[ad_1]

U.S. stock futures dipped on Monday as bulls paused for breath after their recent summer stampede.

How are stock futures trading

-

Futures on the Dow Jones Industrial Average

YM00,

-0.61%

fell 156 points, or 0.5%, to 33,562. -

S&P 500 futures

ES00,

-0.65%

fell 20 points, or 0.5%, to 4,261. -

Nasdaq 100 futures

NQ00,

-0.44%

eased 42.50 points, or 0.3%, to 13,535.25.

The S&P 500

SPX,

advanced 3.3% last week, its fourth straight weekly gain and longest such winning streak since November. The Dow

DJIA,

rose 2.9% last week, while the Nasdaq Composite

COMP,

gained 3.1%.

What’s driving markets

Stocks were struggling to maintain upward momentum after a strong run that saw the S&P 500 record a four-week winning streak that delivered its best percentage advance for such a period since November 2020.

Similarly, the tech-heavy Nasdaq Composite sits near a four-month high after surging 22.6% off its mid-June low.

“That run of gains has been turbocharged over the last couple of weeks by a number of good news stories that have fed into a narrative about whether we might have seen ‘peak inflation’ now, raising hopes that central banks might not need to be as aggressive as feared about raising rates,” said strategists at Deutsche Bank in a note to clients.

Technical indicators speak to the improved tone of late. The CBOE Volatility index

VIX,

a gauge of expected market volatility that usually rises when investors are fearful, closed last week below its long term average of 20. However, the VIX, as it’s also known, was up 6.2% to 20.74 on Monday.

See: Can the stock market bottom without Wall Street’s fear gauge hitting ‘panic’ levels?

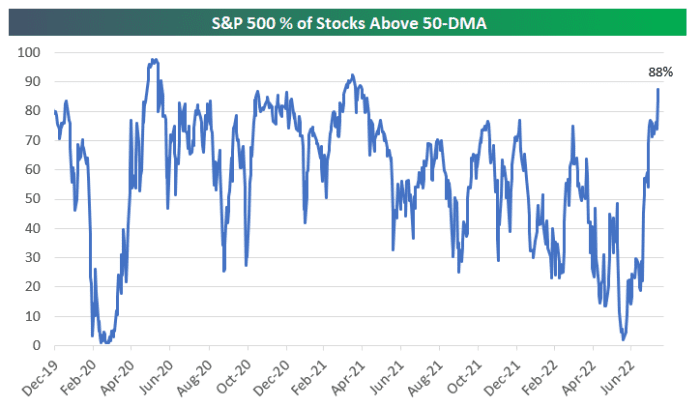

The breadth of the market’s latest bounce is also considered supportive, with Bespoke Investment noting the percentage of S&P 500 stocks trading above their 50-day moving average has jumped to 88% from just 2% on June 16th.

Source: Bespoke Investment

Also Friday, the S&P 500 closed above 4,231, marking a retracement of more than 50% of the 2022 selloff from its Jan. 3 record close to the June 16 low. Technical analysts noted that the S&P 500 in the past half-century hasn’t retraced 50% of a bear-market selloff and then went on to set new cycle lows, though they warned that there was still potential for sharp losses and near-term volatility.

Read: Why stock market bulls are applauding the S&P 500’s close above 4,231

Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, said she remained “constructive on U.S.equities through year-end 2022 and think it’s possible that U.S. equities saw their low in mid June.”

But she was concerned that the need to trim earnings per share forecasts will pressure stocks and this will place great emphasis on the third quarter earnings season when companies will have difficulty with earnings visibility for 2023.

“This makes it challenging to assess valuations today…..We don’t rule out the possibility that conditions will turn choppy again in the months ahead and see some risk that the S&P 500 will retest its year-to-date low again in late 3Q/early 4Q,” Calvasina said.

U.S. economic data due on Monday, include the New York Fed Empire State manufacturing survey at 8:30 a.m. Eastern Time and the NAHB Housing Market Index at 10 a.m.

Adding to the more cautious tone on Monday was disappointing economic news out of China, with retail sales, investment and industrial output all slowing and missing forecasts. The jobless rate for 16-24 year-olds rose to 19.9%. China’s central bank trimmed lending rates. The Shanghai Composite

SHCOMP,

was flat and Hong Kong’s Hang Seng

HSI,

slid 0.6%.

“Bad data from China also weighs on recession worries for the rest of the world,” said Ipek Ozkardeskaya, senior analyst at Swissquote Bank.

How are other assets faring

-

Concerns about slower demand from China pressured energy assets, with WTI crude oil futures

CL.1,

-5.08%

dropping 5% to trade below $88 a barrel. -

The 10-year Treasury yield

TMUBMUSD10Y,

2.792%

fell 2.1 basis points to 2.828%. -

The ICE Dollar index

DXY,

+0.52%

rose 0.5%, and the stronger buck helped push gold

GC00,

-1.20%

down 1.5% to trade below $1,790 an ounce. -

Bitcoin

BTCUSD,

-0.90%

rose above $25,000 for the first time since June, but then reversed, dropping 0.9% to $24,127. -

In Europe, the Stoxx 600

SXXP,

-0.11%

rose 0.1%, while London’s FTSE 100

UKX,

-0.43%

was down 0.2%. -

In Asia, the Shanghai Composite

SHCOMP,

-0.02%

ended fractionally lower, while the Hang Seng Index

HSI,

-0.67%

fell 0.7% in Hong Kong and Japan’s Nikkei 225

NIK,

+1.14%

advanced 1.1%.

Hear from Carl Icahn at the Best New Ideas in Money Festival on Sept. 21 and Sept. 22 in New York. The legendary trader will reveal his view on this year’s wild market ride.

[ad_2]

Source link