.5% by December 2024, according to 30-day Fed Funds futures.

The Treasury will auction $16 billion of 20-year notes at 1 p.m.

Source: Citi

What are analysts saying

“We continue to expect the first 25 basis point Fed rate cut in June, similar to what markets are pricing,” said the economics team at Citi led by Andrew Hollenhorst.

They said strong jobs and elevated inflation make it difficult to justify lowering rates before then, and that stance will be reflected in the minutes. Eventually, however, lower year-on-year core PCE readings may be enough to convince Fed officials to cut, even if activity holds up.

[ad_2]

Source link