[ad_1]

U.S. stocks traded near unchanged early Monday, with Wall Street strugging for direction after falling last week to the lowest level since early November on recession fears.

How stocks are trading

-

The Dow Jones Industrial Average

DJIA,

+0.04%

was down 45 points, or 0.1%, to 32,875. -

The S&P 500

SPX,

-0.36%

fell 3 points, or 0.1%, to 3,849. -

The Nasdaq Composite

COMP,

-0.93%

was off 17 points, or 0.2%, to 10,689.

The S&P 500 logged a 2.1% weekly loss last week, ending Friday at its lowest level since Nov. 9. The Dow Jones Industrial Average saw a 1.7% weekly fall and the Nasdaq dropped 2.7%.

What’s driving the market

Investors have become increasingly concerned about the recession they feel is all but inevitable given the determinedly hawkish stance of major monetary authorities, such as the Federal Reserve and European Central Bank, as they continue to battle high inflation.

Read: The stock market is sliding because investors now fear recession more than inflation

Last week, alongside the Bank of England and others, the two central banks increased interest rates by 50 basis points to multiyear peaks and stressed that borrowing costs would likely go higher for longer than the market had hoped.

“The Fed and ECB seem determined to leave a lump of coal in everyone’s stockings this holiday season,” said Stephen Innes, managing partner at SPI Asset Management.

“With economic data undershooting expectations, it’s not a stretch to think investors may shift their focus from inflation and the Fed to the growing impact that the Fed’s actions are likely to have on the economy in 2023,” Innes added.

The soft performance on Wall Street in previous sessions and worries about a global slowdown saw Asian stock markets fall back on Monday, with China’s Shanghai Composite

SHCOMP,

among the weakest amid more concerns about spiking COVID infections in the world’s most populous nation.

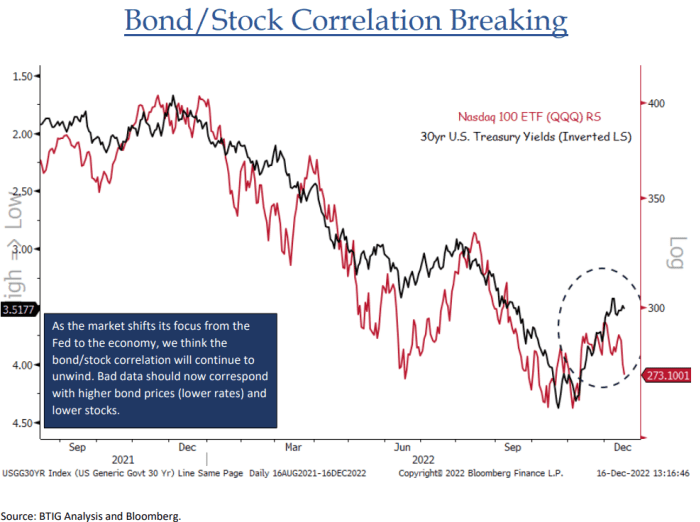

Analysts noted that investors had shifted from believing that bad news on the economy was good news for both bonds and equities — because it discouraged central banks from being too aggressive in their policy tightening — and were now taking bad economic news for what it is, a scenario that may damage company earnings.

Source: BTIG

“The biggest change in markets over the last few weeks, in our view, is the shifting correlation between stocks and bonds. For most of this year bonds and stocks traded in tandem, as inflation ruled the roost,” said Jonathan Krinsky, chief market technician at BTIG, in a note to clients.

“Recently, that has pivoted and lower rates have been met with lower stocks, presumably on fears of economic slowdown. We expect that theme to grow louder into 2023,” Krinsky added.

U.S. economic updates set for release on Monday include the NAHB home builders index for December, due at 10 a.m. Eastern.

Companies in focus

-

About 17.5 million Twitter votes were cast in favor of Elon Musk stepping down from leading the company, Musk’s Twitter account said Monday, a day after he posed the question to users of the social media platform. The news sent shares of Tesla Inc.

TSLA,

+0.70%

up 1.4% on hopes that Musk will refocus his attention on the electric-car company he also heads.

[ad_2]

Source link